European equities extended their decline on Wednesday as support in bond markets faded, while gold surged to fresh record highs above $4,860 an ounce, underscoring persistent investor caution.

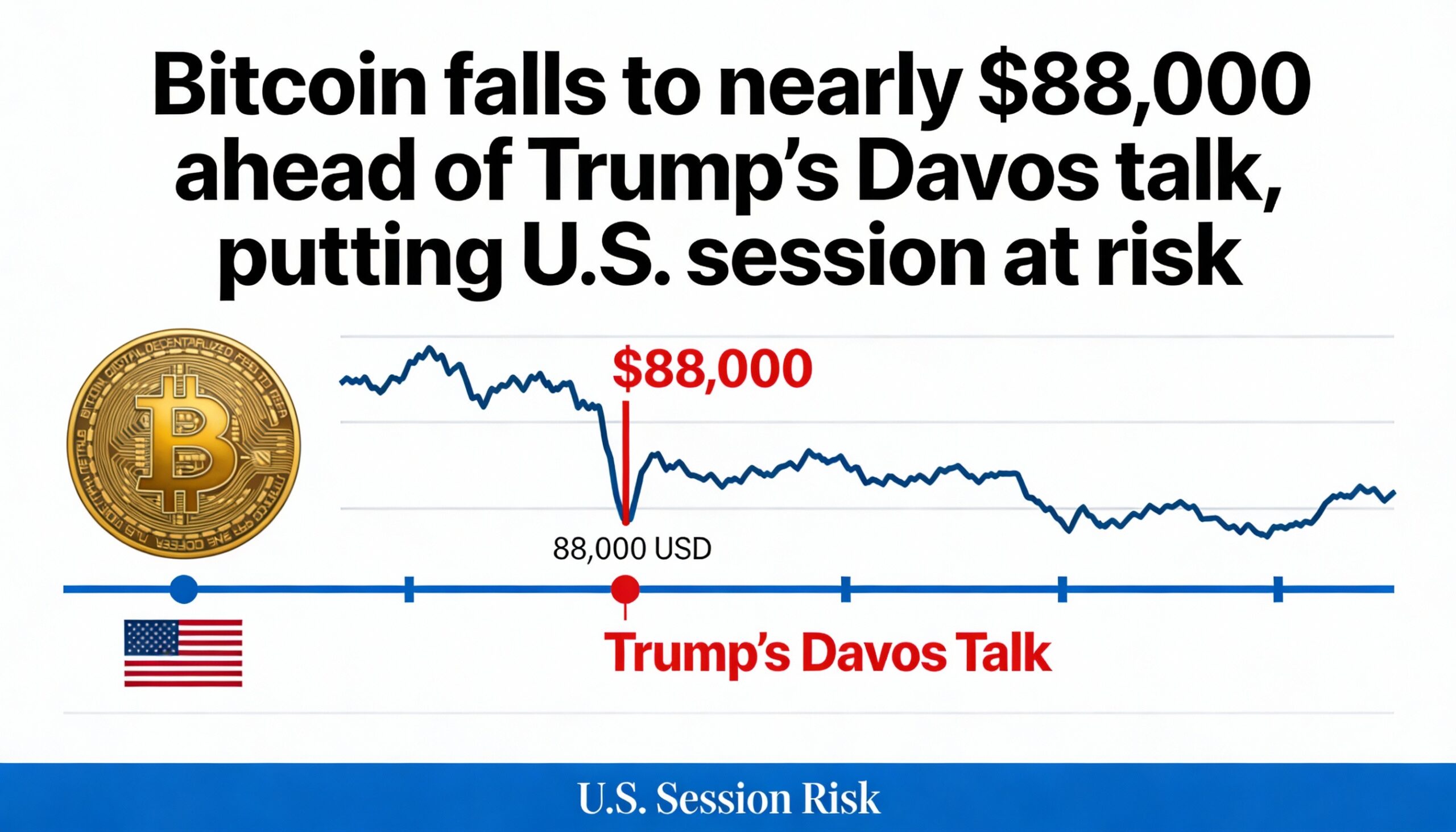

Crypto markets gave back early gains as a tentative rebound ran out of steam. Bitcoin slipped back below $89,000 as risk appetite weakened across European stocks and currencies. The world’s largest cryptocurrency was trading around $88,800 during the U.S. session after briefly approaching $90,000 earlier in the day, suggesting the move reflected a pause following heavy selling rather than a convincing recovery.

Major cryptocurrencies followed a similar trajectory, stabilizing initially before losing momentum as broader financial markets softened.

Sentiment deteriorated through the European afternoon, with the Stoxx 600 falling 0.5% and extending its losing streak to four sessions—the longest run since November. Financial and insurance stocks led the declines. Bond markets, which had provided some relief earlier, also came under pressure as the decline in European yields faded.

U.S. equity futures edged lower, while gold climbed another 2% to new record highs above $4,860 an ounce, reinforcing signs that investors remain focused on capital preservation rather than a return to risk-taking.

Crypto markets had attempted to steady earlier after Japanese government bonds rebounded from a sharp selloff earlier in the week, following efforts by officials to reassure markets. That easing helped bitcoin recover part of Tuesday’s losses, but the rebound proved fragile as macroeconomic headwinds persisted.

Uncertainty remains centered on President Donald Trump’s escalating standoff with Europe ahead of his address at the World Economic Forum in Davos. Trump has threatened tariffs on European nations that oppose his push for U.S. control or acquisition of Greenland, reviving concerns over trade tensions and policy unpredictability.

Those concerns have weighed on the U.S. dollar, which is now barely holding onto its gains for the year, while currencies such as the British pound have come under pressure. Meanwhile, Tuesday’s selloff wiped out more than $1 billion in leveraged crypto positions, and Wednesday’s price action suggests markets are still absorbing the impact of that forced unwinding.