Bitcoin Briefly Tops $94K Before Pullback Ahead of Fed Decision

Bitcoin briefly surged above $94,000 on Tuesday before slipping back toward $92,500 in Wednesday’s Asian session, sparking renewed bullish sentiment but leaving the market exposed ahead of the Federal Reserve’s key policy announcement.

Asian equities were mixed as investors awaited clarity on the Fed’s next steps and Chair Jerome Powell’s final press conference of 2025.

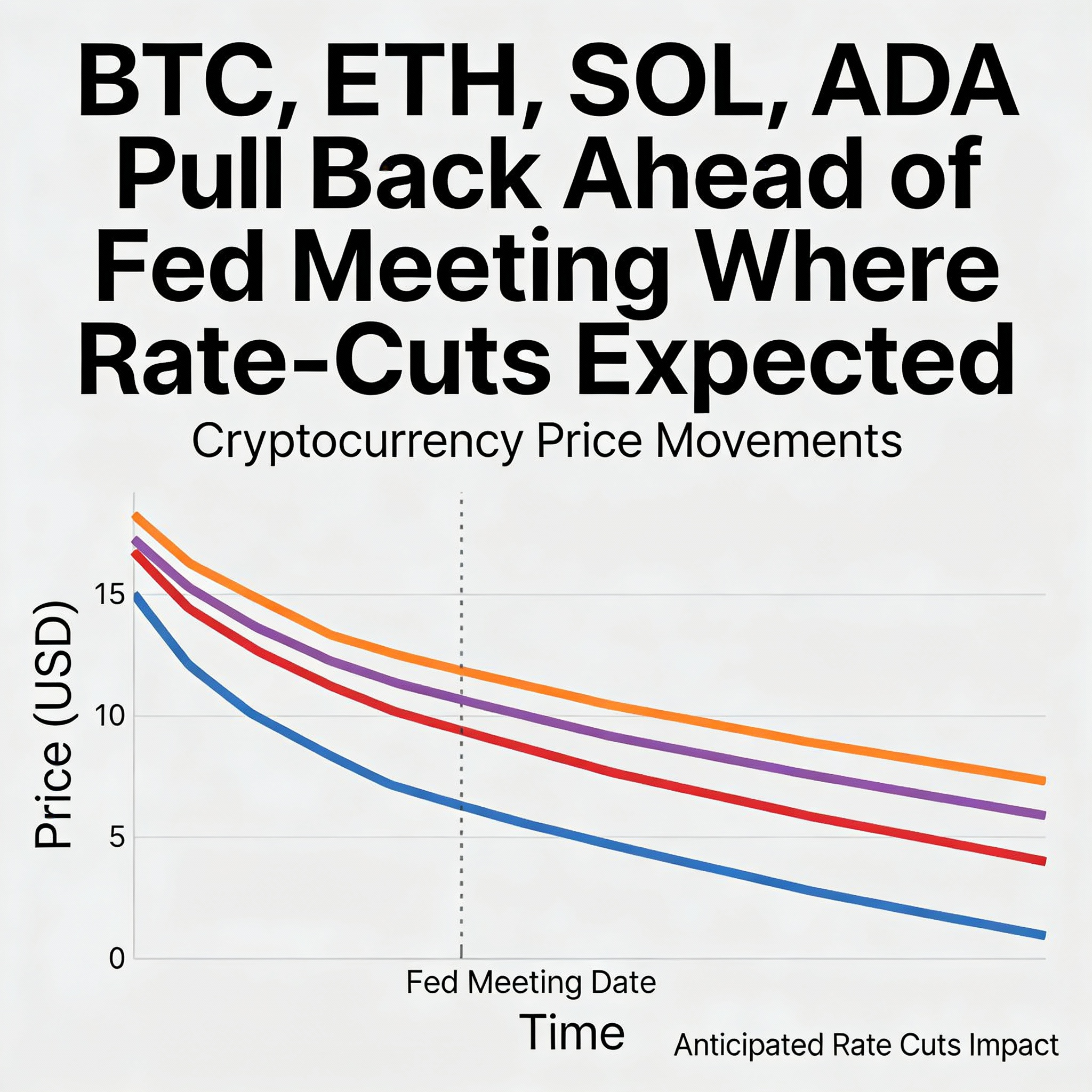

Altcoins Show Mixed Performance

Ether gained 7% over 24 hours to trade around $3,320, extending its weekly rise to nearly 10%. Solana rose over 5%, Dogecoin climbed 5%, and Cardano led altcoins with an 8.5% daily gain and nearly 6% weekly advance. Most tokens retreated 1–2% in Asian morning trading as traders booked profits. XRP added 2% but remains down 4% on the week, while BNB, USDC, and TRX remained flat. Market depth in smaller tokens remained thin, highlighting December’s uneven liquidity.

Volatility and Sentiment

Bitcoin’s early rally was supported by rising social sentiment and retail optimism, according to Santiment. However, BTC fell below $93,000 later, raising questions about whether the move was a breakout or a stop-hunt within the $86,000–$94,000 range. CF Benchmarks analyst Mark Pilipczuk noted that realized volatility surpassing implied volatility—a first in months—can indicate market exhaustion, often preceding a bottom. Bitget CEO Gracy Chen added that Bitcoin’s broad $86,000–$94,000 consolidation reflects a market lacking sufficient anchors for a decisive move.

Global Market Context

Chinese stocks fell on higher-than-expected inflation data, while Japanese equities edged lower. South Korea and Taiwan posted modest gains. Silver hit a record high, and the dollar steadied, reflecting ongoing uncertainty over global central bank policy in 2026.

Outlook

Bitcoin’s next major move will hinge on whether it can reclaim the $94,000–$96,000 range following Powell’s remarks—or if macro caution drives it back toward the mid-$80,000s.