Bitcoin Near Production Cost as Difficulty Regression Model Suggests Fair Value

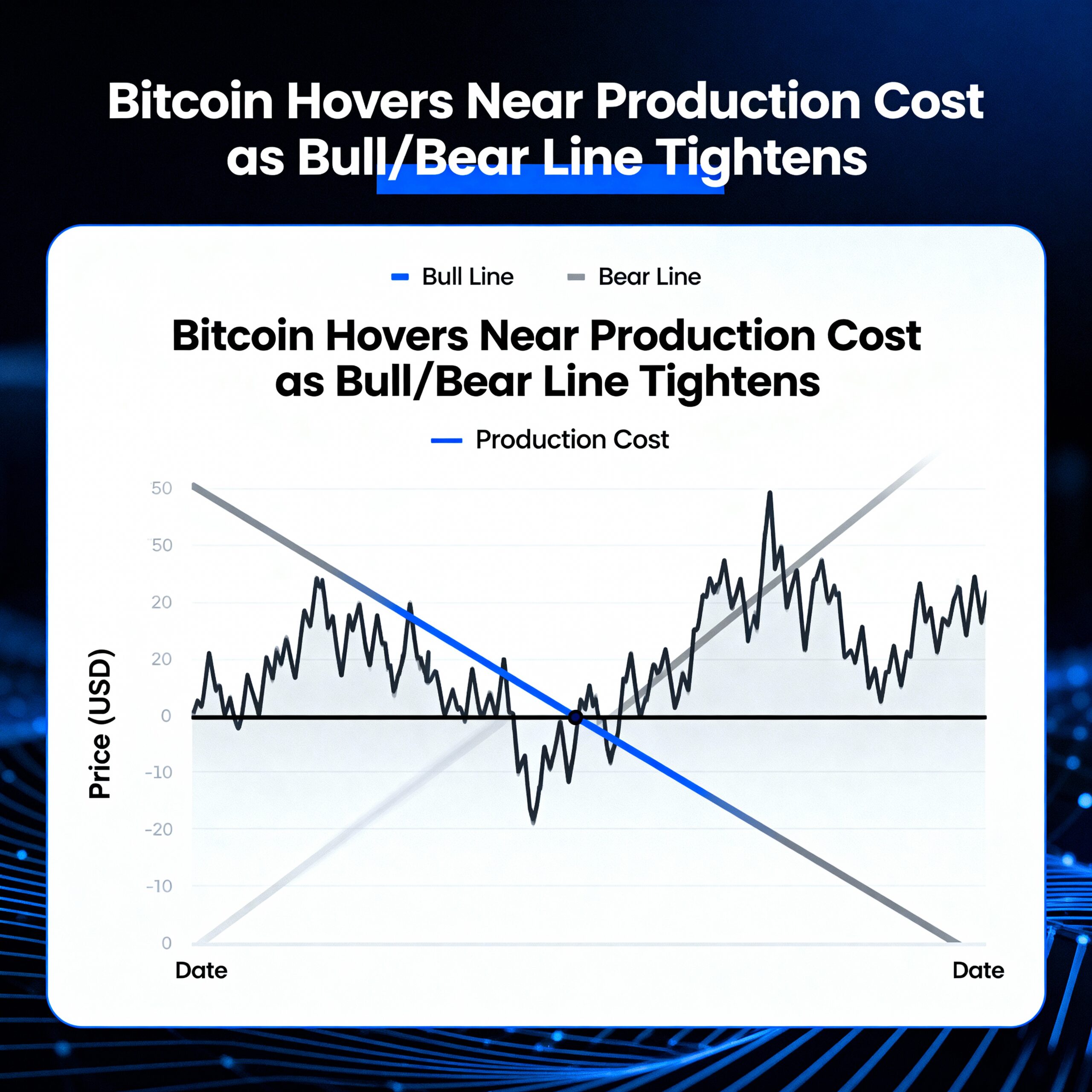

Bitcoin is closely aligned with the Difficulty Regression Model, according to Checkonchain, which estimates the all-in cost to mine a single bitcoin. The model uses mining difficulty as a proxy for production cost, integrating key operational factors without requiring assumptions about hardware, energy, or logistics.

The model currently sits near $92,300, roughly matching Bitcoin’s spot price. The cryptocurrency briefly dipped to around $80,000, below the model, before rebounding. Historically, Bitcoin remains bullish when trading above the model and turns bearish when below it.

In April 2025, Bitcoin hit $76,000 and bounced precisely at the model’s level, highlighting its role as a key support. For much of 2025, the price traded at a roughly 50% premium over the model, compared with 2024 when it hovered close to production costs. By contrast, during the 2022 bear market, Bitcoin traded at a 50% discount, while in previous bull markets, prices exceeded the model by larger multiples—doubling it in 2021 and quintupling it in 2017.

As Bitcoin matures, extreme premiums have become rare. The model suggests that the cryptocurrency is currently trading near its production cost, signaling a fair value zone—a view reinforced by Metcalfe’s Law valuations, which place Bitcoin near $90,000.