Crypto markets opened the first Monday of 2026 on a strong footing, with bitcoin and major altcoins extending early gains during U.S. trading. The move reverses the late-2025 pattern of intraday pullbacks, as traders returned to risk assets following the weekend capture of Venezuela’s Nicolás Maduro.

The Coinbase Bitcoin Premium Index, which tracks the price difference between bitcoin on Coinbase and the global average, has rebounded sharply after hitting a nine-month low on Jan. 1, when bitcoin traded near $88,000. The recovery signals renewed U.S. demand and the return of capital flows to the market.

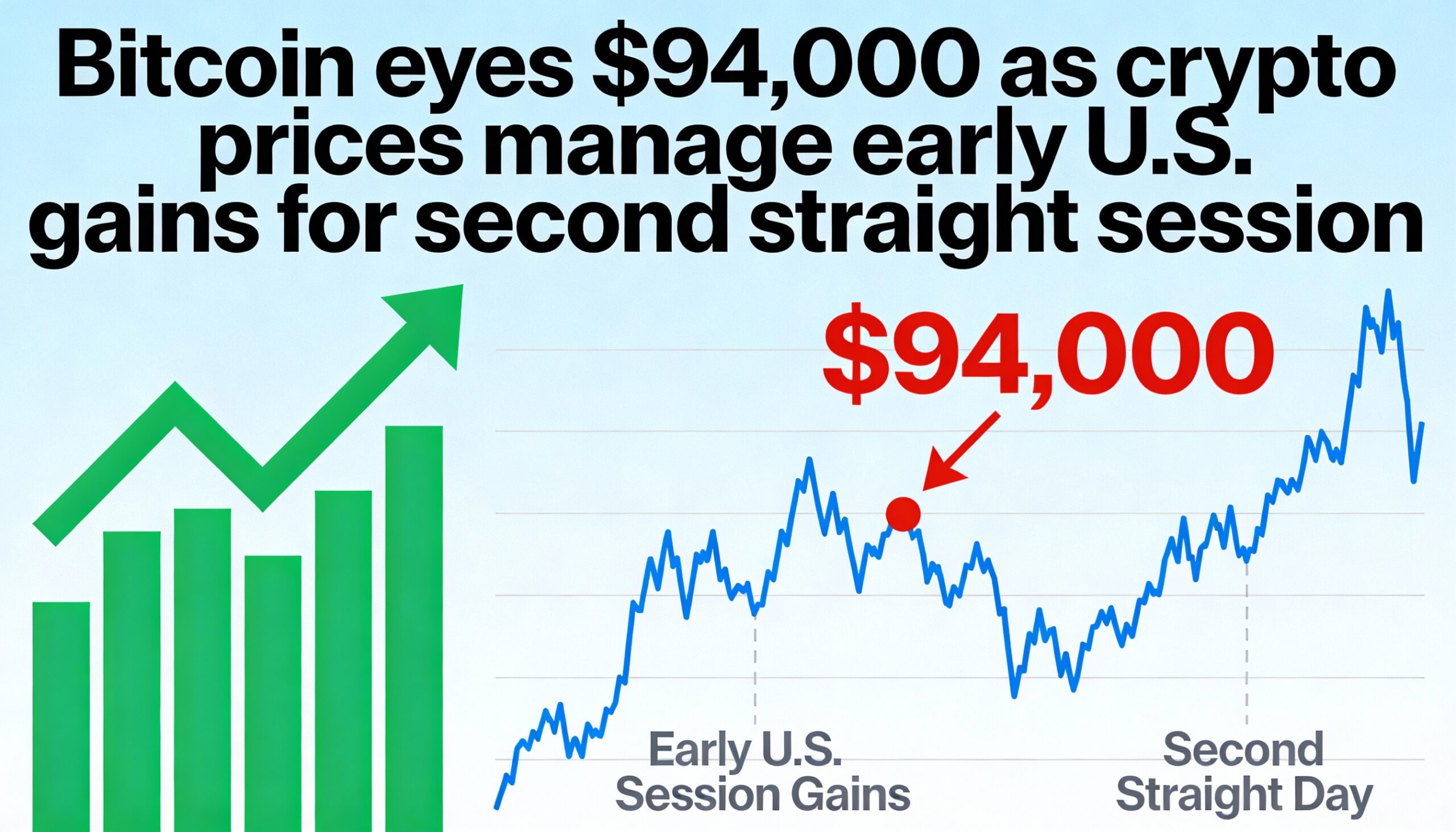

Bitcoin rose nearly 1% in early U.S. trading to around $92,700, approaching $94,000, its highest since early December. Ether (ETH $3,252) and XRP ($2.28) posted similar gains, while Solana (SOL $139.44) advanced modestly. Dogecoin ($0.1505) dipped slightly over 24 hours but remains roughly 20% higher over the past week, attracting ETF inflows.

Digital asset treasury companies, which underperformed in late 2025, led crypto-related stock gains. Strive (ASST) added 101.8 BTC in Q4, bringing total holdings to 7,626 BTC worth around $708 million. American Bitcoin (ABTC) rose 13% after acquiring 329 BTC, and Solana-focused DeFi Development (DFDV) gained 16%.

Analysts said $95,000 remains a key level for bitcoin, with systematic buyers likely to step in if momentum holds during U.S. trading.