A familiar pattern played out in crypto markets Friday: a headline-driven bounce quickly faded as sellers stepped in.

The Supreme Court of the United States ruled 6–3 to strike down President Donald Trump’s tariff framework, finding that the administration exceeded the authority granted under the statute.

In its opinion, the court emphasized that no prior president had invoked the law to impose tariffs of comparable size or scope. The absence of precedent, coupled with the broad powers claimed by the executive branch, suggested the measures stretched beyond the president’s legitimate authority.

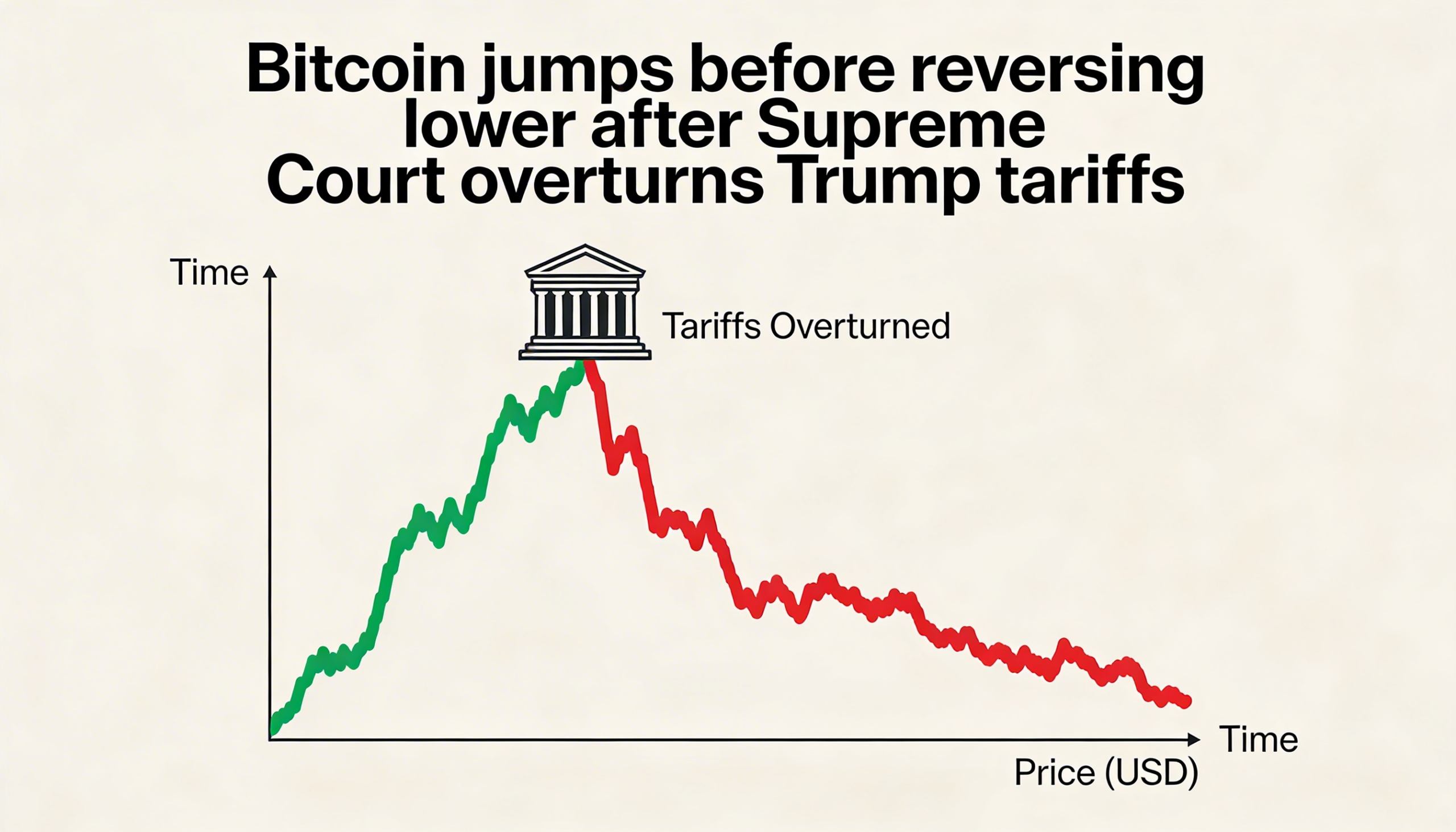

Bitcoin’s knee-jerk move

Bitcoin reacted swiftly to the decision, jumping roughly 2% and briefly clearing the $68,000 mark. The advance, however, was short-lived. Within minutes, the cryptocurrency reversed course and slipped back below $67,000, underscoring the fragile tone that has defined recent trading sessions.

The quick reversal contrasted with a steadier response in equities. The Nasdaq Composite climbed 0.6% to a session high, suggesting stock investors were more comfortable maintaining risk exposure.

Economic data complicates the picture

Earlier in the day, fresh figures from the United States Department of Commerce pointed to a mixed macroeconomic backdrop. The U.S. economy expanded at a 1.4% annualized pace in the final quarter of 2025. For the full year, growth slowed to 2.2%, marking the weakest annual performance since 2020.

At the same time, core personal consumption expenditures (PCE) prices rose 3% year-over-year, exceeding expectations of 2.9% and accelerating from 2.8% previously — a sign that inflationary pressures remain sticky.

Art Hogan, chief market strategist at B. Riley Wealth, said the data delivered conflicting signals. Stronger-than-anticipated inflation alongside softer growth, he noted, reinforces the Federal Reserve’s cautious approach to monetary policy.

For crypto markets, the combination of policy uncertainty and stagflationary signals continues to create a challenging environment — one where even positive headlines struggle to generate sustained upside momentum.