BitMEX Annual Report Highlights October Crash’s Blow to Market Liquidity and Derivatives Markets

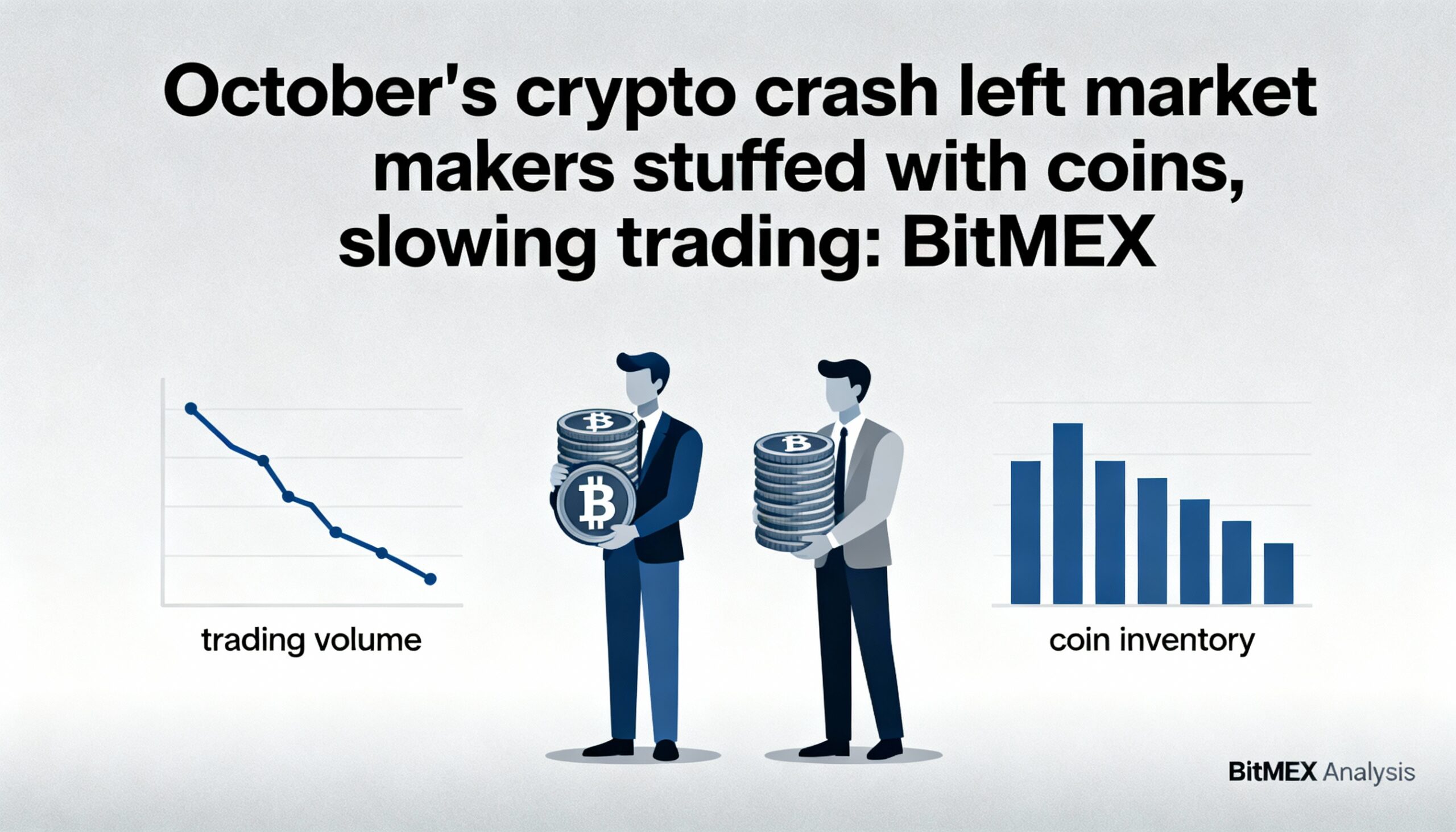

The crypto market crash of early October 2025 did more than erase wealth—it disrupted the engines of trading itself. Market makers, crucial for smooth price execution, were left holding massive crypto positions, creating the most challenging liquidity conditions since 2022, according to BitMEX’s latest report.

Bitcoin, the largest cryptocurrency by market value, plummeted from $121,000 to $107,000 on October 10, while major altcoins including XRP, ETH, and DOGE experienced even steeper declines, according to CoinDesk data. The sudden volatility triggered $20 billion in liquidations across centralized and decentralized exchanges, the largest on record.

Understanding Liquidations and Auto-Deleveraging

Liquidations occur when leveraged trades move against a trader, eroding margin below exchange requirements. Exchanges automatically close such positions to recover funds, often triggering a cascading effect where forced sales push prices lower, causing further liquidations—a long-standing feature of crypto markets.

On October 10, exchanges escalated the process by activating auto-deleveraging (ADL), which closes even profitable positions—including those of market makers—when insurance funds cannot cover losses.

Market makers typically operate delta-neutral strategies, balancing long spot positions with short perpetual futures to maintain neutrality and focus on liquidity provision rather than directional bets. On the day of the crash, ADL forcibly closed market makers’ short futures, leaving them exposed with unhedged long spot holdings.

This breach of neutrality forced market makers to scale back liquidity provision, resulting in the thinnest order books since 2022. Thin liquidity amplifies even modest trades into sharp price swings, intensifying market stress.

“When ADL mechanisms forcibly closed market maker short hedges, firms were left holding naked spot bags in a free-falling market. This breach of neutrality caused market makers to pull liquidity globally in Q4, producing the thinnest order books seen since 2022,” BitMEX said in its report State of Crypto Perpetual Swaps 2025.

The forced unwinding of long spot positions contributed to further price declines, with BTC briefly touching $80,000 on some exchanges by November 21. Prices have since rebounded above $90,000, but liquidity remains fragile.

The End of “Free Money”

BitMEX also highlighted that delta-neutral funding rate arbitrage, once seen as low-risk “free money,” has lost its appeal. This strategy profits from price gaps between spot and perpetual futures markets while avoiding directional exposure. However, as protocols like Ethena inspired industry-wide adoption, funding rates collapsed.

“With billions in automated hedging hitting order books, short supply overwhelmed organic long demand, collapsing funding rates,” the report noted. “By mid-2025, risk-free crypto yields had compressed to sub-4%, often underperforming U.S. Treasuries.”

Previously, similar strategies offered yields above 25%, illustrating how widespread adoption has arbitraged away the price gap.

Exchanges, Manipulation, and DeFi Perpetuals

The report also highlighted structural risks in crypto trading. Some exchanges enforced “abnormal trading behavior” clauses to freeze or seize profits, revealing aggressive B-book practices where platforms bet against users and avoid payouts on losses.

Low-float listings and pre-market manipulation also emerged as recurring problems. The report cited the MMT incident, where coordinated actors cornered spot supply to squeeze perpetual open interest, showing that small-cap perps remain vulnerable to insider activity.

While DeFi platforms like Hyperliquid have grown, BitMEX stressed that decentralization does not eliminate manipulation. The Plasma ($XPL) incident demonstrated that transparent on-chain data alone cannot prevent exploitative liquidation strategies.

Finally, the report noted that crypto derivatives have found “true product-market fit” in 2025, serving as a venue for leveraged trading of traditional equities. Demand surged for trading U.S. stocks like Nvidia and Tesla outside standard market hours, with crypto exchanges filling the gap ahead of earnings announcements.