At the Consensus conference in Hong Kong, a senior BlackRock executive highlighted the enormous potential impact of even modest crypto allocations across Asia’s vast capital base.

Nicholas Peach, head of APAC iShares, said during a panel discussion that growing institutional comfort with crypto exchange-traded funds (ETFs) — particularly in Asian markets — is beginning to reshape long-term expectations for digital assets.

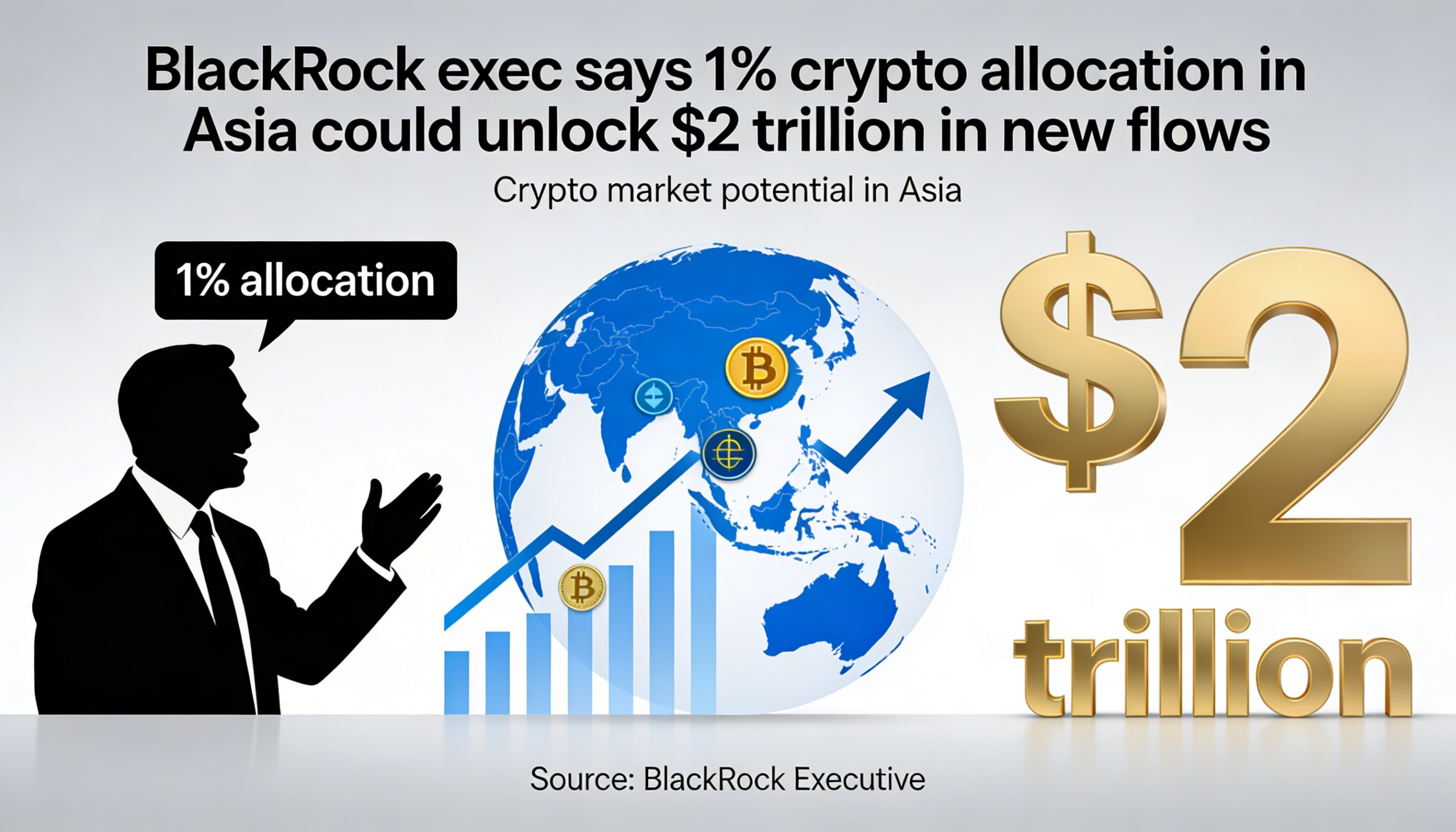

“Some model advisors are now recommending a 1% allocation to cryptocurrencies in a standard investment portfolio,” Peach said. He noted that Asia holds roughly $108 trillion in household wealth. A 1% allocation from that pool would translate to nearly $2 trillion in potential inflows — equivalent to a significant share of the current total crypto market capitalization.

Peach framed the example as a way to illustrate the scale of capital still largely untapped in traditional finance. Even conservative adjustments to portfolio models, he argued, could have an outsized effect on digital asset markets.

BlackRock’s iShares division, the world’s largest ETF provider, has been instrumental in expanding regulated access to crypto for mainstream investors. In January 2024, the firm launched its U.S.-listed spot Bitcoin ETF, iShares Bitcoin Trust (IBIT), which went on to become the fastest-growing ETF in history and now manages nearly $53 billion in assets.

According to Peach, however, the momentum is not confined to the United States. Asian investors have accounted for a meaningful portion of flows into U.S.-listed crypto ETFs. He also pointed to a broader surge in ETF adoption across the region, with investors increasingly using the structure to gain exposure to equities, fixed income, commodities — and now digital assets.

Several Asian financial hubs, including Hong Kong, Japan, and South Korea, are moving to introduce or expand crypto ETF offerings as regulatory frameworks evolve. Market participants expect local platforms to deepen further as clarity improves.

For BlackRock and its peers, Peach said the next phase involves pairing expanded product access with investor education and thoughtful portfolio integration.

“The pools of capital in traditional finance are extraordinarily large,” he said. “It doesn’t take much adoption to produce very meaningful financial outcomes.”