Bitcoin’s Slide Tied to Dollar Strength as BTC Falls from $91K Peak

It feels like a lifetime ago, but bitcoin nearly touched $91,000 on Wednesday before the U.S. dollar began to rebound.

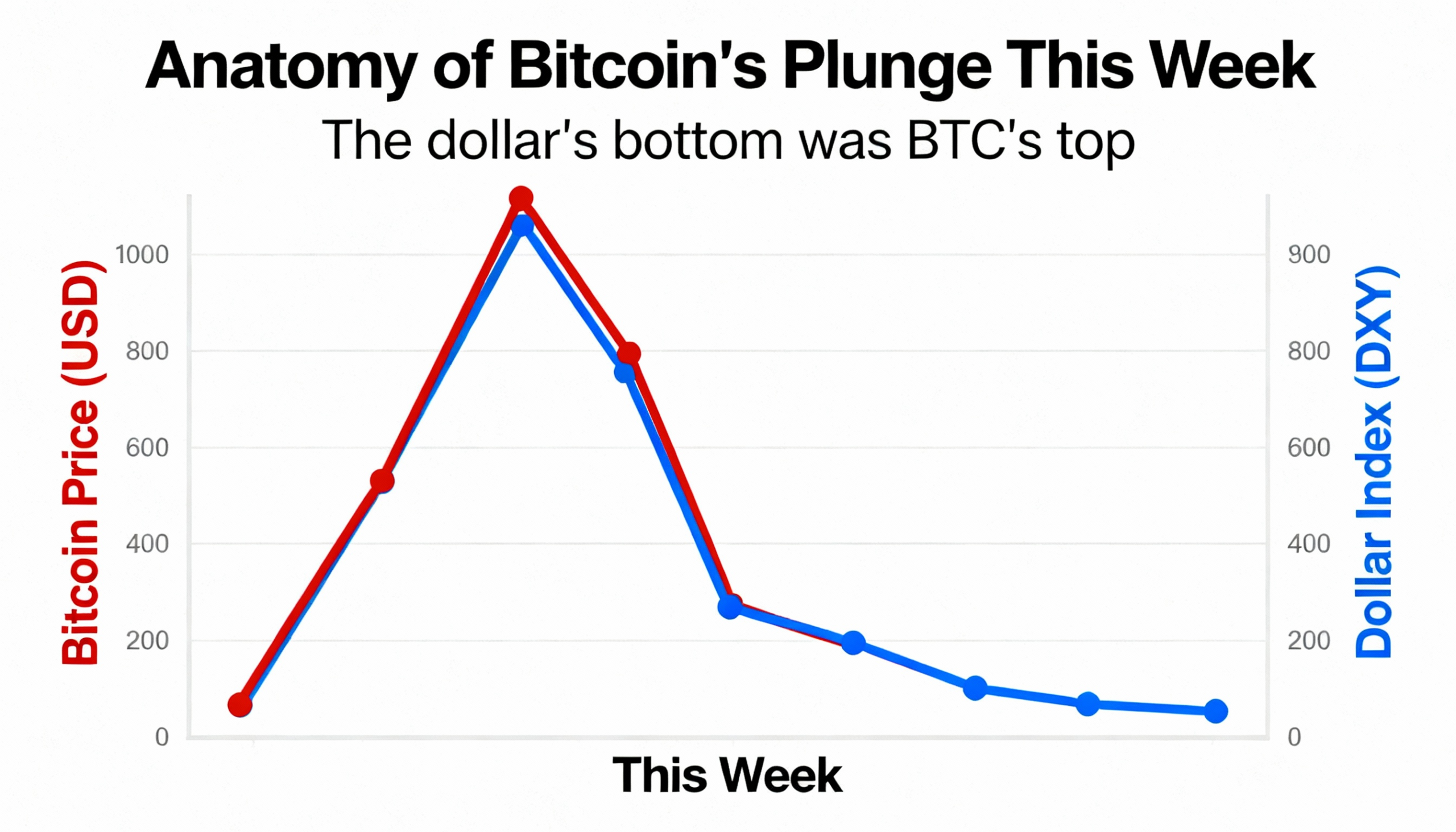

Bitcoin’s sell-off this week, down to around $77,424, appears to have had little to do with crypto-specific factors and more to do with the dollar’s strength. After a typical weekend decline in crypto prices, bitcoin had actually been rising through the week, buoyed in part by a falling U.S. dollar.

The cryptocurrency peaked late Wednesday afternoon near $91,000, following the Federal Reserve’s decision to hold interest rates steady and as markets speculated on who President Trump might nominate as the next Fed chair. The peak coincided with the dollar index (DXY) hitting a multi-year low of 95.34. Historically, a weaker dollar is supportive of risk assets, including bitcoin, stocks, and commodities.

Despite warnings from technicians that a DXY below 96 could trigger deeper declines, the dollar reversed course, steadily climbing through Thursday. Bitcoin mirrored the move, retreating from its weekly high.

Thursday evening, reports that Kevin Warsh—a hawkish contender—was set to become Fed chairman sent the dollar surging and bitcoin sliding further, bottoming near $81,000.

Bitcoin has since rebounded to roughly $83,000, but the continued strength in the dollar raises questions about the sustainability of the crypto rally.