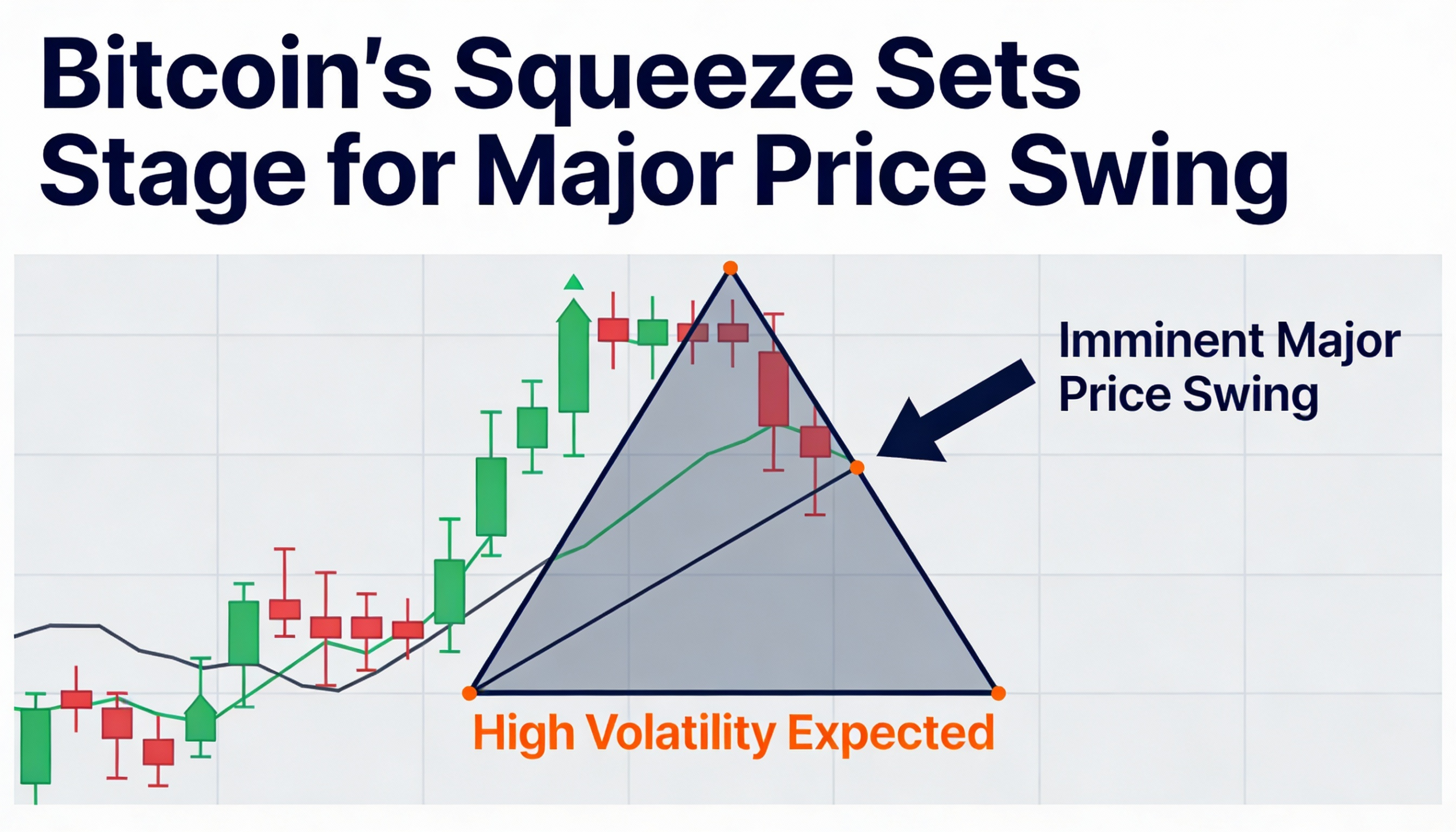

Bitcoin’s calm charts hint at a potential big move after volatility squeeze

Bitcoin’s price has settled into an unusually tight range, with volatility compressing to levels that historically precede sharp swings.

BTC has traded between $85,000 and $90,000 over the past two weeks. During this period, the gap between its Bollinger Bands — a volatility measure set two standard deviations above and below the 20-day moving average — has narrowed to less than $3,500, the tightest since July, according to TradingView data.

Such a Bollinger Band “squeeze” signals a low-volatility phase, often followed by sudden price turbulence. Past examples illustrate the pattern: in late July, a two-week sideways grind between $115,000 and $120,000 preceded a three-month price surge that saw BTC swing from $100,000 to $126,000. Similarly, in late February, a tightening range near $94,000–$98,000 foreshadowed a sharp decline to $80,000 by month-end.

Since at least 2018, Bollinger Band squeezes have reliably signaled periods of heightened volatility.

The latest compression suggests traders remain on alert, as BTC could move rapidly in either direction. At the time of writing, bitcoin traded around $88,600, up just over 1% on the day.