Leveraged Bulls Blindsided as $1B in Crypto Positions Liquidated, $200M BTC Long Wiped on Binance

A harsh reality check hit crypto markets Thursday as more than $1.15 billion in leveraged positions were liquidated, halting the euphoria sparked by Circle’s IPO and DeFi’s recent momentum.

The most brutal hit came from a $200 million bitcoin long on Binance, the largest single liquidation of the year. The identity behind the position remains unknown, but its collapse sent shockwaves through the industry.

Coinglass data shows nearly 247,000 traders saw their positions wiped, with the vast majority of liquidations affecting longs—a sign of excessive bullish leverage after weeks of positive sentiment.

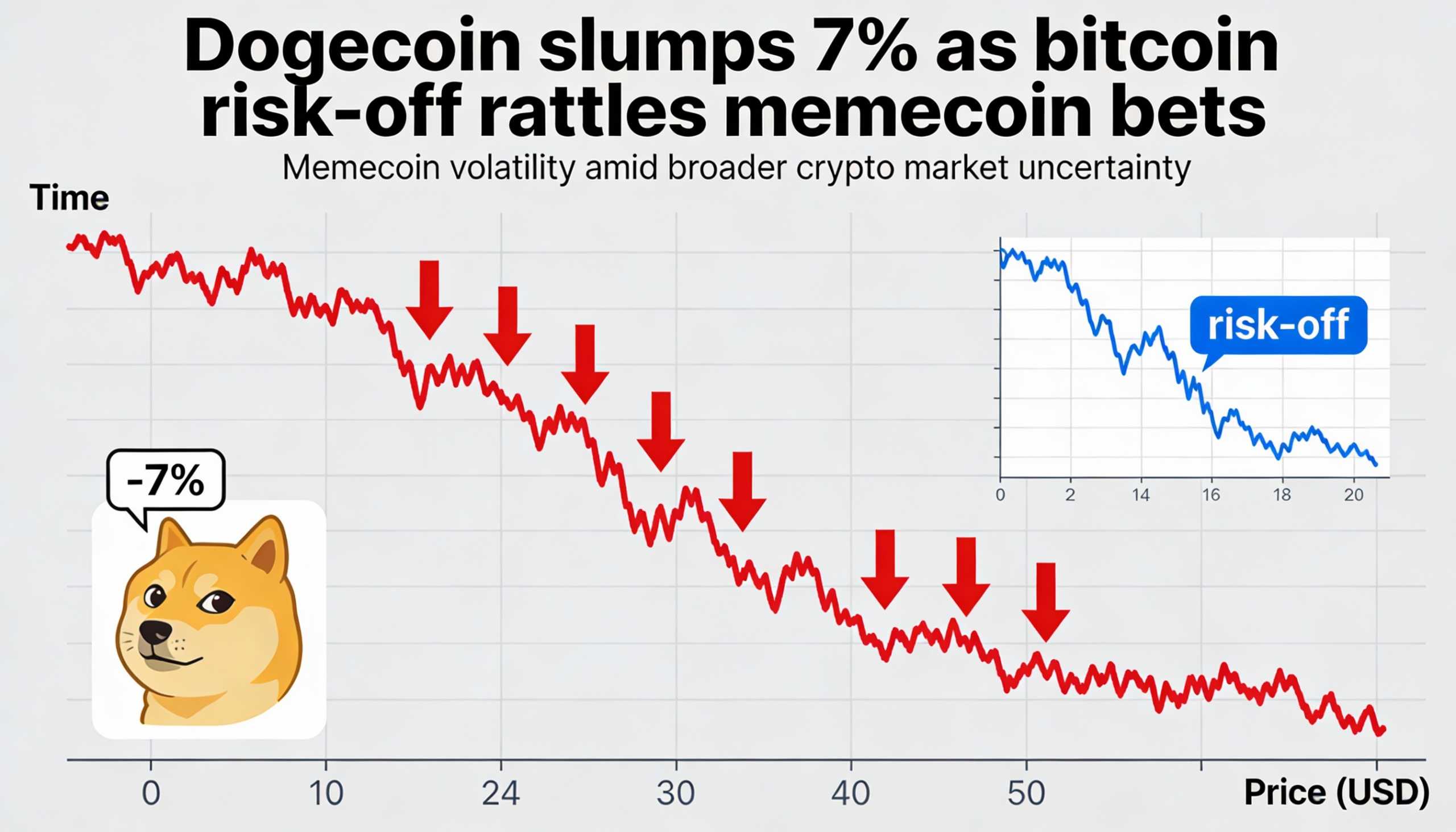

BTC fell over 3% to $104,700, while ether plunged 8% to around $2,530. Altcoins including Solana, XRP, and Dogecoin suffered steep declines in tandem, each losing between 7–9%.

Exchanges Binance and Bybit bore the brunt, accounting for over $834 million in liquidated trades.

This wave of forced selling may signal a capitulation event, potentially clearing the decks for more sustainable positioning ahead.