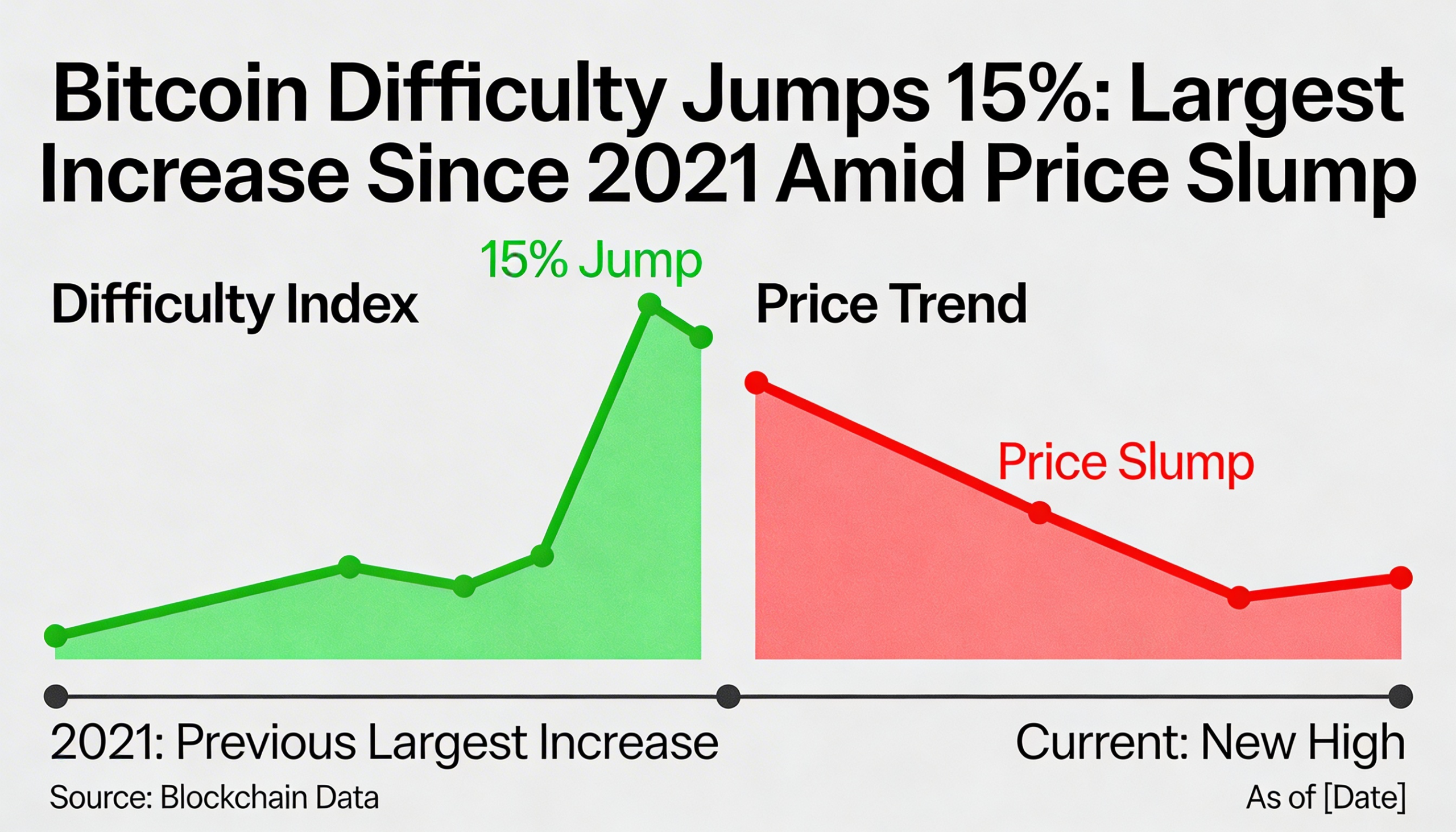

Bitcoin’s mining difficulty has climbed back to 144.4 trillion, registering a 15% increase in the latest adjustment — the largest percentage jump since 2021. The rebound comes as network hashrate recovers to 1 zettahash per second (ZH/s), even though miner revenues remain compressed at multi-year low hashprice levels.

Difficulty reflects how challenging it is to mine a new block and automatically adjusts every 2,016 blocks, or roughly every two weeks, to maintain Bitcoin’s average 10-minute block time. The latest surge follows a 12% decline in the previous adjustment, which came after a drop in total network computing power.

That decline marked the sharpest hashrate pullback since late 2021, when a severe winter storm in the United States forced several major mining operators to scale back activity.

Network strength had previously peaked in October, when bitcoin reached an all-time high near $126,500 and hashrate touched 1.1 ZH/s. As prices later fell to around $60,000 in February, hashrate slid to 826 exahash per second (EH/s). Since then, computing power has rebounded to 1 ZH/s, while bitcoin’s price has recovered to roughly $67,000.

Despite the recovery in hashrate, miner economics remain under pressure. Hashprice — the estimated daily revenue earned per unit of hashrate — is hovering near $23.9 per petahash per second (PH/s), among the lowest levels seen in several years.

Even with margins squeezed, large-scale miners with access to inexpensive power continue to operate at scale. The United Arab Emirates, for instance, is estimated to be holding approximately $344 million in unrealized gains from its mining operations.

Well-capitalized and energy-efficient operators are helping keep the network’s hashrate elevated, demonstrating resilience even during periods of subdued bitcoin prices.

At the same time, structural shifts are reshaping the sector. A contributing factor behind the earlier dip in hashrate has been the decision by several publicly traded mining companies to redirect energy and infrastructure toward artificial intelligence (AI) and high-performance computing (HPC) data centers.

Bitfarms (BITF) recently unveiled a rebrand that deemphasizes its bitcoin roots as it expands its AI infrastructure strategy. Meanwhile, activist investor Starboard has called on Riot Platforms (RIOT) to accelerate its move into AI-focused data center operations, underscoring a broader industry trend toward diversification beyond pure bitcoin mining.