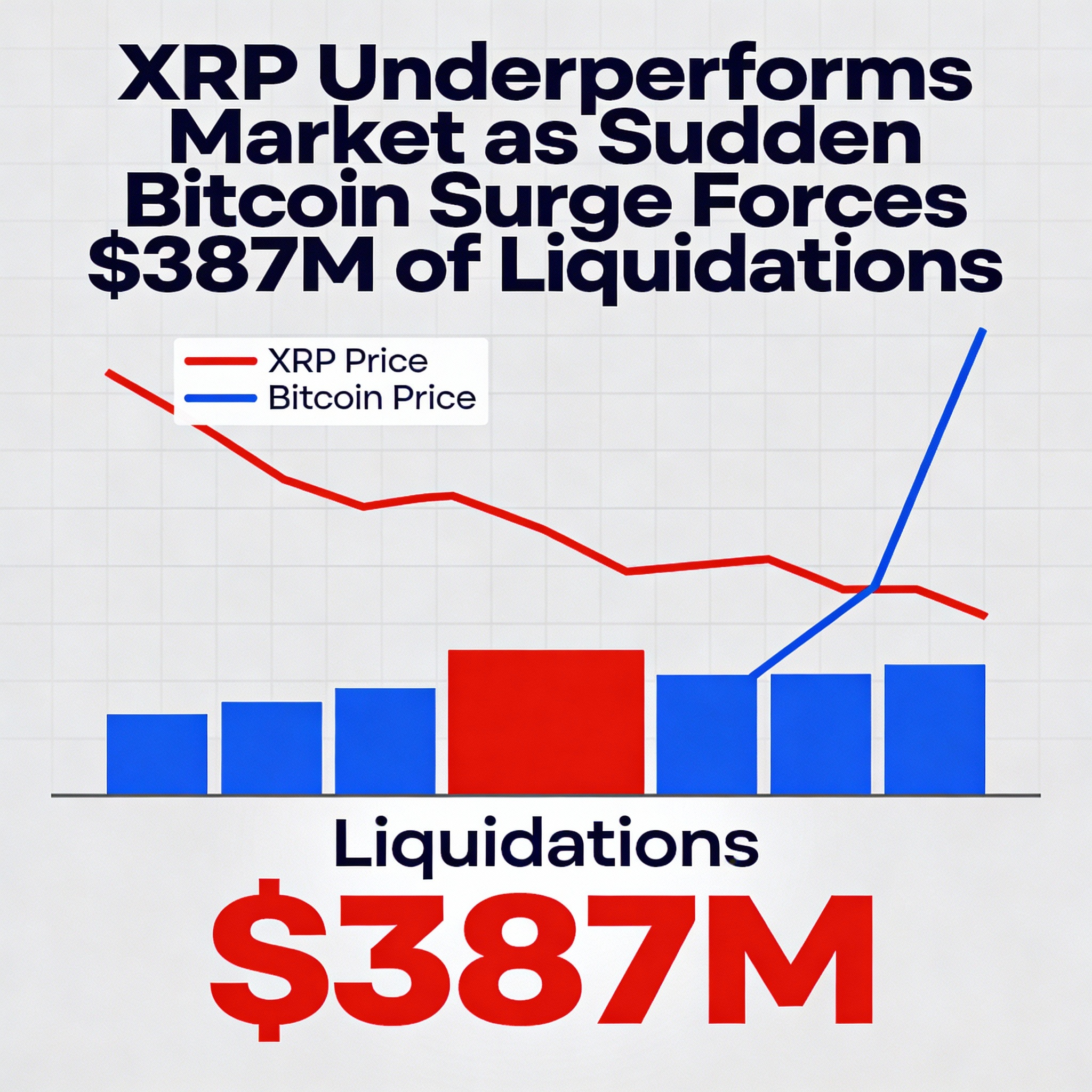

XRP Struggles to Keep Pace as Bitcoin Surge Triggers $387M in Liquidations

XRP’s price action remains cautious, with key support at $2.05 and resistance at $2.17, as traders watch for stronger volume to confirm upward momentum. While the token gained modestly, it lagged the broader crypto market as Bitcoin climbed past $94,000, sparking widespread liquidations across derivatives markets.

Market Dynamics

Bitcoin’s rapid advance above $94,000 set off a broad rebound in major crypto assets, generating immediate volatility among large-cap tokens. The move forced 107,333 traders out of positions within 24 hours, totaling $387.5 million in liquidations—including a single $23.98 million BTC long on HTX.

Despite the bullish macro backdrop, XRP’s performance was muted. The token underperformed the CD5 index by 1.55%, signaling rotation away from XRP during the risk-on rally. Institutional flows were similarly subdued, with 24-hour trading volume 5.88% below the seven-day average, underscoring limited conviction behind the price move.

Technical Outlook

XRP maintains an intraday structure marked by higher highs and higher lows, but momentum remains inconsistent compared to other major tokens. Support at $2.05 has held across multiple tests, while resistance at $2.17 capped the recent rally. Without sustained volume expansion, bullish trends lack confirmation.

Short-term indicators highlight soft follow-through after a breakout attempt. A spike around 15:00 met heavy volume rejection at resistance, pulling the price back into the $2.15–$2.16 range. While this reflects profit-taking rather than a reversal, broader participation is needed for bulls to regain control.

XRP’s underperformance relative to Bitcoin and other majors is itself a key technical signal—potentially pointing to a delayed catch-up rally or deeper consolidation if macro momentum fades.