Most investors in spot bitcoin ETFs are now trading close to breakeven, with the average entry price hovering around $90,000.

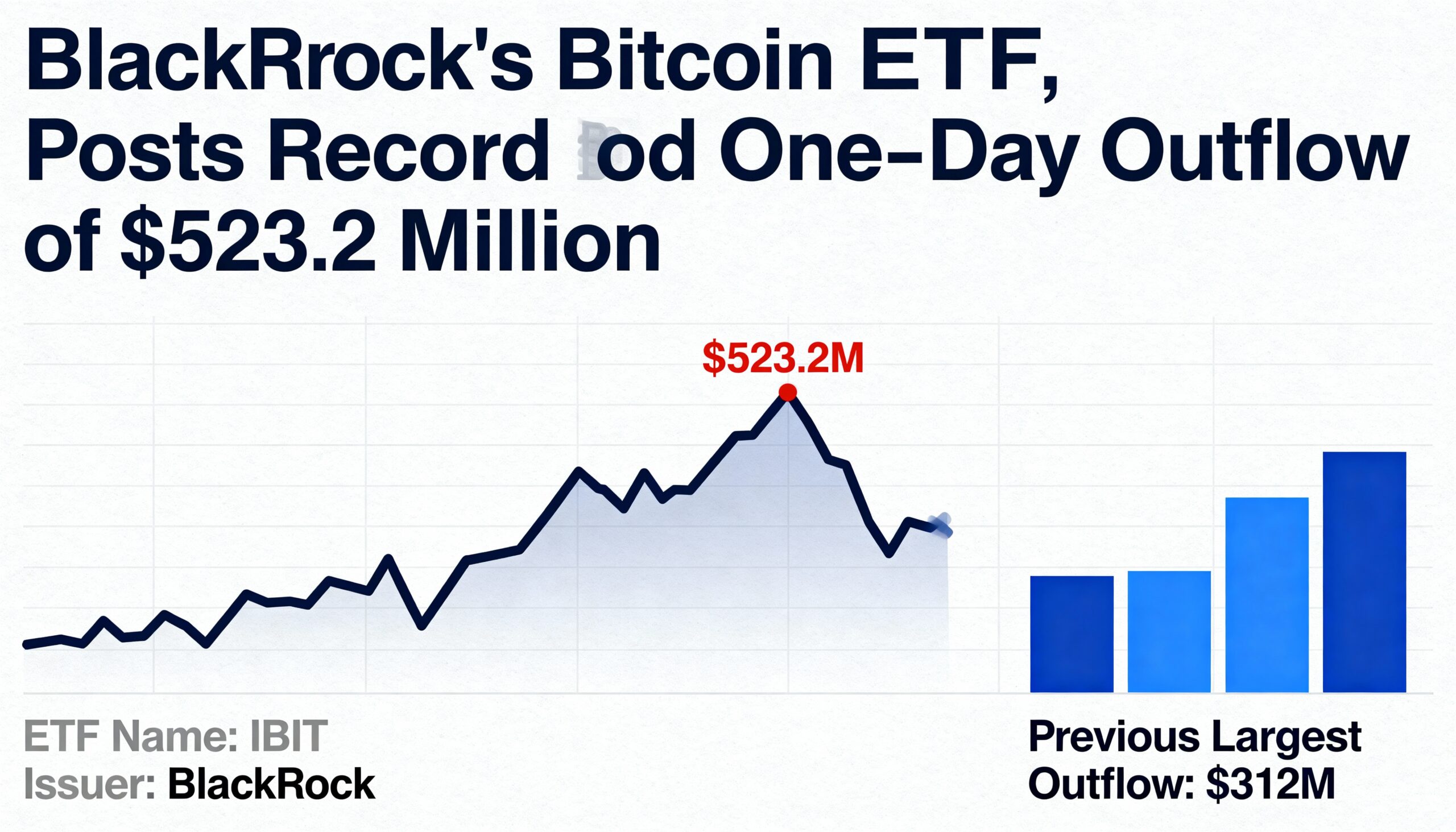

BlackRock’s IBIT registered its largest daily withdrawal since its January 2024 launch, capping what has already become a record month of outflows, according to Farside. The ETF saw $523.2 million exit on Tuesday, despite bitcoin rising more than 1% and briefly moving above $93,000.

Outflows were not uniform across issuers. Franklin Templeton’s EZBC brought in $10.8 million in new money, while the Grayscale Bitcoin Mini Trust recorded $139.6 million in inflows. Even with those pockets of demand, the broader ETF market closed the day with a net outflow of $372.8 million—the fifth straight session of redemptions.

November has been particularly soft, producing only three days of net inflows so far. Bitcoin is currently trading near $90,000, about 30% below its October peak. Since their introduction, U.S. spot bitcoin ETFs have collectively attracted $58.2 billion in net inflows.

CoinDesk Research noted that despite bitcoin’s steep decline this month, overall ETF assets under management remain relatively stable, indicating that the bulk of selling pressure is occurring outside ETF products.

Jim Bianco of Bianco Research added that the average cost basis for all accumulated spot bitcoin ETF flows since January stands at $90,146—meaning the typical holder is only slightly in profit with bitcoin edging above $91,000.

IBIT was down 1.5% in pre-market trading at $52.