Crypto markets and related stocks faced renewed selling pressure on Thursday, as digital assets retreated and trading volumes remained under strain amid the ongoing bear market.

Bitcoin dipped toward the lower end of its recent trading range during late-morning U.S. sessions, trading around $65,700 — down about 1.5% over the past 24 hours. Ethereum slipped below $2,100, down more than 2%, as the tech-heavy Nasdaq Composite fell 1.6%.

The current price action highlights a recurring trend: bitcoin shows weak correlation when U.S. equities rise but tends to follow declines in lockstep with the stock market. Attempts to mount a sustained recovery following last week’s sharp drop have faltered, signaling heightened caution among bullish investors.

Sentiment gauges reinforce the negative mood. Alternative’s Crypto Fear & Greed Index plummeted to 5, placing it in “extreme fear” territory — a level lower than during the major collapses of the 2022 crypto winter and the 2020 Covid-19 crash.

Adding to market concerns, Geoff Kendrick of Standard Chartered cut his 2026 price forecasts for bitcoin, ether, solana, BNB, and AVAX, warning that bitcoin could slide as low as $50,000.

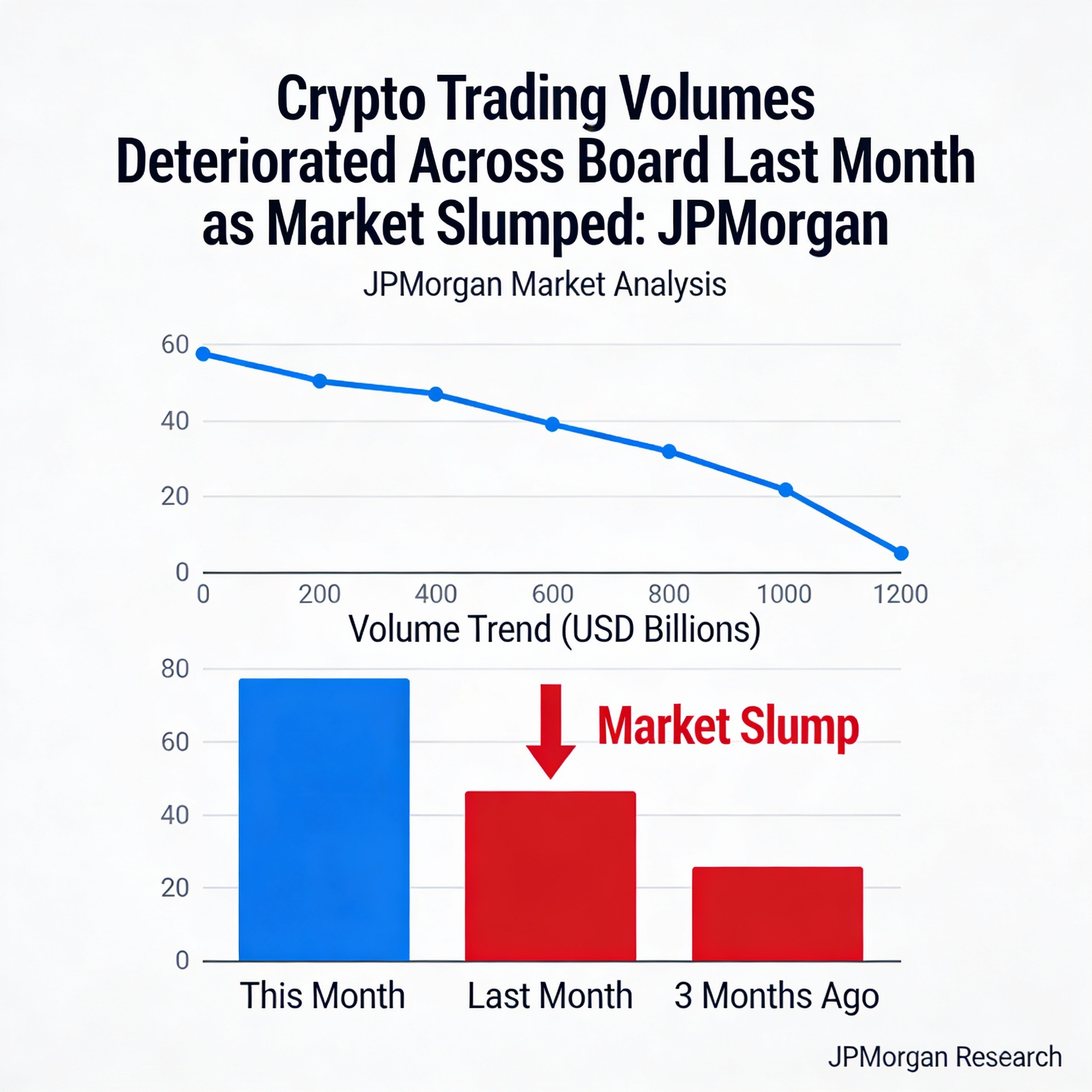

Crypto-focused stocks were hit hard. Coinbase and Robinhood both fell over 8%, with Coinbase set to report Q4 earnings after the bell. Robinhood’s Q4 results earlier this week had already shown the bear market’s toll on trading revenues in late 2025, before prices deteriorated further this year.

Other notable decliners included Strategy (-4.2%), Circle (-4.3%), and Hut 8 (-6.6%), reflecting widespread weakness across crypto-linked equities.