Cryptocurrencies Slide While Gold and Silver Rally Amid Global Risks

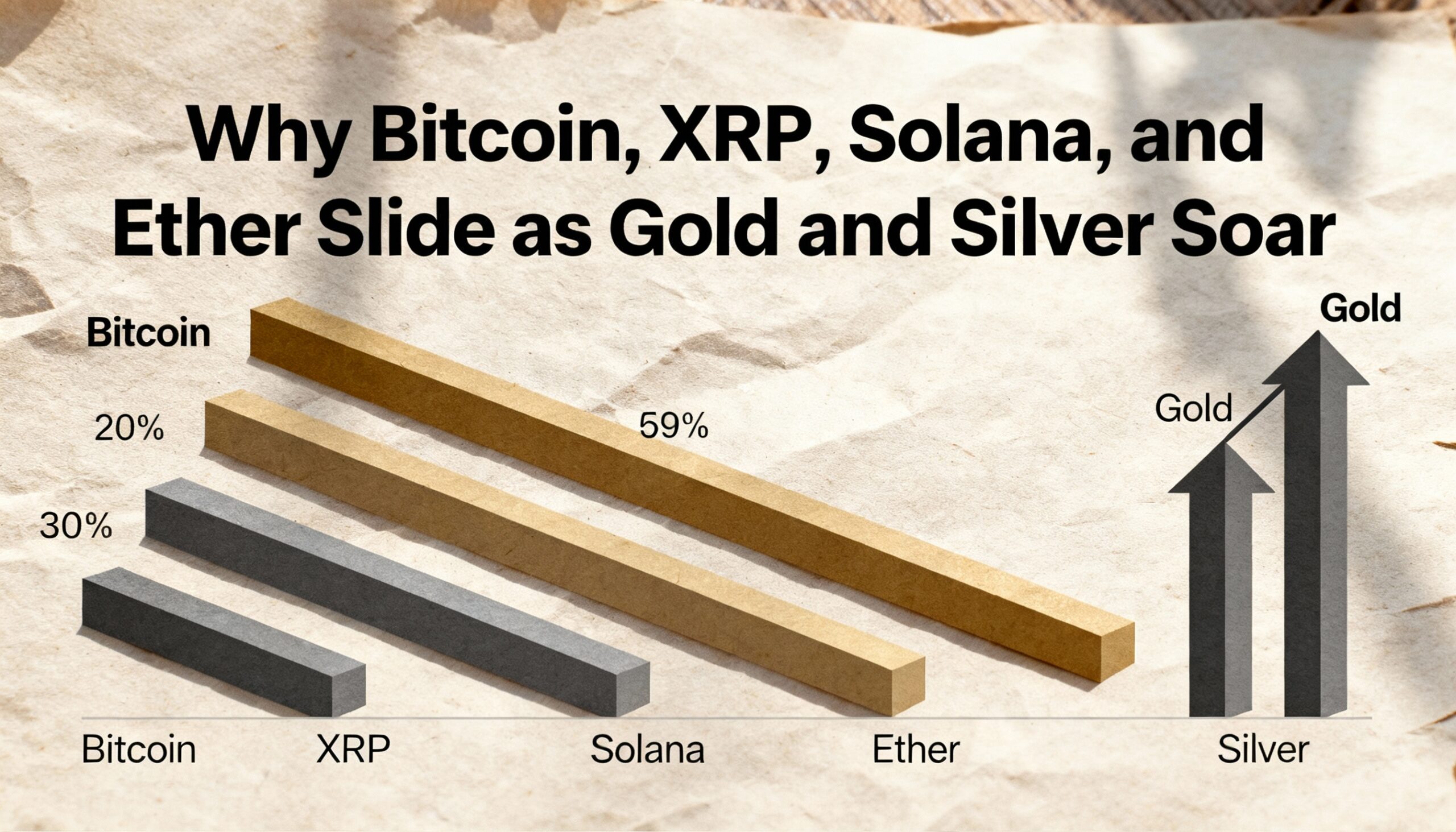

Major cryptocurrencies are under pressure this month, while gold and silver continue to climb, highlighting diverging trends between digital assets and traditional safe havens.

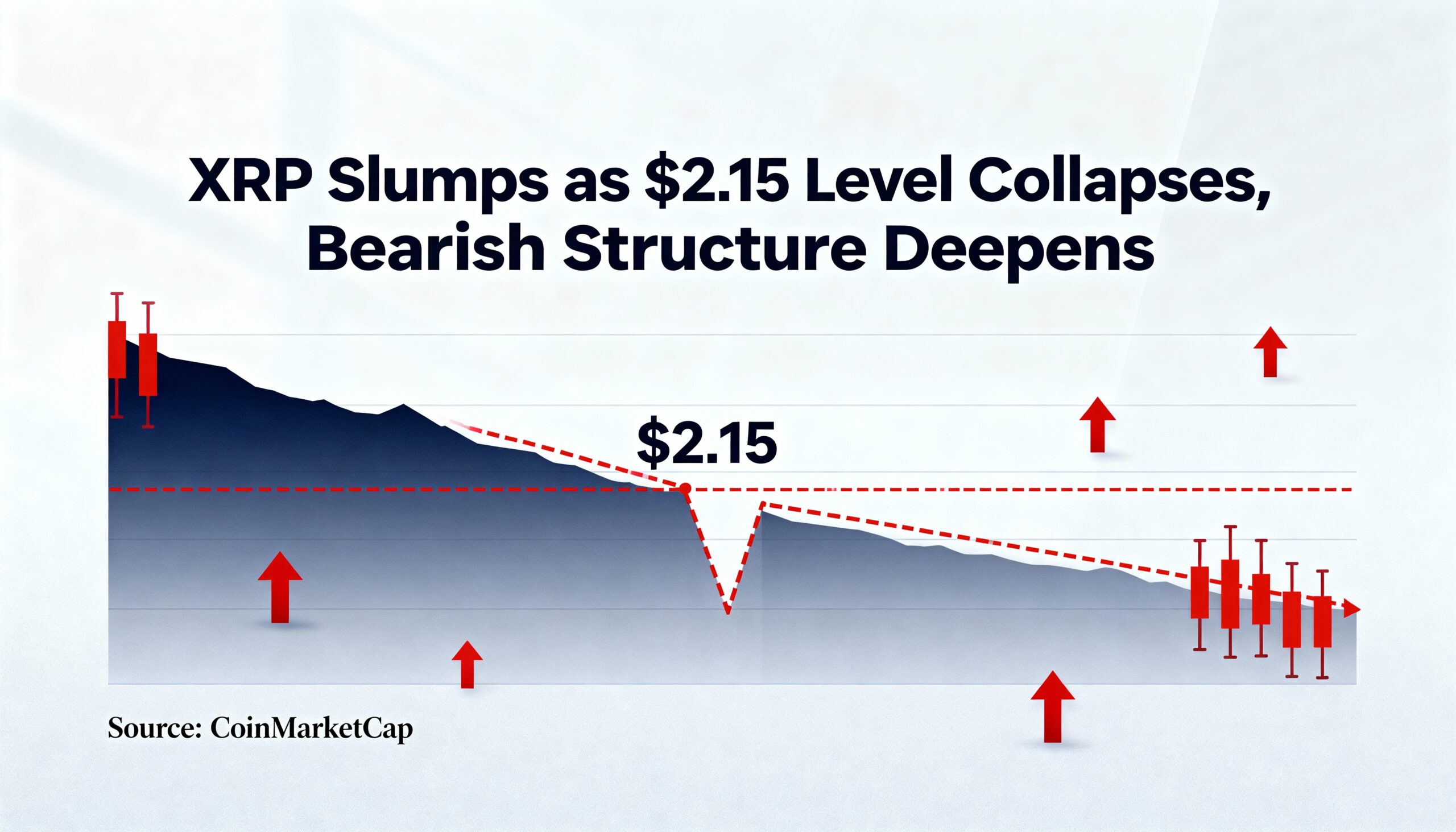

Bitcoin (BTC) has fallen more than 9% in November, dropping below the $100,000 on-chain support level. Ether (ETH), Solana (SOL), and Dogecoin (DOGE) have declined 11%–20%, while XRP has shown relative resilience with a 7% drop.

The weakness in crypto comes even as the U.S. dollar index (DXY) loses momentum after hitting resistance above 100. While a softer dollar typically benefits both crypto and precious metals, only gold and silver have gained traction this month, rising roughly 4% and 9%, respectively. Palladium and platinum have also posted modest gains above 1%.

Greg Magadini, director of derivatives at Amberdata, cited overextended bullish positioning and systemic risks from digital asset treasuries (DATs) as key factors. DATs rely on credit markets to fund crypto purchases; tightening credit could force sell-offs, particularly in altcoins, though BTC remains more resilient.

Precious metals gains are fueled by fiscal concerns in major economies. Japan’s debt-to-GDP exceeds 220%, the U.S. is above 120%, and France and Italy surpass 110%. China’s total non-financial debt exceeds 300% of GDP. Robin Brooks of Brookings Institution said, “The metals rally reflects deeply broken fiscal policies, especially in the Eurozone.”

Historically, gold has led BTC by about 80 days, suggesting bitcoin may eventually gain momentum as gold stabilizes, though uncertainty remains.