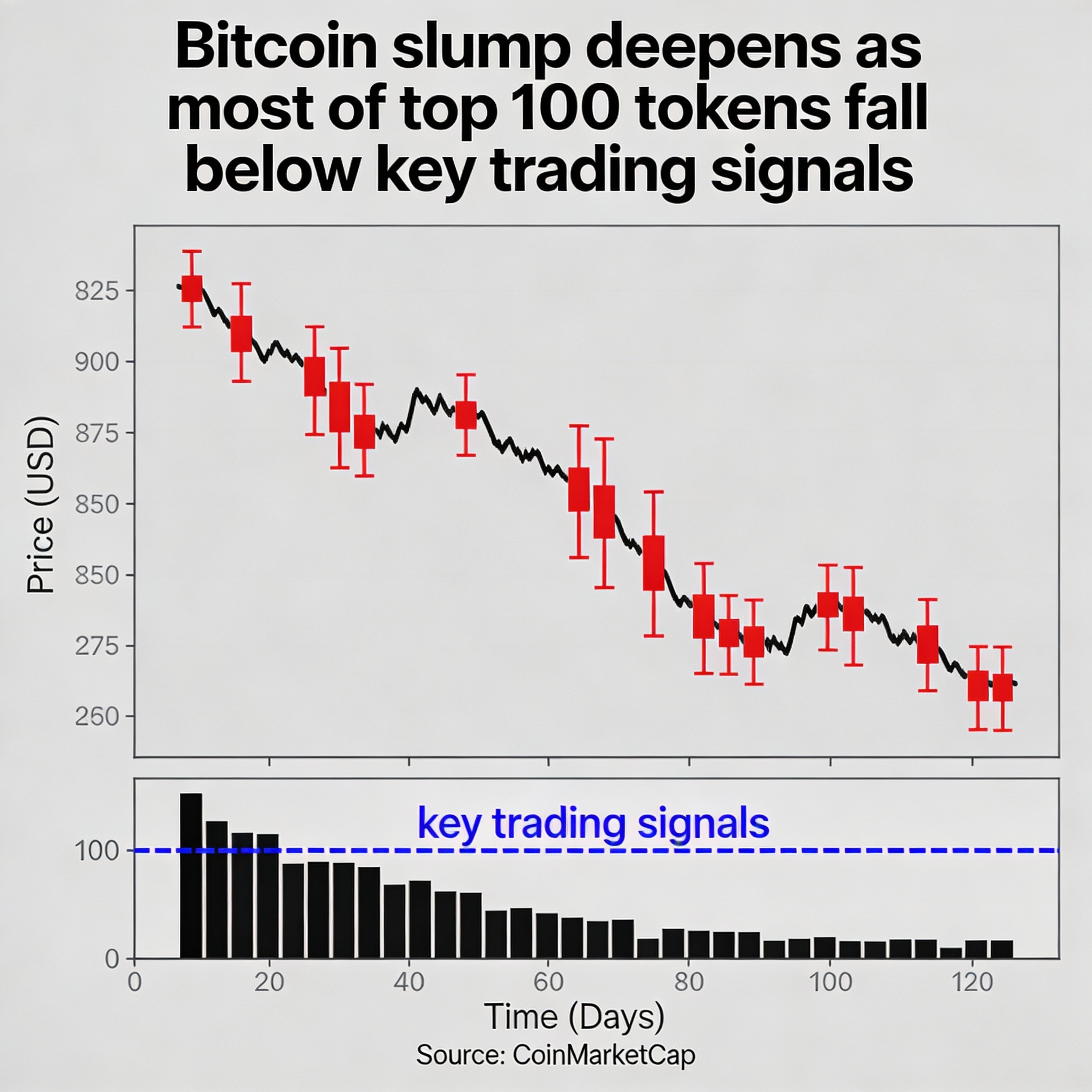

Crypto Bear Market Intensifies as 75 of Top 100 Coins Fall Below Key Moving Averages

The cryptocurrency market is showing deepening bearish signals as the year-end approaches.

According to TradingView, 75 of the top 100 coins by market capitalization are trading below both their 50-day and 200-day simple moving averages (SMAs), signaling widespread weakness. Bitcoin’s slide from over $126,000 in early October to around $87,000 has contributed to capital outflows and declining investor confidence.

SMAs are closely watched indicators that smooth out short-term price volatility to reveal longer-term trends. When coins fall below both averages, it often triggers additional selling and accelerates declines. By contrast, only 29 Nasdaq 100 stocks are below these levels, highlighting the relative resilience of technology equities. Bitcoin’s correlation with the Nasdaq can amplify losses during bearish phases.

Major Tokens Lead Losses

Among the 75 coins below their SMAs are bitcoin, ether (ETH$2,972.48), solana (SOL$127.94), BNB (BNB$847.03), and XRP (XRP$1.9279), which together account for roughly 78% of the $3 trillion crypto market. Weakness in these liquid, institutionally traded assets often depresses investor appetite for smaller, less liquid cryptocurrencies.

Oversold Coins Remain Limited

Only eight top-100 coins—PI, APT, ALGO, FLARE, VET, JUP, IP, and KAIA—are classified as oversold on the 14-day relative strength index (RSI), which gauges recent price momentum on a 0-100 scale. Readings below 30 suggest oversold conditions, potentially indicating short-term consolidation or a bounce, while values above 80 signal overbought conditions.

The combination of widespread SMA breaches with few oversold coins indicates that most cryptocurrencies have further downside risk before a meaningful recovery occurs, confirming the market’s bearish trend.