Bitcoin Dips Below $94K as Crypto Market Faces Renewed Pressure

Bitcoin (BTC) extended its slide on Monday as bearish sentiment across the crypto market deepened, fueled by macroeconomic concerns and a downturn in U.S. equities.

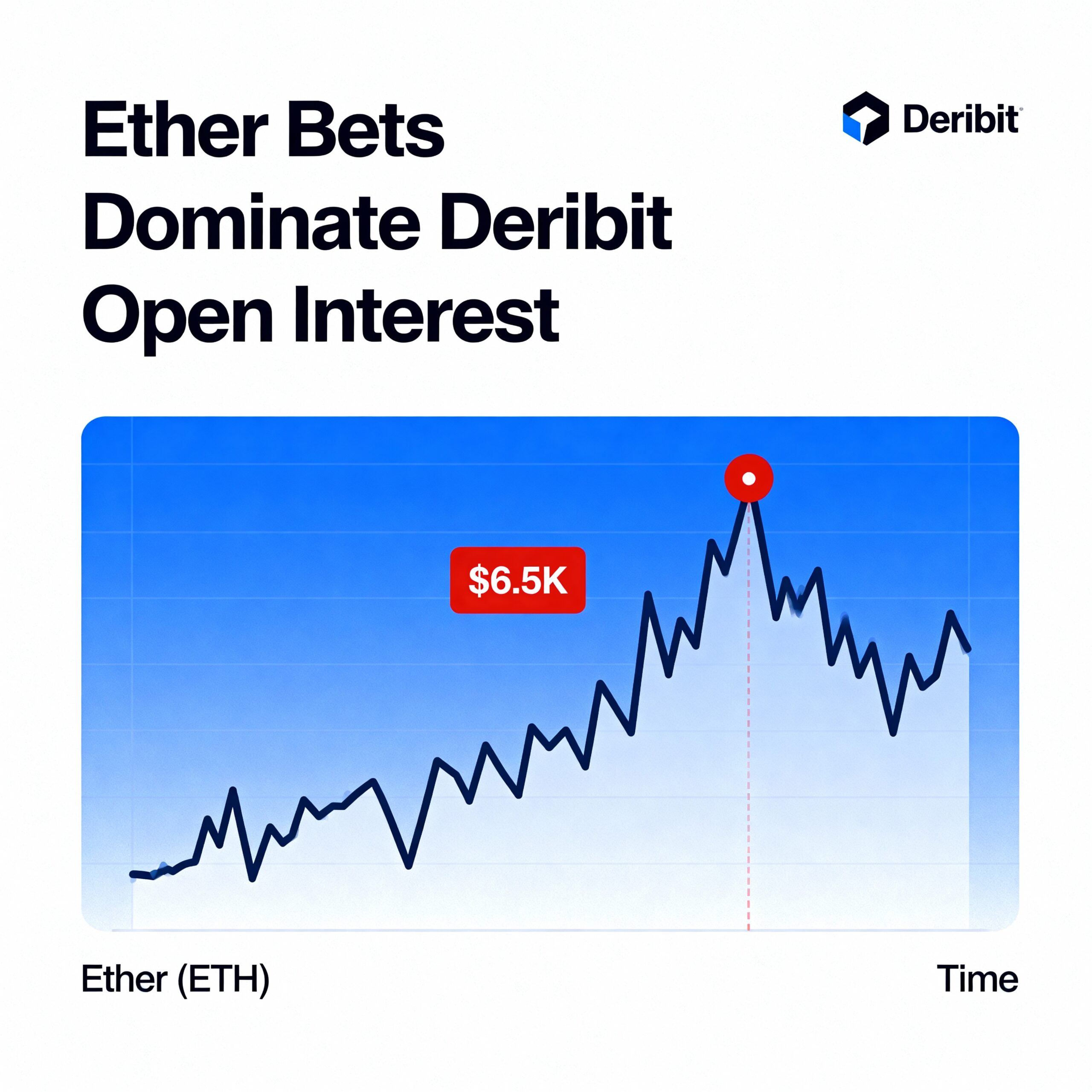

BTC fell to around $93,900 by the time U.S. markets closed, marking a 1.9% decline in 24 hours. Ether (ETH) saw a sharper drop of 5.9%, while the broader CoinDesk 20 Index slid 5.1%.

Stocks also struggled to rebound after last week’s losses, with the Nasdaq shedding another 1.2% and the S&P 500 dipping 0.5%.

Solana (SOL) emerged as one of the biggest losers, plunging nearly 10% on the day and 41% over the past month. Analysts attribute the decline to upcoming token unlocks, increased inflation on the network due to the recent SIMD-96 fee structure update, and fading enthusiasm around the memecoin boom that had previously driven Solana’s trading volume. SOL is now back at $151, erasing all its post-election gains.

Crypto hedge fund manager Quinn Thompson, founder of Lekker Capital, cautioned traders about Bitcoin’s near-term outlook.

“$95,000 might seem like a reasonable exit in hindsight,” he posted on social media, predicting an 80% chance that BTC won’t set new highs in the next three months and a 51% chance it won’t for at least a year.

Meanwhile, concerns over the U.S. economy continue to grow. Neil Dutta, head of economic research at Renaissance Macro Research, warned of slowing wage growth, a deteriorating housing market, and reduced state and local government spending—all potential signs of economic trouble.

“If 2023 was about upside surprises, 2025 could bring downside risks,” Dutta wrote, adding that a tightening financial environment could drive down stock prices and weaken the labor market.

With economic uncertainty and crypto volatility both in play, investors are bracing for more turbulence in the weeks ahead.