Bitcoin Bounces Back After Sharp Drop on U.S. Tariff News, Supported by Strong Volume and Institutional Demand

Bitcoin has staged a recovery following a steep decline triggered by headlines surrounding U.S. tariff developments. Key buying activity near the $103,000 mark and renewed interest from institutional investors have helped stabilize the market.

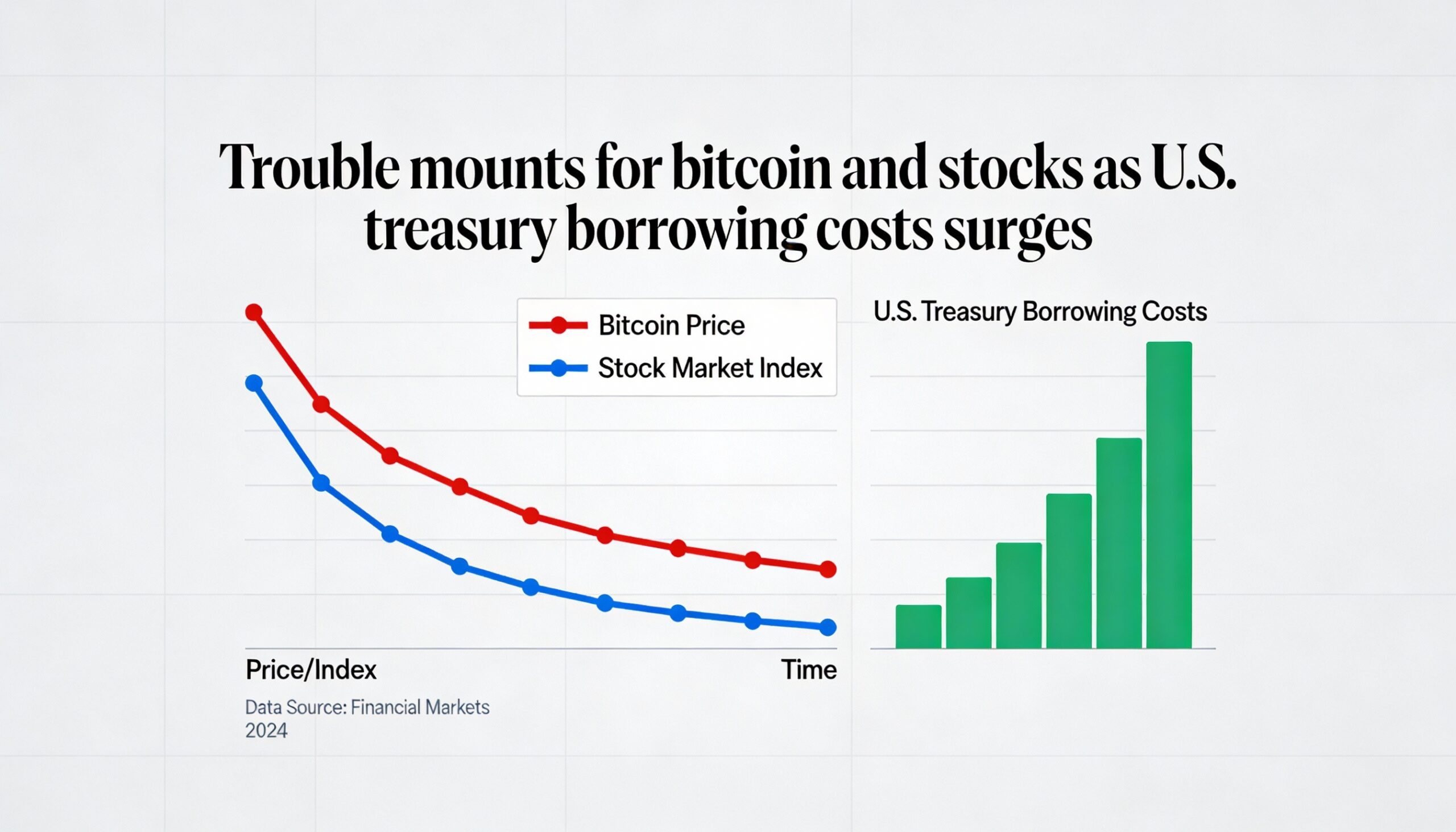

Ongoing global economic tensions and uncertainties around trade policies continue to impact cryptocurrency markets, but Bitcoin appears to be regaining its footing after the recent sell-off.

Institutional demand remains robust, with prominent companies like Strategy (formerly MicroStrategy) and GameStop reportedly increasing their Bitcoin holdings as part of their corporate treasury strategies.

Technical Insights

According to CoinDesk Research’s technical data model, Bitcoin formed a clear bottom during the last 24 hours, with strong volume support clustered between $103,200 and $103,400. Buyers consistently stepped in within this zone, helping halt the decline.

The rebound gained strength once Bitcoin pushed past the $104,000 resistance level, supported by growing volume that confirmed buyer confidence. This pattern suggests the correction phase is likely over, and the price is now building a fresh support base, setting the stage for a potential continuation of the broader upward trend.

In the most recent trading hour, Bitcoin showed impressive momentum, climbing from $104,146 to $104,303, driven by a surge in bullish volume starting at 14:01. The price jumped from $104,188 to $104,323 on a notably higher volume, with 429 BTC changing hands.

Before the breakout, Bitcoin consolidated between $104,077 and $104,263, establishing key support around $104,080-$104,090, which helped pave the way for the upward move.