Bitcoin remained range-bound Wednesday as derivatives markets stabilized and traders rotated into select altcoins ahead of fresh macro signals and a high-profile industry event.

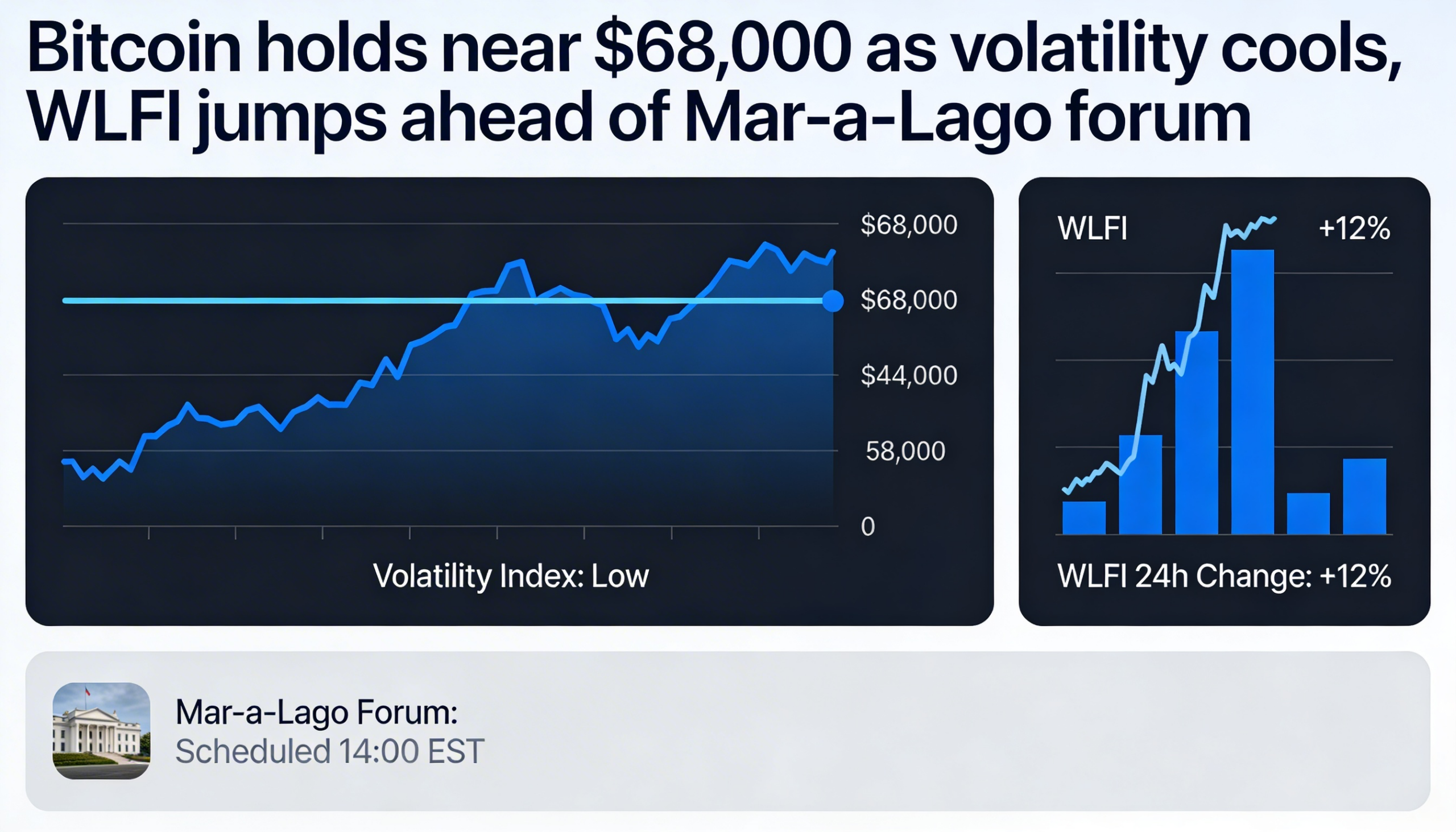

BTC changed hands near $68,000, up about 0.9% since midnight UTC. The asset has largely moved between $65,100 and $72,000 since Feb. 6, after a sharp Feb. 5 decline pushed prices to their lowest level since October 2024. Since that selloff, volatility has cooled, leaving the market in consolidation mode.

Altcoins, meanwhile, showed pockets of divergence. Monero (XMR) rose roughly 3%, while Cardano’s ADA gained 1.7%. On the downside, Zcash (ZEC) fell 3.5% and Hyperliquid’s HYPE slipped 1.1%, highlighting the uneven performance across the broader market.

The muted crypto backdrop comes as U.S. equity futures attempt a modest rebound. S&P 500 and Nasdaq 100 futures climbed 0.57% and 0.66%, respectively, as investors awaited the Federal Reserve’s latest meeting minutes for further guidance on interest-rate policy.

Derivatives shift from deleveraging to balance

Futures positioning suggests the recent phase of leverage unwinding may be giving way to stabilization. Open interest has held steady around $15.5 billion, signaling a more durable base after earlier volatility.

Retail enthusiasm appears to have cooled, with funding rates flattening and even turning slightly negative — Binance funding hovered near -0.11%. Institutional appetite, however, remains intact, with the three-month annualized futures basis holding close to 3%.

Options markets reflect a similar equilibrium. Over the past 24 hours, call and put volumes were nearly balanced at 49% and 51%. The one-week 25-delta skew eased to 11%, indicating reduced demand for near-term downside protection. Even so, implied volatility continues to show short-term backwardation, with elevated front-end IV before flattening toward 49% for longer-dated contracts.

Liquidations totaled $193 million in the past 24 hours, with 62% stemming from long positions and 38% from shorts. BTC accounted for $72 million in forced closures, followed by ETH at $52 million and other tokens at $12 million. Binance liquidation data points to $68,800 as a key level that could trigger additional upside liquidations if breached.

Event-driven flows lift select tokens

The altcoin season index has improved to 34 out of 100, up from 22 earlier this month, suggesting strengthening relative performance among smaller-cap assets despite subdued volatility overall.

WLFI, the Trump family-backed DeFi token, led gains Wednesday, climbing 8.8% since midnight and 18.5% over the past 24 hours. Traders appear to be positioning ahead of the project’s crypto forum at Mar-a-Lago, where executives from Goldman Sachs, Nasdaq and Franklin Templeton are expected to participate.

However, rallies tied to real-world events often carry “buy the rumor, sell the news” risk, as speculative positions may unwind once the event concludes.

Elsewhere, Morpho’s native MORPHO token continued its upward trajectory, rising 7% on the day and 36% over the past week, as market participants seek momentum opportunities in an otherwise range-bound environment.