Quantum Computing Fears Return as Bitcoin Trails Gold and Equities

Bitcoin’s recent weakness has sparked renewed debate over quantum computing risks, though analysts argue that conventional market pressures are the main cause.

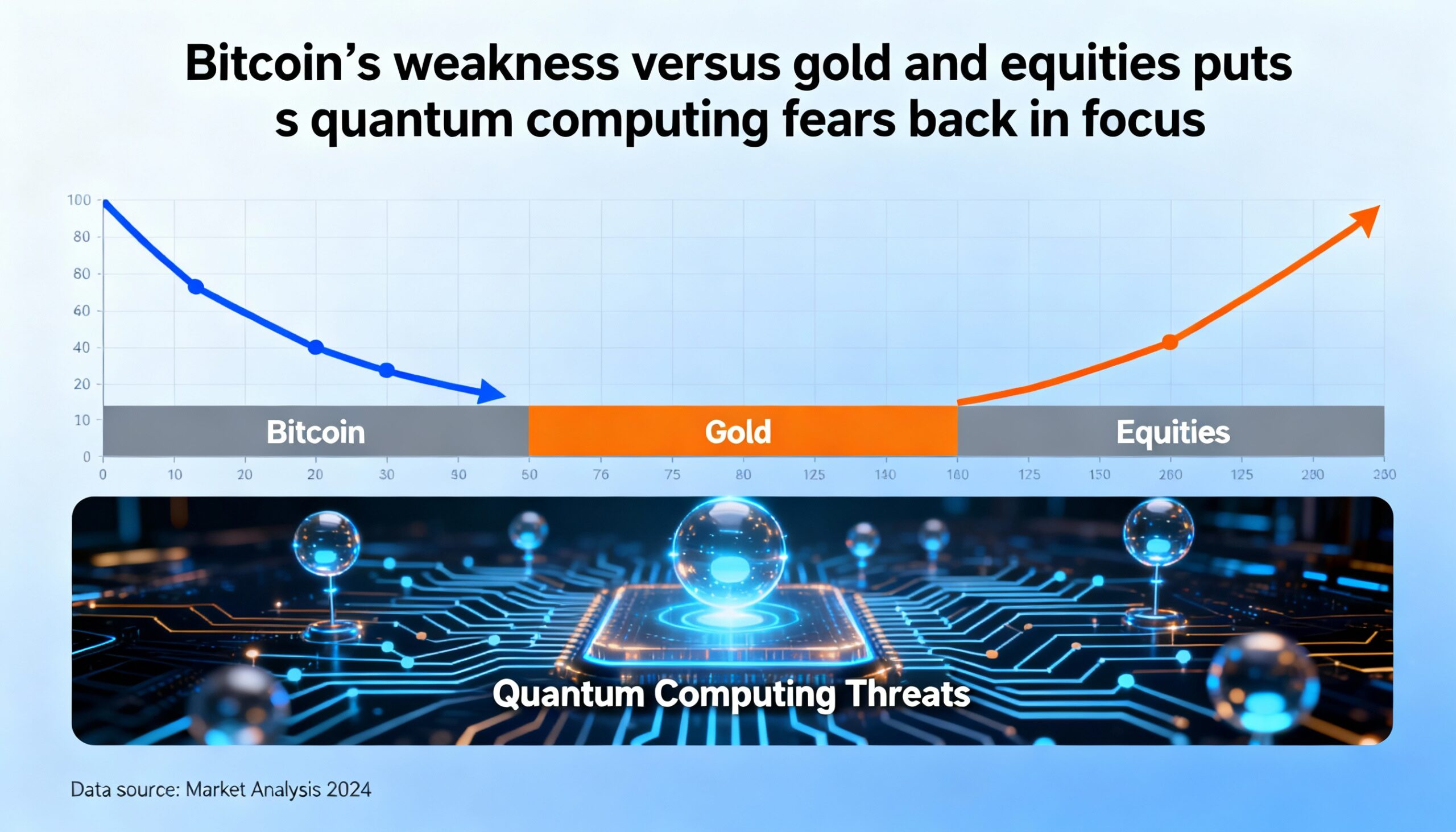

On Thursday, gold rose 1.7% to a record $4,930 an ounce and silver jumped 3.7% to $96, while Bitcoin dipped just above $89,000—roughly 30% below its early-October high. Since Trump’s November 2024 election win, Bitcoin has fallen 2.6%, compared with gains of 205% for silver, 83% for gold, 24% for the Nasdaq, and 17.6% for the S&P 500.

Castle Island Ventures partner Nic Carter attributed Bitcoin’s “mysterious” underperformance to quantum computing, calling it “the only story that matters this year.”

Other observers disagree. @Checkmatey, an onchain analyst at Checkonchain, said recent price moves reflect supply and HODLer sell pressure, not futuristic risks. Investor Vijay Boyapati similarly cited large Bitcoin unlocks by whales as a key factor.

Quantum computing could theoretically threaten Bitcoin’s cryptography, but practical machines remain decades away. Developers highlight mitigation plans, such as Bitcoin Improvement Proposal 360, which outlines a gradual transition to quantum-resistant addresses.

Some traditional finance figures, like Jefferies strategist Christopher Wood, have flagged quantum computing as a long-term risk. Still, analysts stress that any upgrade would take years, making it an unlikely explanation for short-term price behavior.