Bitcoin Dips Below Key 2025 Cost Basis as Correction Deepens

Bitcoin (BTC $84,408.02) has fallen sharply, breaching crucial 2025 cost basis levels amid an ongoing market correction. The cryptocurrency is down 30% from its October all-time high of $126,250 and has lost 17% in November, marking the joint weakest month of 2025 and its worst monthly performance since June 2022.

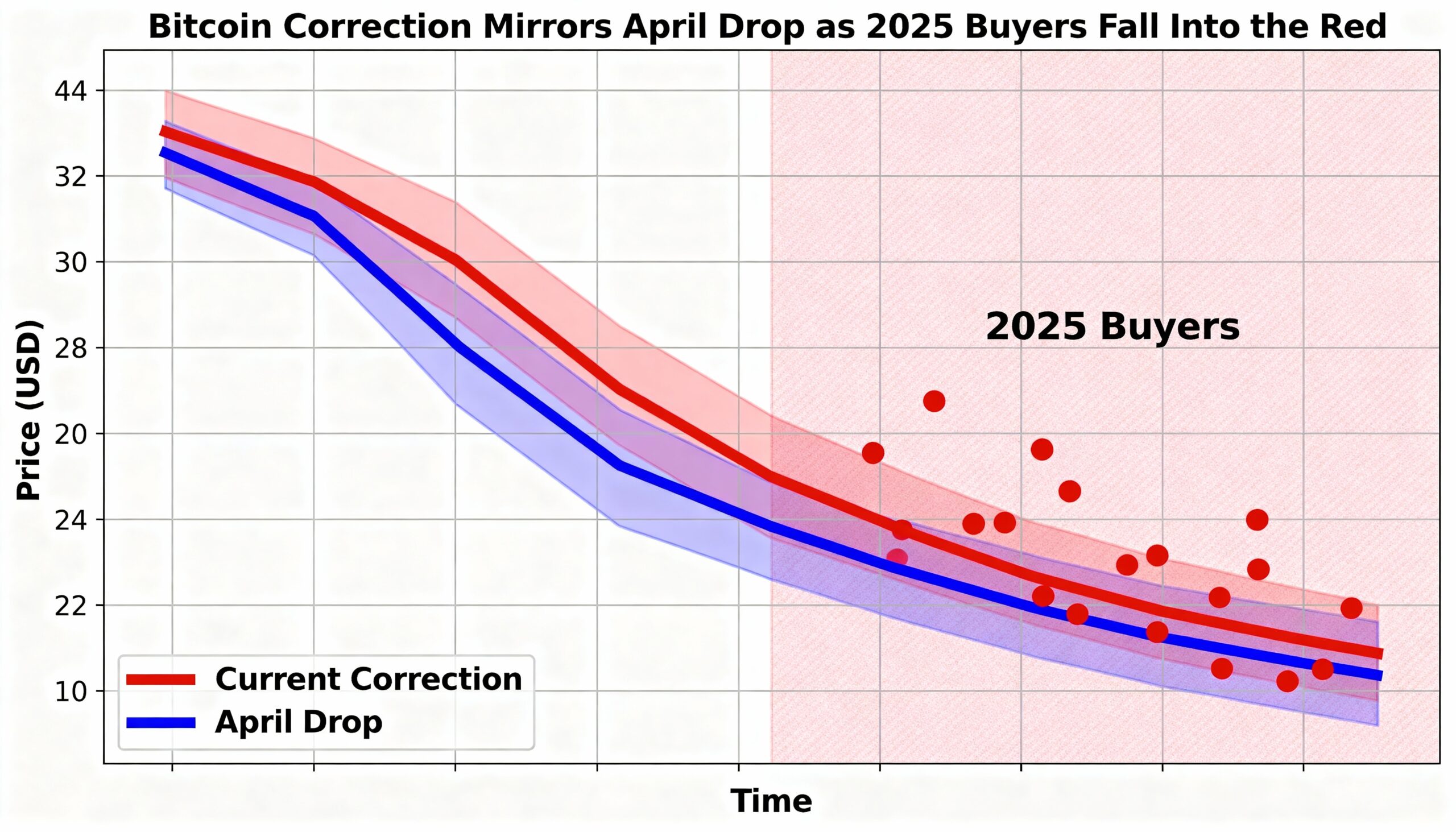

After falling below $90,000 early Tuesday, Bitcoin is now 43 days into its current correction, comparable in magnitude to the April 2025 drawdown when prices dropped from $109,000 to $76,000. That earlier decline, however, lasted roughly 80 days—nearly twice as long as the current one.

The selloff has pushed Bitcoin below the 2025 realized price of $103,227, leaving the average 2025 buyer with a 13% unrealized loss. The realized price reflects the average cost at which coins were acquired, and a drop below it signals that many investors are now underwater.

Glassnode data shows that Bitcoin has historically dipped below the yearly realized price during market corrections, often creating strong entry points. Since the 2023 cycle began, each year’s realized price has generally acted as support, with brief exceptions in March 2023 during the Silicon Valley Bank collapse and August 2024 amid the Yen carry trade episode