Bitcoin slipped below $71,000 during Asian trading on Thursday as a renewed rout in global technology stocks spilled over into crypto markets, undermining hopes for a durable rebound after last week’s turbulence.

The world’s largest cryptocurrency dropped as much as 7.5% over the past 24 hours, briefly touching lows near $70,700 before recovering some ground, according to CoinDesk data.

The decline followed sharp losses across Asian equities, where concerns over peaking AI investment, stretched valuations, and slowing earnings growth have driven investors further away from risk assets.

MSCI’s Asia tech index fell for a fifth time in six sessions, led by steep losses in South Korea’s Kospi, which slid about 4% as AI-linked heavyweights came under renewed pressure.

The weakness extended a selloff that began in U.S. trading, where the Nasdaq slid after disappointing earnings from companies including Alphabet, Qualcomm, and Arm reinforced fears that AI spending may be cresting sooner than expected.

Bitcoin has increasingly behaved like a high-beta risk asset during equity-led drawdowns, particularly when liquidity is thin and macro uncertainty intensifies.

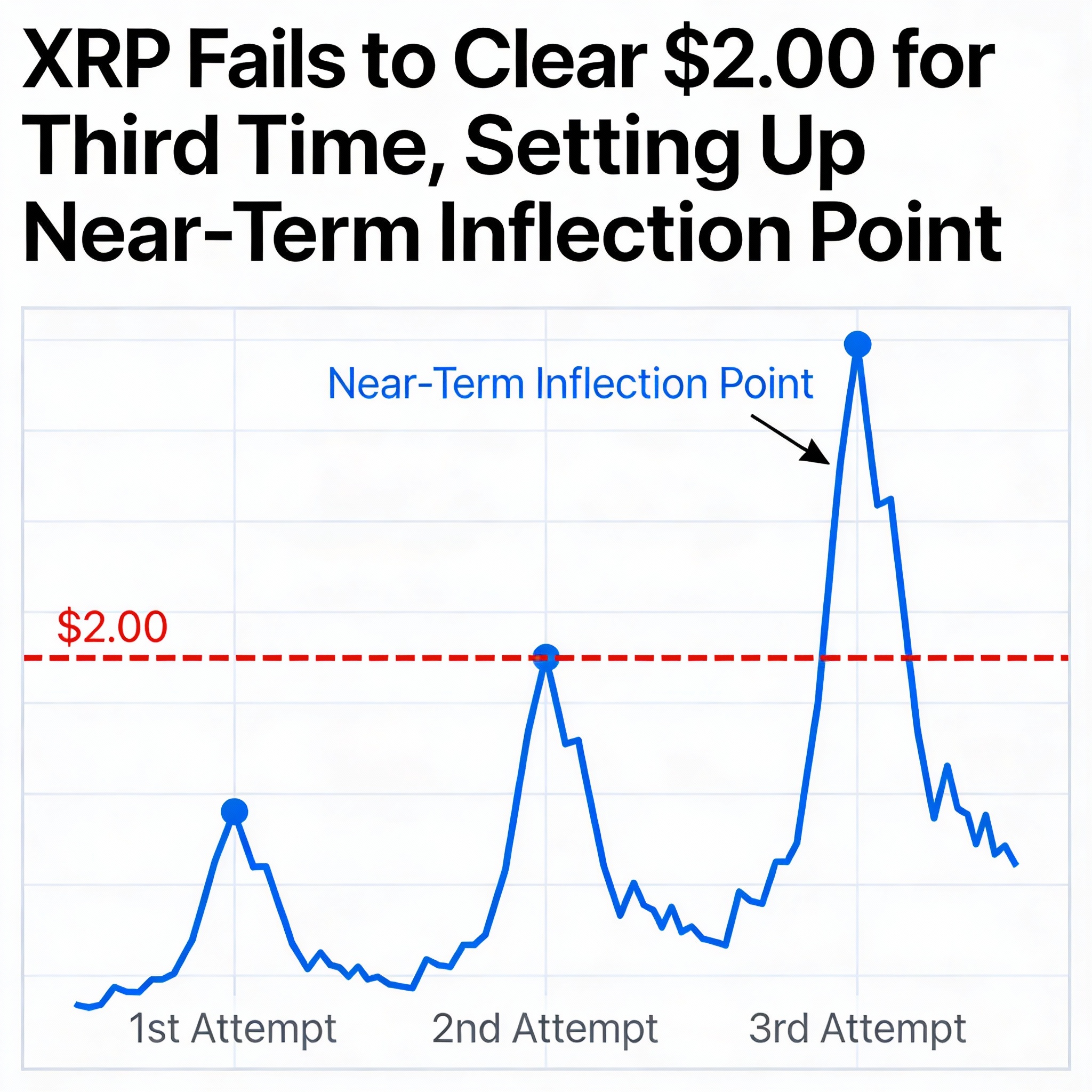

The latest drop follows choppy price action earlier this week, when bitcoin briefly fell toward $73,000 before rebounding above $76,000—a move some traders interpreted as fragile positioning rather than a decisive trend reversal.

“Bitcoin’s move below the low-$70,000s has accelerated a broader deleveraging, flushing out crowded positioning built during the post-ETF rally,” said Wenny Cai, COO of Synfutures. “Liquidations have been heavy, sentiment has turned risk-off, and price action is now being driven more by balance-sheet mechanics than narrative.”

“This doesn’t signal the end of institutional participation, but it does mark the end of complacency,” Cai added.

Pressure was amplified by sharp moves in commodities. Silver plunged as much as 17%, while gold fell more than 3%, extending a brutal unwind that has already triggered heavy liquidations in tokenized metals products across crypto trading venues.