Bitcoin RSI Hits Oversold Levels, But Rebound Remains Uncertain

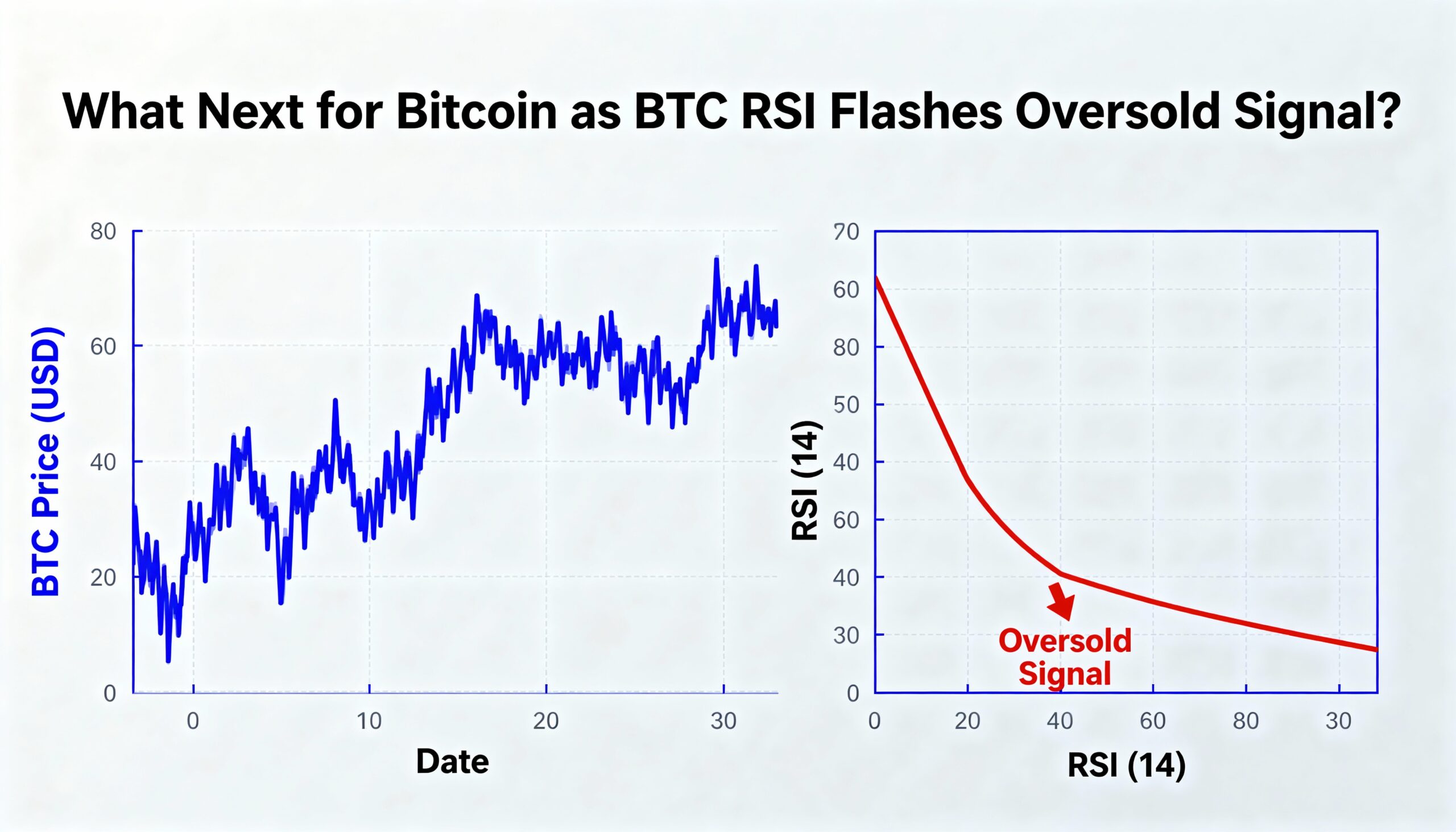

Bitcoin (BTC) fell below $90,000, down 28% from last month’s all-time high above $126,000, as the 14-day Relative Strength Index (RSI) dipped below 30, signaling oversold conditions. This indicator often suggests a potential pause or rebound following a sharp decline.

However, an oversold RSI is not a guaranteed reversal signal. The metric can stay in oversold territory for extended periods while downward momentum continues. Traders emphasize that confirmation from price action is critical.

Indicators to watch include support levels and candlestick patterns such as Doji candles or long lower wicks, which can show that selling pressure is easing. If these emerge, they may validate the RSI signal and set the stage for a bounce.

The last time BTC’s RSI fell below 30—late February—Bitcoin traded under $80,000, slowing the downtrend before bottoming near $75,000 in early April.

Because the RSI is closely followed by market participants, its signals can sometimes become self-fulfilling, with collective trading amplifying the effect. Traders should focus on price behavior alongside the RSI to assess whether a rebound is likely.