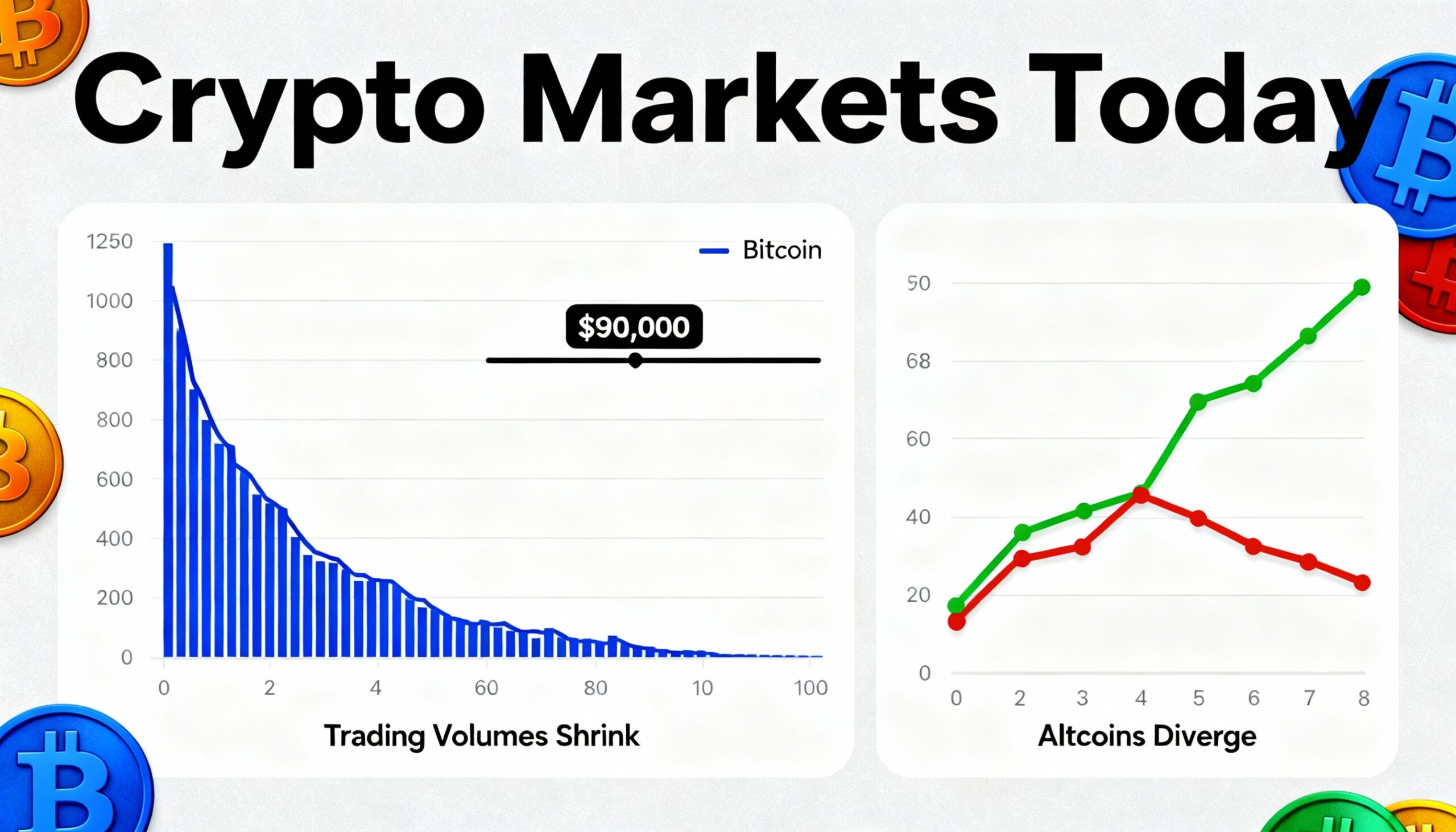

Bitcoin (BTC) traded in a tight range over the past 24 hours, drifting back toward Thursday’s lows and holding just above $90,000. The world’s largest cryptocurrency has remained locked in this range since late November, with market activity steadily fading.

Daily trading volume fell 9% to about $38 billion, a sharp contrast to the $80 billion–$130 billion routinely seen just a few months ago. The drop in activity, combined with low liquidity, has contributed to choppy price behavior across both bitcoin and altcoins, with sharp intraday moves frequently reversing and catching leveraged traders off guard.

Altcoins sent mixed signals. Polygon’s POL token jumped 7.8% since midnight UTC after the project announced a pivot toward becoming a neobank, making it the top performer among major tokens. Maple Finance’s SYRUP and Zcash (ZEC) also posted gains, while tokens such as SKY and TON traded lower.

Derivatives data reflected the quieter market. More than $200 million in crypto futures positions were liquidated over the past 24 hours, well below the $400 million or more seen on each of the previous three days, suggesting traders are increasingly staying on the sidelines. Volmex’s Bitcoin Volatility Index (BVIV), which tracks 30-day implied volatility, cooled to 43% from 47.3%, unwinding an end-of-December spike. Ether’s volatility index (EVIV) also slipped to 60%, its lowest level since Oct. 11.

Total notional open interest in crypto futures declined to $138.5 billion from above $141 billion earlier in the week, with open interest falling across most major tokens. ZEC was a notable exception, posting a 14% increase, likely reflecting hedging activity amid heightened price swings. Funding rates for most major perpetual contracts remained positive, signaling lingering demand for bullish exposure, though XLM, WLFI, CRO and TRX continued to show negative rates.

In options markets, straddles and strangles accounted for nearly 30% of bitcoin option block flows on Deribit over the past 24 hours, indicating traders are positioning for volatility rather than betting on a specific price direction. For ether, strangles and call spreads were the most popular strategies.

Despite POL’s strong rally to its highest level since Nov. 20, liquidity remains thin. The token’s 2% market depth stands at just $197,000 on the upside, meaning a buy order of roughly $200,000 could push the price more than 2%.

Elsewhere, several altcoins lagged the broader market. SKY fell 1.7% since midnight UTC, while TON slid 4.3%. Privacy coins reversed some of Thursday’s moves, with Monero (XMR) edging lower and Zcash rebounding more than 14% from its lows as concerns around a recent development team shakeup appeared to ease.