Crypto, Commodities, and Asian Equities Rally on AI Momentum and Geopolitical Developments

Cryptocurrency markets surged Monday, mirroring gains in commodities and Asian equities, driven by AI-fueled momentum and geopolitical developments.

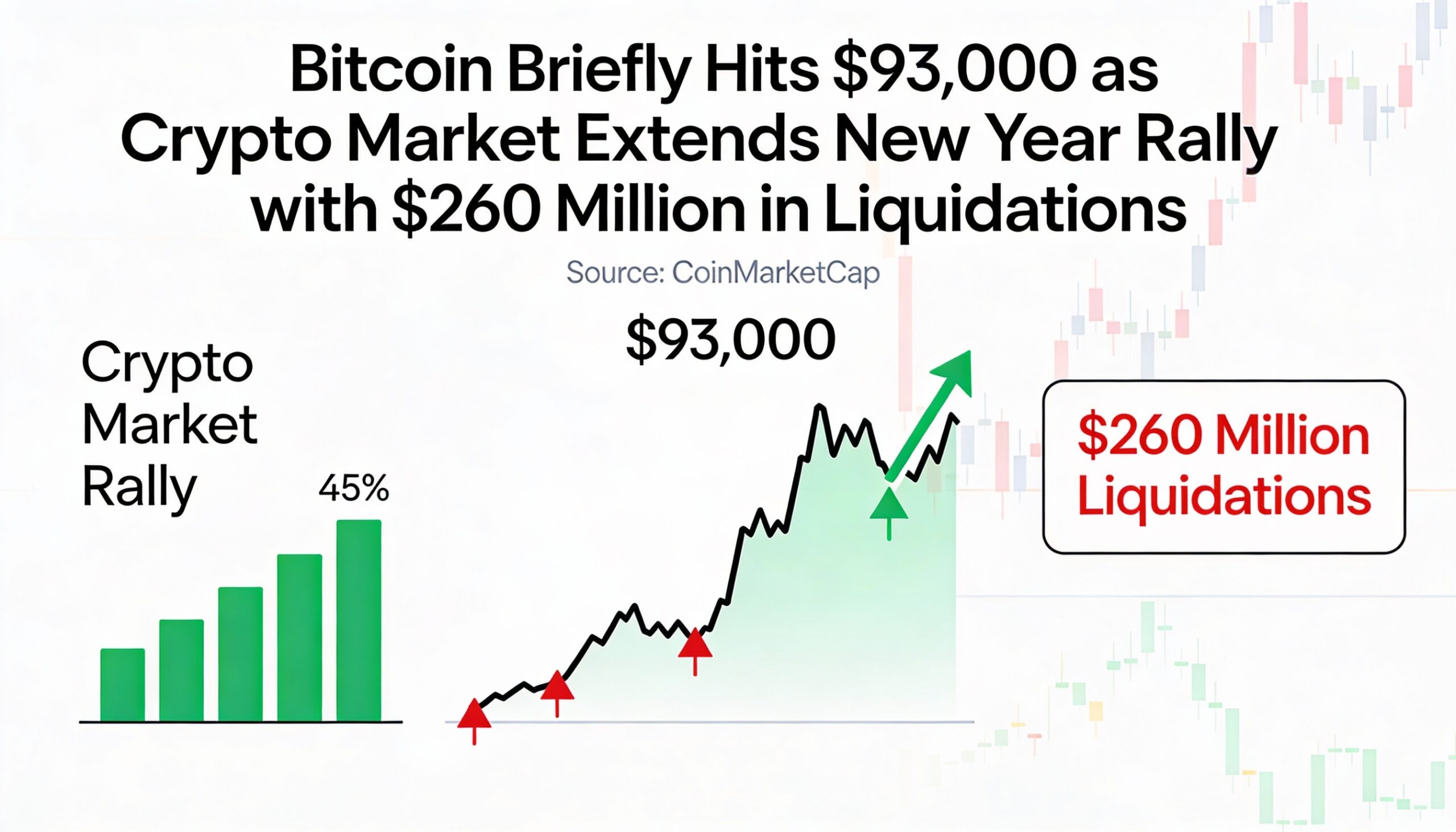

Bitcoin briefly touched $93,000 as traders leaned into a broad risk-on move following the U.S. detainment of Venezuelan President Nicolás Maduro. BTC traded around $93,824, up roughly 1% over 24 hours and 3% for the week. Ether (ETH) held near $3,184, XRP rose above $2.18, and Solana (SOL) hovered near $136. Dogecoin (DOGE) slipped slightly on the day but remained up 17% over the past week, the strongest gains among major tokens.

Derivative activity amplified the rally. Over the past 24 hours, liquidations exceeded $260 million, with shorts accounting for about $200 million as late sellers were forced to cover. In just four hours, more than $121 million in short positions were wiped out, compared to under $9 million in long liquidations. Overall, bearish leverage appeared crowded and vulnerable, with shorts representing roughly 54.4% of liquidated positions versus 45.6% longs on decentralized platform Hyperliquid, according to HyperDash.

The crypto rally coincided with strength across risk assets. Asian equities hit record highs as investors continued to pour into technology stocks, extending last year’s AI-driven momentum. Brent crude steadied after early weakness tied to Venezuelan developments, while gold surged above $4,400 an ounce and silver saw even larger gains.

Traders attributed the start-of-year bid to a mix of positioning and relative value. “In the new year, traders are jumping in to exploit price inefficiencies,” said Jeff Mei, COO of BTSE, noting that cryptocurrencies remain far below their all-time highs even as equities and precious metals reach new records.

Weekend developments in Venezuela fueled market moves. The U.S. took Maduro into custody, with Donald Trump signaling that troops would not be deployed as long as acting Venezuelan president Delcy Rodríguez “does what we want,” adding a geopolitical catalyst to an already active market start.