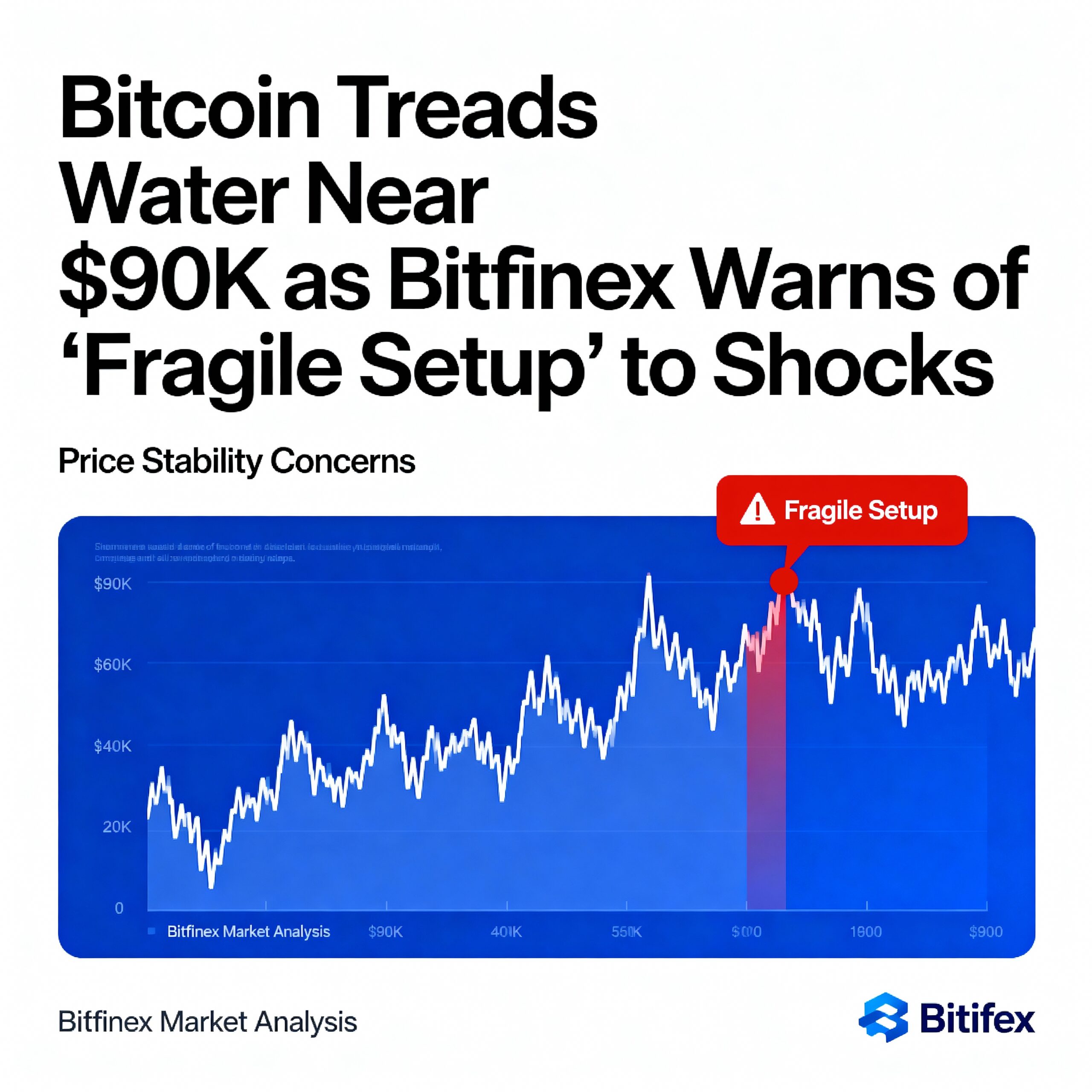

Bitcoin Struggles Near $90K Amid Weak Spot Demand and Macro Risks

Bitcoin stalled near $90,000 on Monday, reflecting muted spot demand and rising vulnerability to macroeconomic shocks, according to Bitfinex analysts.

After a late-weekend rally attempt, BTC lost most of its gains during early U.S. trading, closing around $90,500—down roughly 1% over 24 hours.

Altcoins also showed mixed results. Ethereum’s ETH slipped slightly but outperformed bitcoin, reaching its strongest relative level against BTC in over a month. Privacy-focused Zcash (ZEC) and institutional blockchain Canton Network (CC) posted double-digit gains, while the CoinDesk 20 Index fell 0.8%.

Global markets added pressure. Long-duration government bond yields surged amid concerns over Japanese debt, with the U.S. 10-year Treasury hitting 4.19%, its highest in three months. Japanese 10-year yields approached 2%, levels not seen in nearly two decades, while U.K. and European government bonds also sold off. U.S. equities were lower, with the S&P 500 down 0.5% and the Nasdaq 0.3%.

Investors now turn to the Federal Reserve’s year-end meeting. A 25-basis-point rate cut is widely expected, but signals about future policy could spark volatility. “Easing financial conditions or a weaker U.S. dollar could support crypto, while hawkish surprises may increase downside pressure,” said LMAX strategist Joel Kruger.

Structural Weakness Remains

Bitfinex analysts highlighted structural headwinds for bitcoin. Despite bouncing from November lows, BTC remains rangebound while equities hit near-record highs, underscoring relative weakness.

Key indicators include:

- Spot bitcoin ETF outflows, with traders selling into strength, reflected in negative Cumulative Volume Delta (CVD) across exchanges.

- Over seven million BTC held at unrealized losses, signaling bearish sentiment.

- Modest capital inflows of $8.69 billion per month (Net Realized Cap Change), far below peak levels.

“These factors create a fragile setup,” the report said. “Weakening spot demand reduces price support and heightens sensitivity to macro shocks and tighter financial conditions.”