Long-term bitcoin holders are selling at their fastest pace since August, even as some market watchers argue the broader crypto market may be nearing a bear-market bottom.

Bitcoin’s latest weakness has been driven in part by a stronger U.S. dollar following President Donald Trump’s surprise nomination of former Federal Reserve governor Kevin Warsh as the next Fed chair. The move boosted the dollar, unwound the recent rally in precious metals, and pushed bitcoin below an important technical support zone.

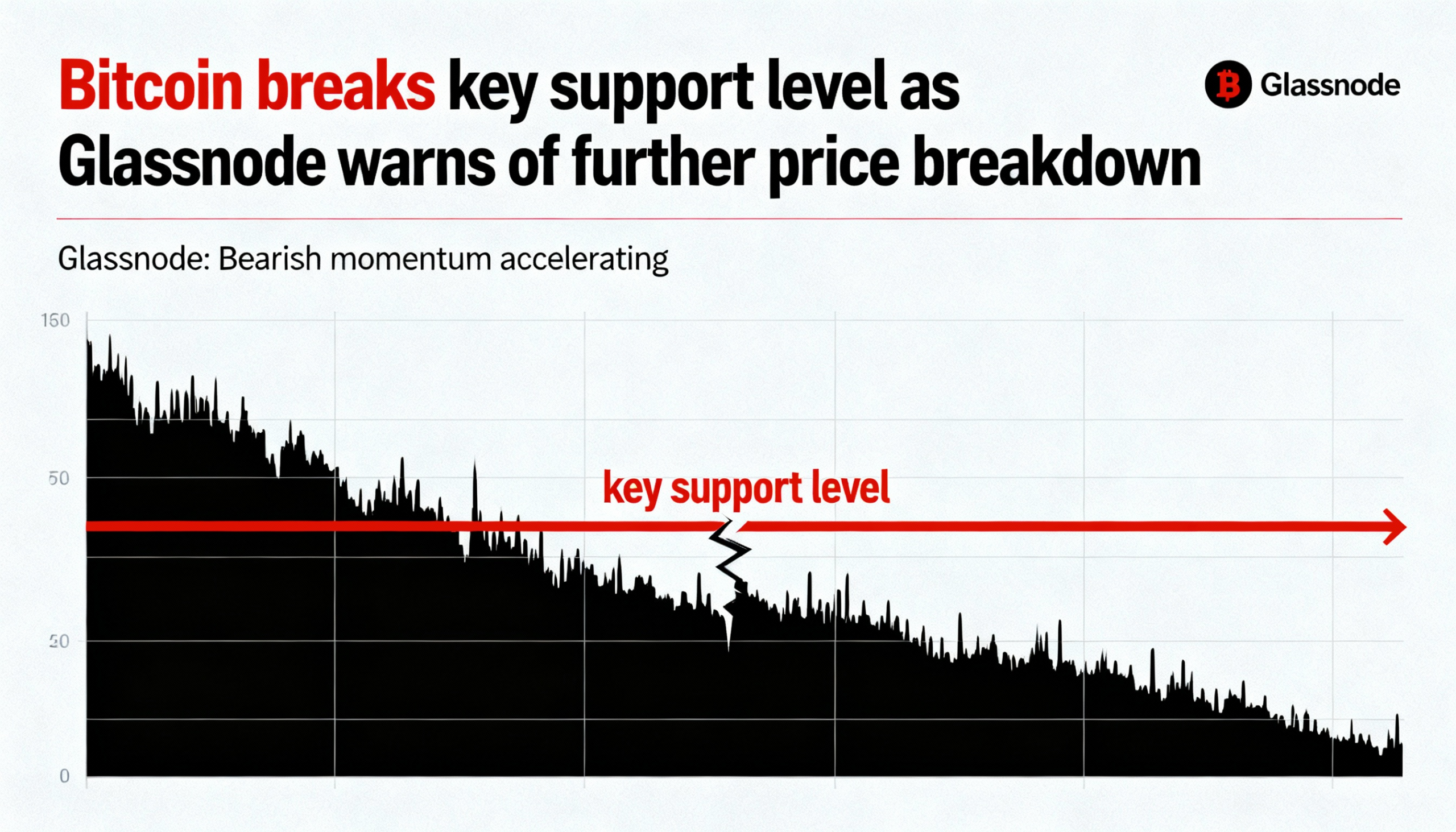

Onchain data from Glassnode shows bitcoin had been consolidating just above structural support near $83,400, a level that marks the lower bound of its short-term holder cost-basis model. A sustained break below that area risks opening a deeper decline toward $80,700, known as the “True Market Mean.”

That breakdown now appears to be underway. Over the past seven days, bitcoin has fallen more than 9.2% and is trading near $81,200. The broader market has fared worse, with the CoinDesk 20 (CD20) index down 12.4% over the same period, dragging the Crypto Fear & Greed Index into “extreme fear.”

Despite the decline, Glassnode noted that short-term holder supply held at a loss remained at 19.5% with BTC above the prior support level, well below the roughly 55% threshold typically associated with full capitulation. That suggests some underlying resilience, even as buyer conviction weakens and prices drift lower.

Derivatives markets are also flashing caution. Funding rates remain subdued, pointing to restrained speculative positioning. Meanwhile, options markets show rising demand for downside protection, with dealer gamma turning negative below $90,000 — a setup that raises the risk of sharper volatility if support levels continue to fail.

Overall, the data points to a market that is fragile but not yet broken, with liquidity conditions likely to determine the next major move.

At the same time, extreme fear across the crypto market may be offering a contrarian signal. According to analytics firm Santiment, sentiment across cryptocurrency communities has plunged to unusually low levels that have historically preceded price recoveries.

In a recent report, Santiment described the surge in bearish social-media commentary as one of the few constructive signals in an otherwise gloomy backdrop. “While network fundamentals are stagnant, crowd sentiment has hit extreme negativity levels,” the firm wrote, adding that such pessimism has often marked local bottoms.

Prices have continued to slide in recent months, even as long-term holders accelerate selling and the recent pullback coincides with a reversal in the U.S. dollar’s decline. Still, some industry observers believe the current wave of pessimism may prove short-lived.

Bitwise CIO Matt Hougan recently told CoinDesk’s Markets Outlook that crypto appears to be in the late stages of forming a bear-market bottom. Historically, he noted, crypto markets have tended to move against prevailing crowd sentiment — a dynamic that could favor stabilization if fear remains elevated.