Bitcoin Hits New High Above $116K, Wiping Out Nearly $1B in Shorts as Bulls Look Ahead

Bitcoin has smashed through a new all-time high above $116,000, climbing past $113,800 on Thursday in a powerful rally that’s nearly doubled its price over the past year.

The flagship cryptocurrency briefly touched $115,469 during U.S. trading hours, up 4.3% in the last 24 hours, according to CoinDesk data. Just a year ago, BTC was trading at $57,899, showing remarkable gains despite occasional sharp pullbacks.

Traders and analysts are debating whether bitcoin can continue its momentum toward $120,000—or whether this week’s surge might prove short-lived.

Short Sellers Take a Heavy Hit

— Krisztian Sandor, CoinDesk Markets Reporter (22:40 UTC)

Bitcoin’s latest spike triggered over $950 million in liquidations of leveraged short positions, the largest single-day wipeout so far this year, data from CoinGlass shows. Traders who bet against bitcoin’s price rise were forced to cover their positions as prices moved sharply higher.

Prediction Markets Eye $140K

— Aoyon Ashraf, Head of Americas (22:28 UTC)

On prediction platform Kalshi, traders are wagering on bitcoin reaching $141,000 by year’s end, fueled by the current rally and increasing market optimism.

Gerry O’Shea, Head of Global Market Insights at Hashdex, noted:

“Despite macro uncertainties, we think the bull market is intact. New catalysts like institutional platforms offering bitcoin exposure could push BTC beyond $140,000 this year.”

Saylor’s MicroStrategy Sees Windfall

— Aoyon Ashraf, Nikhilesh De (22:05 UTC)

MicroStrategy’s Michael Saylor is one of the biggest winners of bitcoin’s surge, proudly proclaiming:

“The halls of eternity echo with the cries of those who sold their Bitcoin.”

Since 2020, MicroStrategy has accumulated 597,325 BTC, effectively functioning as a quasi-bitcoin ETF before such products existed in the U.S. At current prices, those holdings are valued at $69.29 billion.

Echoes of 2017, But a New Era

— Nikhilesh De, CoinDesk Managing Editor for Global Policy & Regulation (22:05 UTC)

The buzz around bitcoin feels reminiscent of December 2017, when prices surged toward $20,000. But the crypto landscape today in July 2025 is vastly changed:

- Interest rates are higher.

- Institutional participation has increased.

- Regulation is more prominent.

- The crypto user base is significantly larger.

While the excitement may look familiar, the market’s underlying structure is very different.

Analysts Target $120K Next

— Aoyon Ashraf, Head of Americas (21:42 UTC)

Some observers believe bitcoin’s rally still has room to run. Ryan Gorman, Chief Strategy Officer at Uranium Digital, cited corporate bitcoin buying and supportive signals from President Trump and the upcoming “Crypto Week” in D.C. as key drivers:

“Momentum is growing across regions and sectors. Coupled with bullish options positioning and lighter summer trading, we could see bitcoin hit $120,000 before next week is over.”

Fresh Highs Recorded on Coinbase

— Aoyon Ashraf, Head of Americas (21:20 UTC)

Bitcoin soared to $116,221 on Coinbase, setting fresh records on multiple exchanges. The jump highlights the swift and sometimes unpredictable moves in crypto markets.

Macro Factors Fueling the Rally

— Aoyon Ashraf, Head of Americas (20:20 UTC)

Bitcoin’s surge may be linked to speculation around U.S. monetary policy. The Kobeissi Letter reported that a potential 3% cut in the federal funds rate—as floated by Trump—could save the government $2.5 trillion over five years but risks reigniting inflation and weakening the dollar.

Rumors that Trump might replace Fed Chair Jerome Powell could accelerate rate cuts, pushing investors toward alternative assets like bitcoin.

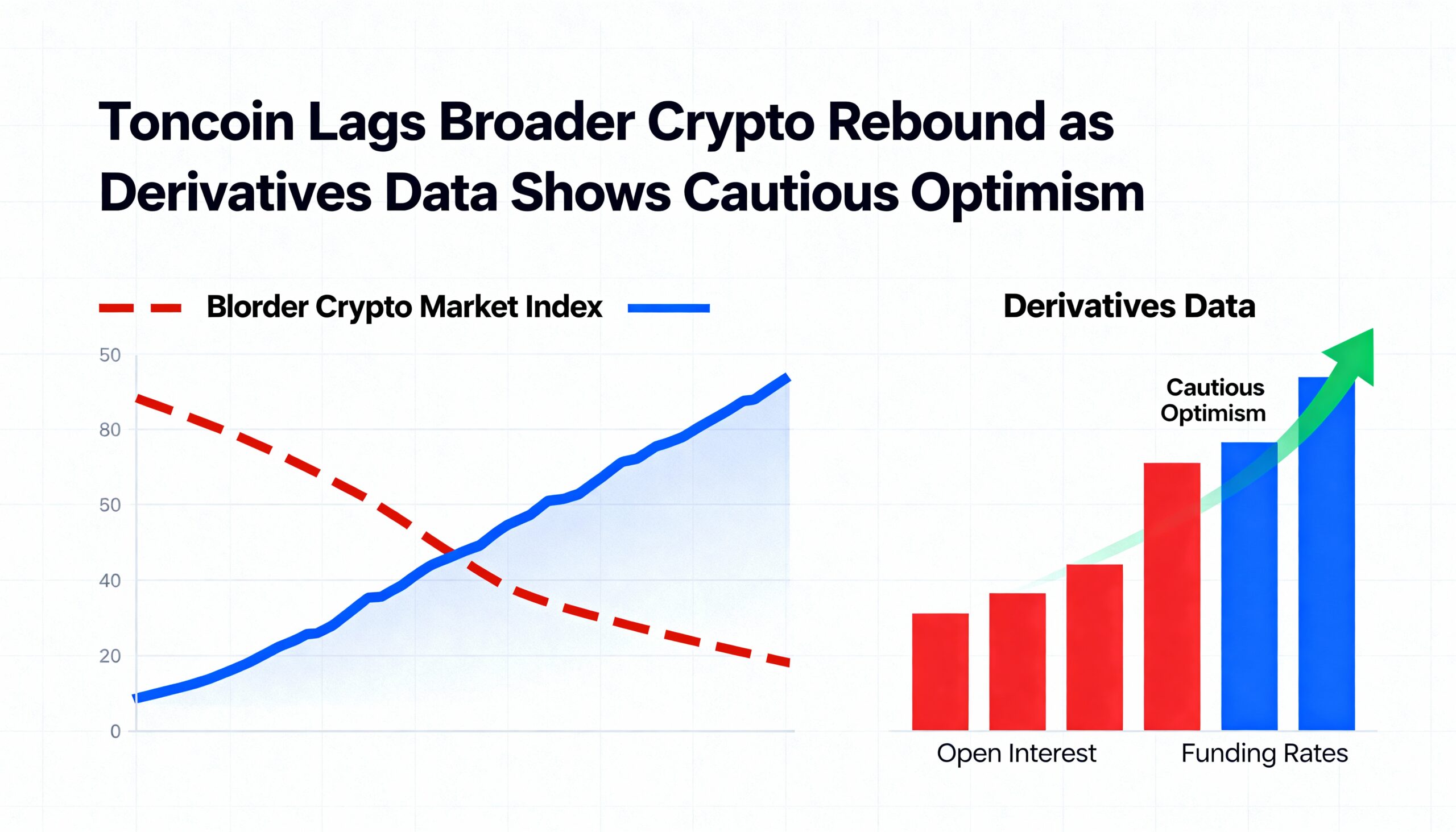

Calm on the Derivatives Front

— Krisztian Sandor, CoinDesk Markets Reporter (20:08 UTC)

Despite bitcoin’s leap, perpetual futures funding rates remain neutral, signaling that speculative froth hasn’t yet taken over. As Charlie Morris from ByteTree put it:

“Crypto feels quiet. But quiet bulls are the best bulls.”

Altcoins See Smaller Gains

— Tom Carreras, CoinDesk Markets Reporter (19:50 UTC)

Altcoins have been steadier, with most major tokens up 2-5%. Standouts among the top 50 include:

- SUI, up 12.4%

- PEPE, up 8.6%

- DOGE, up 6.3%

The CoinDesk 20 Index is up 3.2%.

Market Makers Could Add Volatility

— Omkar Godbole, CoinDesk Co-Managing Editor for Markets (19:45 UTC)

Deribit options data shows bitcoin in a “negative dealer gamma zone” between $112,000 and $120,000. This means market makers may have to buy more BTC as prices rise to stay hedged, potentially fueling further upward swings.

Dollar Weakness a Key Factor?

— Nikhilesh De, CoinDesk Managing Editor for Global Policy & Regulation (19:20 UTC)

Some analysts caution that bitcoin’s record high reflects dollar weakness rather than pure BTC strength. For instance, BTC/EUR remains below its all-time peak from January. As one expert said:

“Bitcoin’s dollar ATH is partly driven by USD devaluation.”

Crypto Stocks Rally

— Helene Braun, CoinDesk Markets Reporter (19:12 UTC)

Crypto-linked stocks have joined the rally:

- Robinhood (HOOD) and Coinbase (COIN) each rose over 3%.

- Miners like Hut 8, Bitfarms, and HIVE Digital gained more than 4%.

- Newly public stablecoin issuer Circle (CRCL) rose modestly by 0.4%.

A Different Cycle with New Buyers

— James Van Straten, CoinDesk Bitcoin Analyst (18:55 UTC)

Unlike the leverage-driven rally of 2021, today’s market appears fueled by fresh factors, including corporate treasuries and potentially crypto-friendly policy shifts. Yet technical signals remain mixed:

- The daily RSI shows bearish divergence.

- Trading volume has declined since earlier highs.

- BTC is still below all-time highs in EUR and GBP terms, suggesting dollar weakness is playing a role.

Many trading desks remain cautious—even though they were also skeptical during bitcoin’s climb from $30,000 to $70,000 in the last bull cycle.

With bitcoin now above $116,000, the question remains: Will the rally push on to $120,000—or is a correction looming? Stay tuned for further updates.