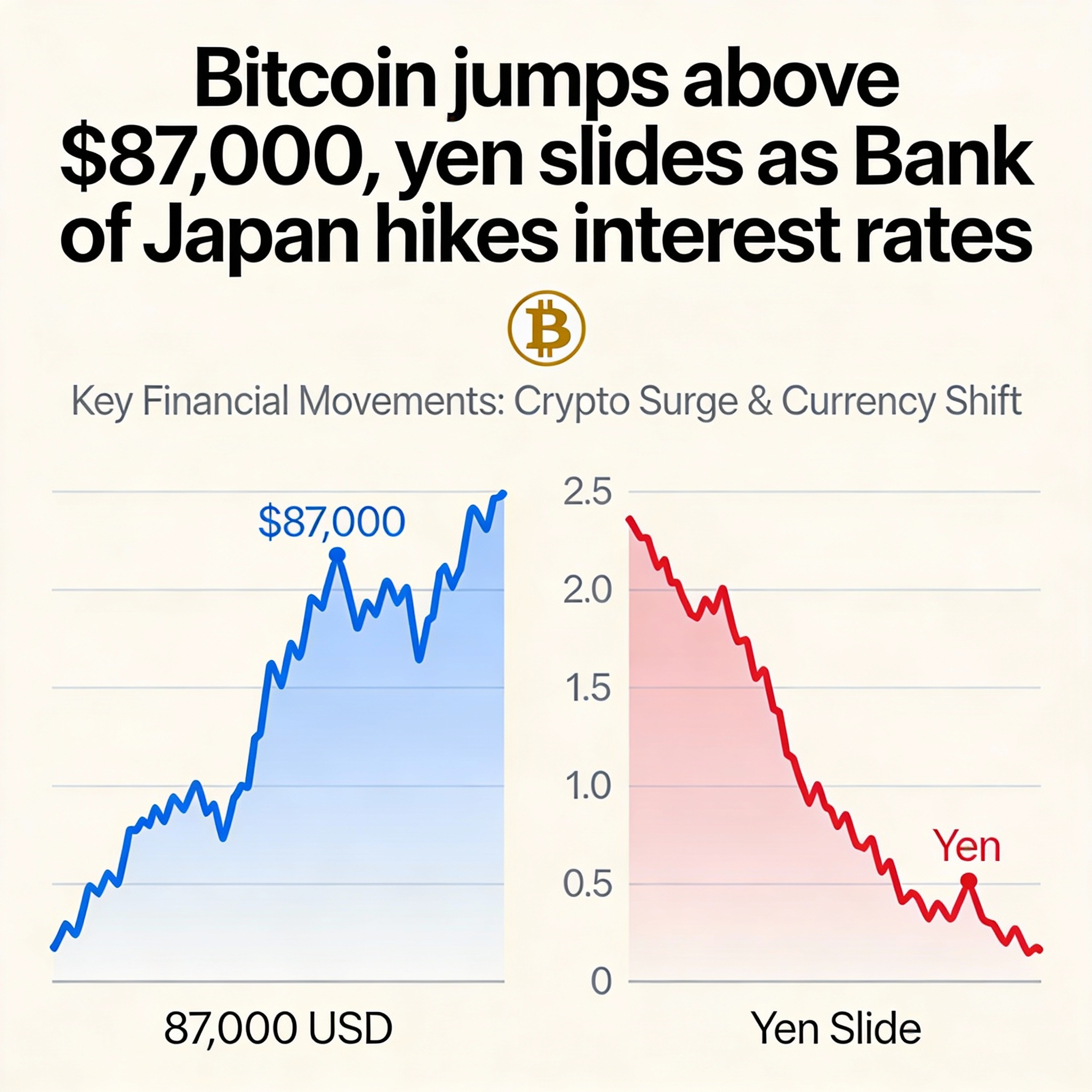

Bank of Japan Hikes Rates, Bitcoin Rises as Yen Slides

The Bank of Japan (BOJ) raised its short-term policy rate by 25 basis points to 0.75%, the highest level in nearly 30 years, signaling a gradual move away from decades of ultra-loose monetary policy.

Following the announcement, Bitcoin (BTC $88,471.90) climbed from $86,000 to $87,500 before stabilizing near $87,000, while the Japanese yen fell to 156.03 per U.S. dollar from 155.67.

The BOJ noted that inflation has remained above its 2% target due to rising import costs and stronger domestic prices, but real interest rates remain negative, keeping monetary conditions accommodative.

Market reaction was largely as expected. Long-held yen positions limited any sharp appreciation, and fears of a mass unwinding of carry trades proved overstated. For decades, Japan’s near-zero rates made the yen a popular funding currency for carry trades in higher-yielding assets. Even with the hike, Japanese rates remain far below U.S. levels, reducing risk to global risk assets.