Bitcoin Under Pressure Amid Macro Headwinds, Drop Below $90K Could Trigger Steeper Declines: Standard Chartered

Bitcoin (BTC) is under renewed selling pressure as macroeconomic uncertainties weigh on investor sentiment. A report from Standard Chartered on Monday warned that if bitcoin fails to hold the critical $90,000 support level, it could face a sharp decline of up to 10%, bringing prices into the $81,000-$82,000 range.

“The broader macro environment remains unfavorable for risk assets, including bitcoin, as hawkish central bank policies and rising bond yields continue to dampen optimism,” said Geoff Kendrick, head of digital assets research at Standard Chartered.

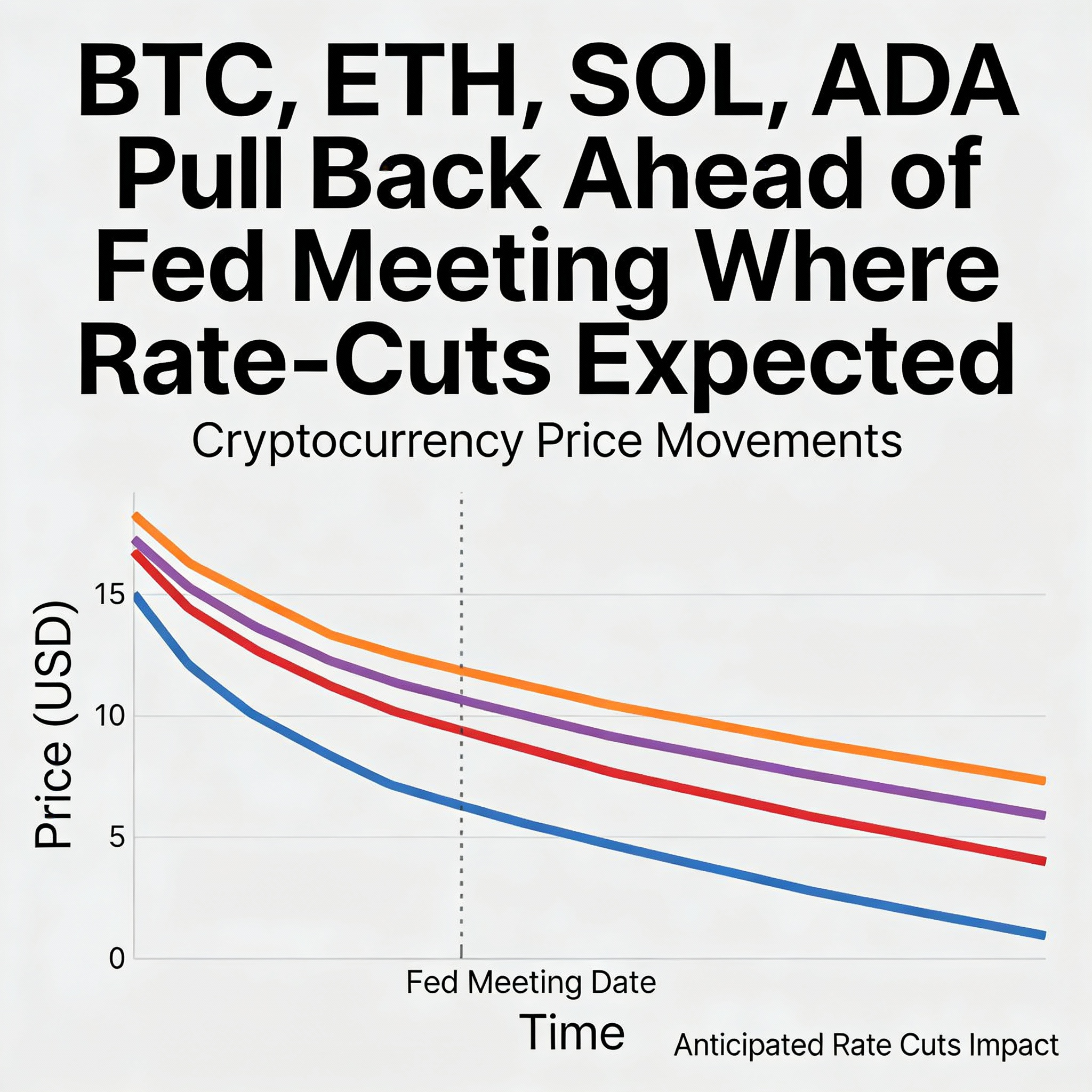

The sell-off comes after Federal Reserve Chair Jerome Powell’s December remarks dashed hopes for aggressive rate cuts, leading to a rise in treasury yields and a stronger dollar—both traditionally bearish signals for bitcoin.

Adding to the pressure, many traders who entered the market during bitcoin’s November rally or via spot ETFs are now facing positions that are near or below their entry points. “This could lead to increased liquidation risks and panic selling, particularly if $90,000 is breached,” Kendrick said.

Despite the near-term risks, Standard Chartered reiterated its bullish long-term outlook for bitcoin, maintaining its end-of-year price target of $200,000. The bank cited increasing institutional adoption, regulatory clarity under the new Trump administration, and growing corporate interest as key drivers of future upside.

For now, the bank advises caution, suggesting that investors monitor price action closely before taking new positions. “A confirmed recovery above $96,000 would provide a stronger foundation for bullish momentum,” Kendrick added.