Bitcoin Volatility Surges Ahead of S&P 500, Offering Potential Pair Trade

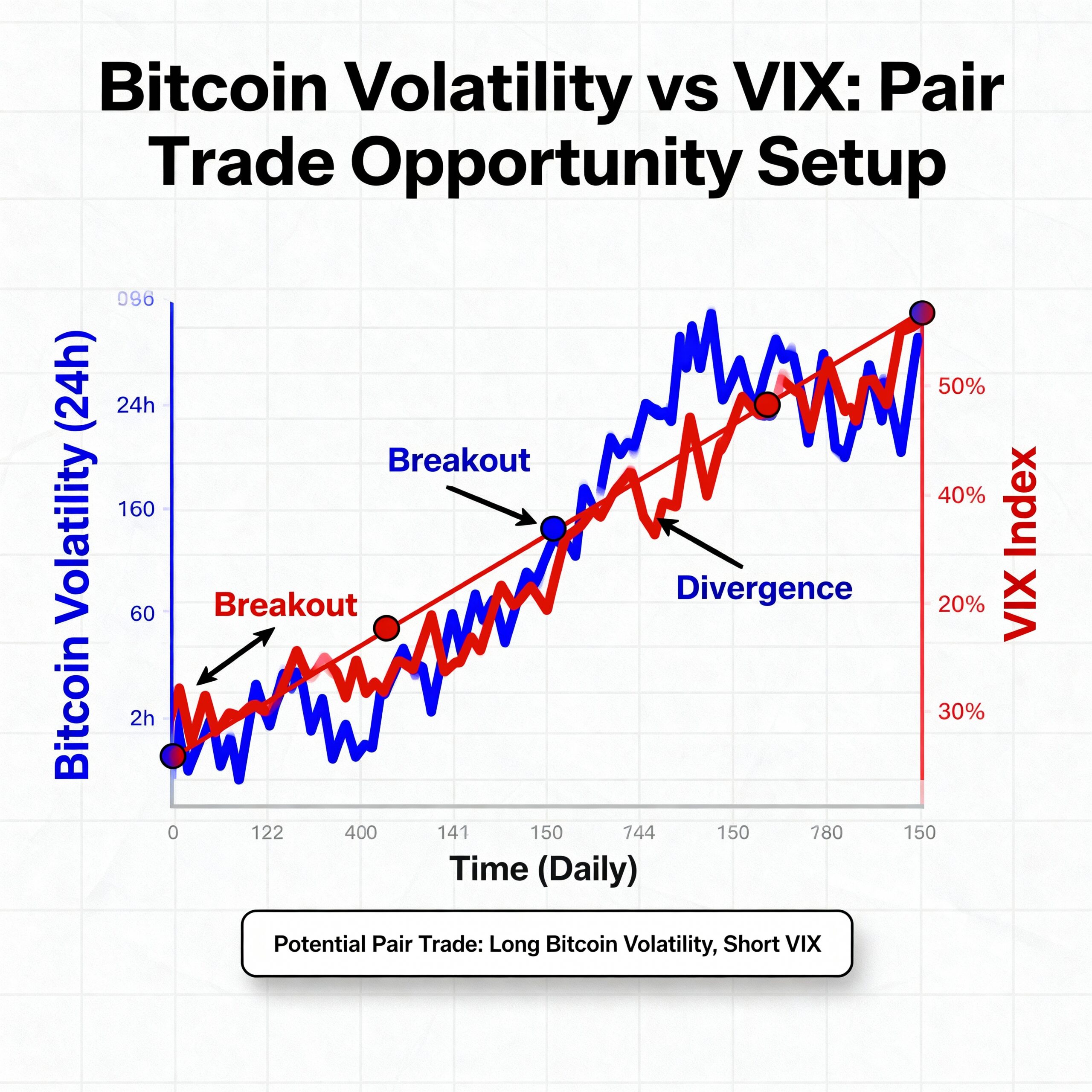

The spread between Bitcoin (BTC) and S&P 500 implied volatility indices is widening once again, signaling expectations for higher BTC volatility compared with equities.

The metric compares Volmex’s BVIV—the 30-day implied volatility index for BTC—with the VIX, the benchmark for S&P 500 volatility. Implied volatility reflects demand for options and hedging instruments, and a widening spread indicates that crypto markets are pricing in more significant swings than equities.

“When the BVIV–VIX spread widens, it signals that markets anticipate greater crypto volatility than equity volatility,” said Cole Kennelly, Founder of Volmex. “Crypto options adjust more quickly to liquidity and macro catalysts, so implied volatility often leads traditional markets.”

The spread recently broke out of a months-long range of 20.000–32.000 and exceeded the downtrend from March 2024, pointing to elevated near-term BTC volatility.

Such moves may attract pair traders, who take opposing volatility positions between BTC and equities. Kennelly noted, “A widening BVIV–VIX is often viewed as a relative value setup, executed via multi-legged cross-asset volatility trades rather than simple directional bets.”

Volatility trading, which focuses on price swings rather than market direction, is capital-intensive, high-risk, and best suited for institutional investors.