Long-term bitcoin holders accelerate selling as price trails broader markets

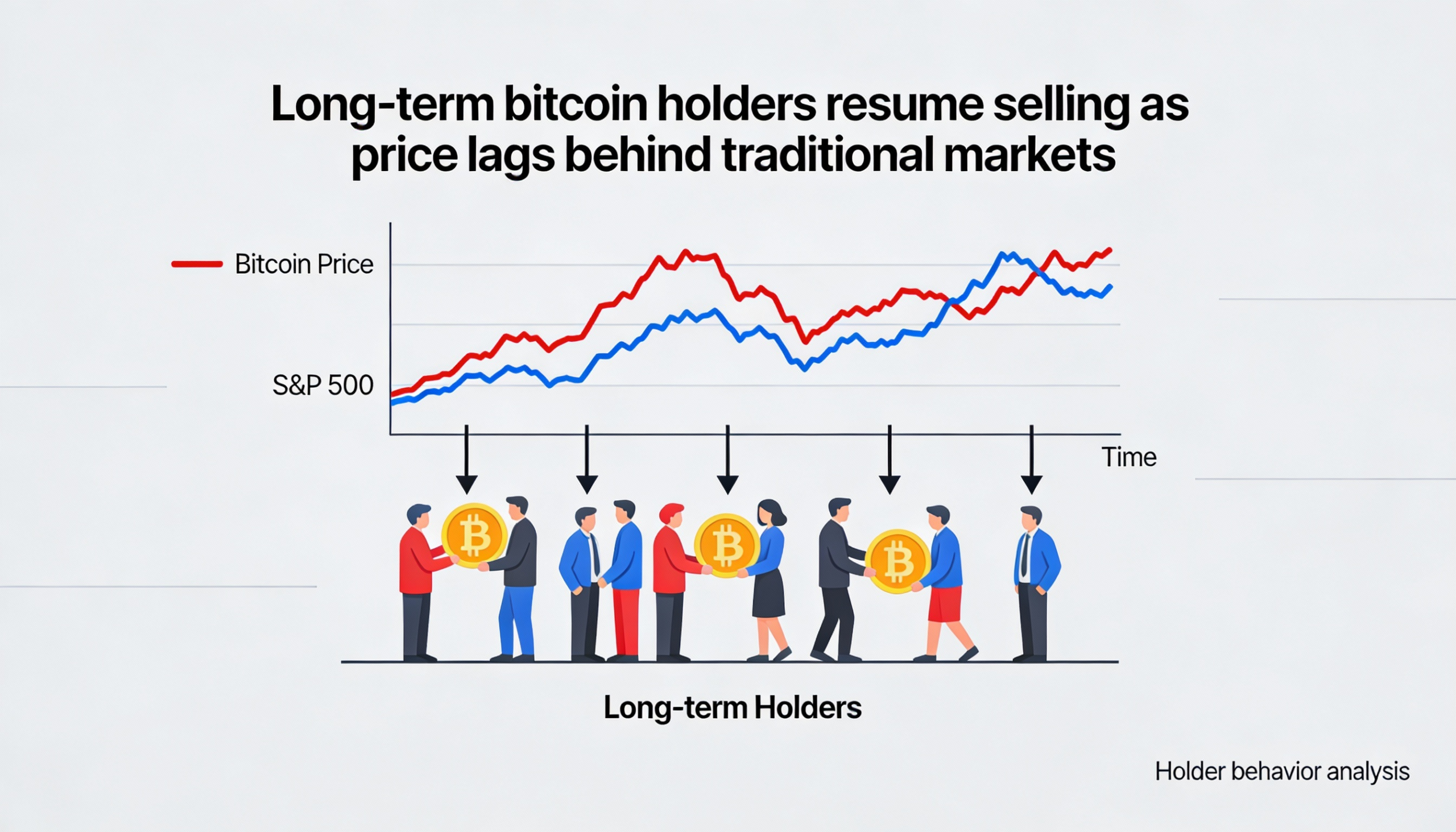

Long-term bitcoin holders are stepping up sales at the fastest pace since August, as bitcoin lags gains in traditional financial assets.

Investors who have held bitcoin (BTC $83,148.69) for at least 155 days—a cohort often seen as the most conviction-driven—have sold roughly 143,000 BTC over the past 30 days, according to Glassnode data. This level of distribution mirrors the prior peak in August, when about 170,000 BTC changed hands in a 30-day span, ahead of a record-high price in October.

Bitcoin’s underperformance relative to assets such as gold and silver, which are trading near or at record highs, underscores market stress and suggests a risk of further downside or prolonged consolidation.

The October high was largely in line with a long-observed four-year cycle tied to bitcoin’s mining reward halving, which last occurred in April 2024. Historically, these cycles peak in the fourth quarter, followed by extended drawdowns and consolidation periods.

At the October top, nearly all long-term holder supply—roughly 15 million BTC—was in profit. A subsequent 36% drop through late November briefly eased in late December into early January, when long-term holders returned to net accumulation. This pause helped stabilize prices, with bitcoin climbing to around $97,000. Currently, about 2 million BTC are held at a loss, though long-term holders still control roughly 14.5 million BTC.

The ongoing sales from this group remain a key factor for bitcoin’s near-term price outlook, suggesting that long-term reductions could continue to weigh on momentum unless broader market conditions improve.