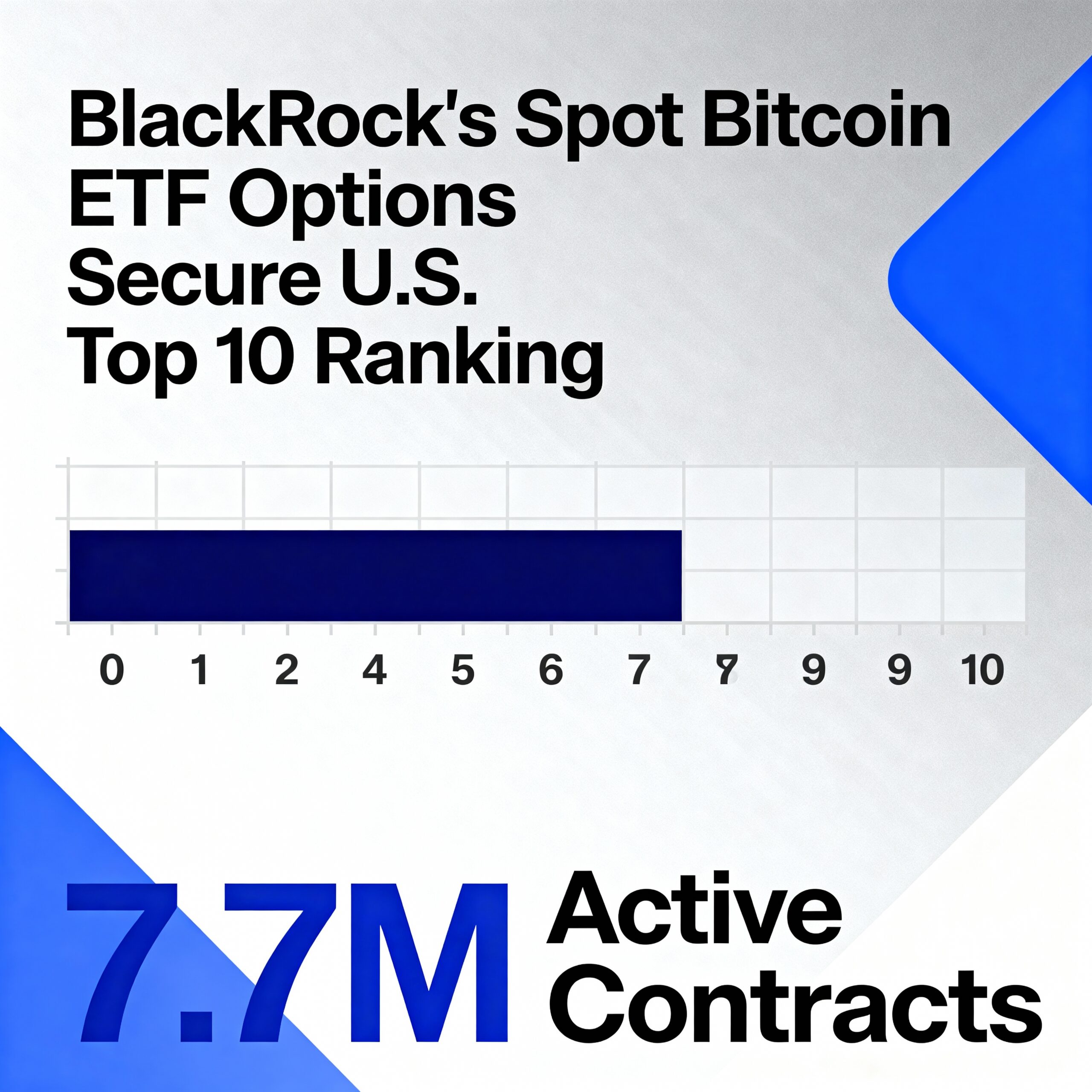

BlackRock’s Bitcoin ETF Options Surge Into U.S. Top 10 With 7.7M Contracts

Options linked to cryptocurrencies are booming in U.S. markets, and BlackRock’s bitcoin ETF (IBIT) is leading the trend. Just over a year after its November 2024 debut, IBIT options have already cracked the top 10 in open interest.

As of Tuesday, 7,714,246 IBIT contracts were active, ranking ninth across all U.S.-listed stock, ETF, and index options, according to optioncharts.io. Among individual stocks, IBIT options rank second.

BloFin Research said the rise in IBIT options highlights Bitcoin’s growing appeal as a macro asset. “Including Deribit’s open interest, IBIT rivals VIX and SPY options, cementing its position as a top macro asset,” the firm told CoinDesk.

Since launch, IBIT options have been used for hedging, speculation, and yield strategies like covered calls. These contracts give holders the right to buy (call) or sell (put) the underlying asset at a predetermined price.

IBIT options have outpaced SPDR Gold ETF (GLD) contracts, which totaled 5,151,654 open contracts Tuesday, despite gold rising 50% this year versus Bitcoin’s modest -0.1% change. Options on major tech stocks and ETFs linked to emerging markets and Treasuries also trail IBIT.

Notably, Nasdaq-listed IBIT options’ open interest surpassed bitcoin options on Deribit, the crypto options pioneer, by September’s end. While S&P 500 and Nvidia options remain leaders with over 20 million contracts each, IBIT’s rapid rise underscores growing institutional adoption and the mainstreaming of crypto derivatives.