Crypto markets delivered another sharp reminder of the dangers of leverage over the past 24 hours, as violent price swings triggered more than $625 million in forced liquidations and punished traders on both sides of the market.

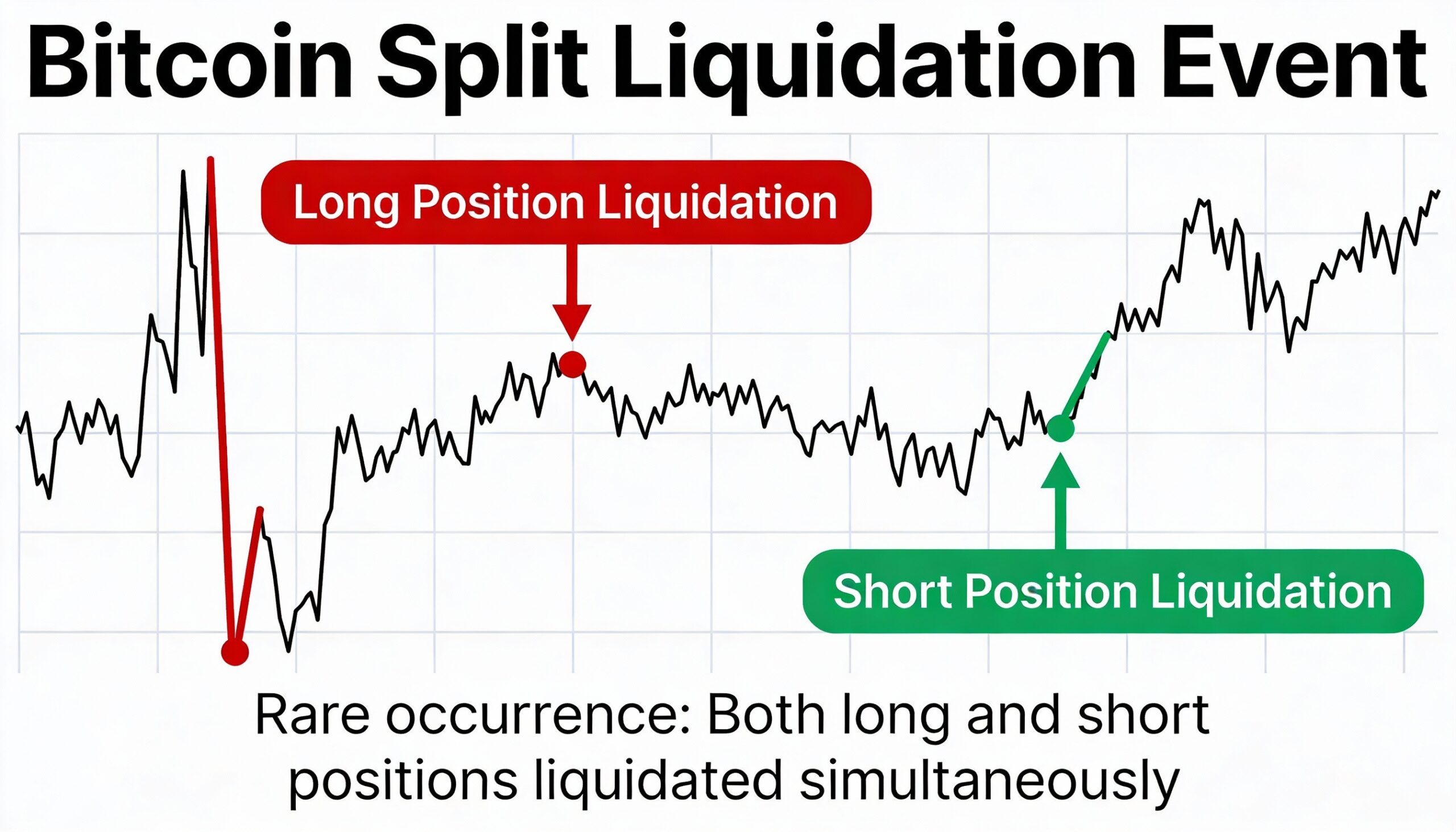

According to CoinGlass, roughly 150,000 traders were pushed out of positions, with liquidations split nearly evenly between longs and shorts. About $306 million in bullish bets were wiped out, while approximately $319 million in short positions were liquidated — a rare balance that highlighted how abruptly prices reversed during the session.

The largest single liquidation occurred on Hyperliquid, where a $40.22 million ETH-USD position was forcibly closed. Hyperliquid also accounted for the biggest share of overall liquidations, with around $220.8 million erased on the platform. More than 72% of that total came from short positions, suggesting traders there were leaning heavily toward downside just as prices turned higher.

Major centralized exchanges also saw heavy activity. Binance recorded about $120.8 million in liquidations, largely skewed toward long positions, while Bybit posted close to $95 million, with longs again slightly outweighing shorts.

The liquidation wave coincided with sharp intraday swings in bitcoin, which briefly fell below $88,000 before rebounding toward the $90,000 level.

Those moves unfolded amid heightened macro uncertainty, driven by shifting expectations around U.S. trade policy, ongoing volatility in bond markets, and investor reaction to comments from U.S. President Donald Trump during his appearance at the World Economic Forum in Davos.

For leveraged traders, the sequence proved punishing. Early downside momentum triggered long liquidations that accelerated the decline. As prices quickly snapped back, short positions were caught offside, sparking a second wave of forced closures in the opposite direction. The result was a textbook whipsaw that left both bulls and bears nursing losses.

Two-way liquidation events like this typically emerge when markets are caught between competing narratives, with no clear trend and little room for error. In this case, fast-moving macro headlines drove rapid shifts in sentiment, while leverage amplified each move.

Looking ahead, traders will be watching whether volatility subsides or continues to flare. Until a clearer directional signal emerges, the latest liquidation episode suggests caution — rather than aggressive leverage — may be the more prudent approach.