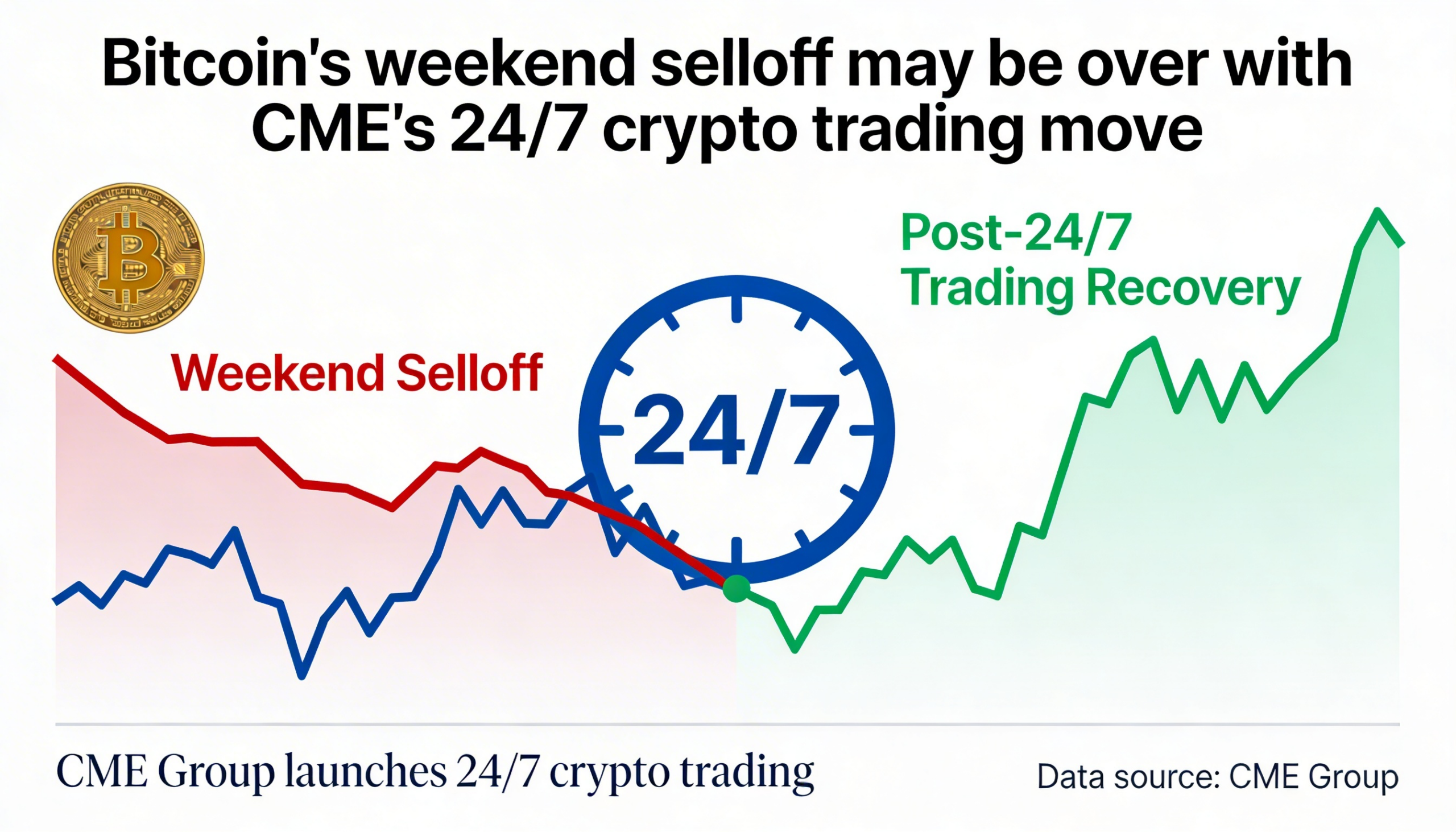

The U.S. derivatives heavyweight CME Group is preparing to roll out 24/7 trading for its cryptocurrency futures and options, a move analysts say could meaningfully alter weekend liquidity and volatility across digital asset markets.

Starting May 29, institutional clients will be able to trade CME’s crypto derivatives without interruption. The decision marks a significant evolution for traditional finance, which has historically operated on fixed trading schedules even as crypto markets run continuously.

CME said the expansion reflects accelerating demand from professional investors seeking round-the-clock risk management tools. While spot bitcoin and other cryptocurrencies trade 24/7, CME’s regulated futures and options have until now paused from Friday evening to Sunday, limiting institutions’ ability to hedge exposure during volatile weekend sessions.

Tim McCourt, the exchange’s global head of equities and FX, said crypto derivatives activity has grown rapidly, with notional volumes reaching $3 trillion last year. That growth, he noted, underscored the need for uninterrupted market access.

Closing a structural gap

The change directly addresses the long-observed “CME gap” phenomenon — price differences that appear between Friday’s futures close and Sunday’s reopen while the spot market continues trading.

Those gaps often left institutional traders exposed to sharp weekend price moves, fueling volatility when markets reopened. In some cases, thin liquidity during off-hours contributed to abrupt swings and liquidation cascades.

Bobby Ong, co-founder of CoinGecko, said some of the most aggressive price movements have historically occurred when regulated derivatives venues were offline. Continuous trading, he suggested, represents a structural acknowledgment of crypto’s always-on nature.

Smoother flows, tighter pricing

Adam Haeems, head of asset management at Tesseract Group, described the move as eliminating one of the final disconnects between crypto-native markets and traditional derivatives infrastructure.

Institutional flows that once paused over weekends will now remain active, potentially lowering hedging costs and narrowing spreads. By reducing the mismatch between spot and futures trading hours, weekend volatility could become less extreme and more evenly distributed.

However, Haeems cautioned that extended access does not automatically translate into deep liquidity. Institutional desks may not allocate the same capital or staffing levels on weekends as they do during peak weekday hours, meaning improvements in market stability may take time to materialize.

Retail traders could see fewer sharp Monday-morning price gaps — a technical pattern that has historically attracted significant attention. With futures trading no longer stopping and restarting, those setups may gradually lose prominence.

Bitcoin as a weekend macro barometer

Maxime Seiler, CEO of STS Digital, said the shift enhances CME’s appeal for institutions wary of liquidation mechanisms on crypto-native exchanges.

He also suggested uninterrupted derivatives access could strengthen bitcoin’s role as a macro hedge during weekends. With traditional markets closed, bitcoin may increasingly function as a real-time indicator of global risk sentiment, reacting to geopolitical or economic developments before other asset classes reopen.

By aligning regulated derivatives trading with crypto’s continuous market structure, CME’s 24/7 launch could gradually reshape how liquidity, risk transfer, and price discovery unfold outside conventional trading hours.