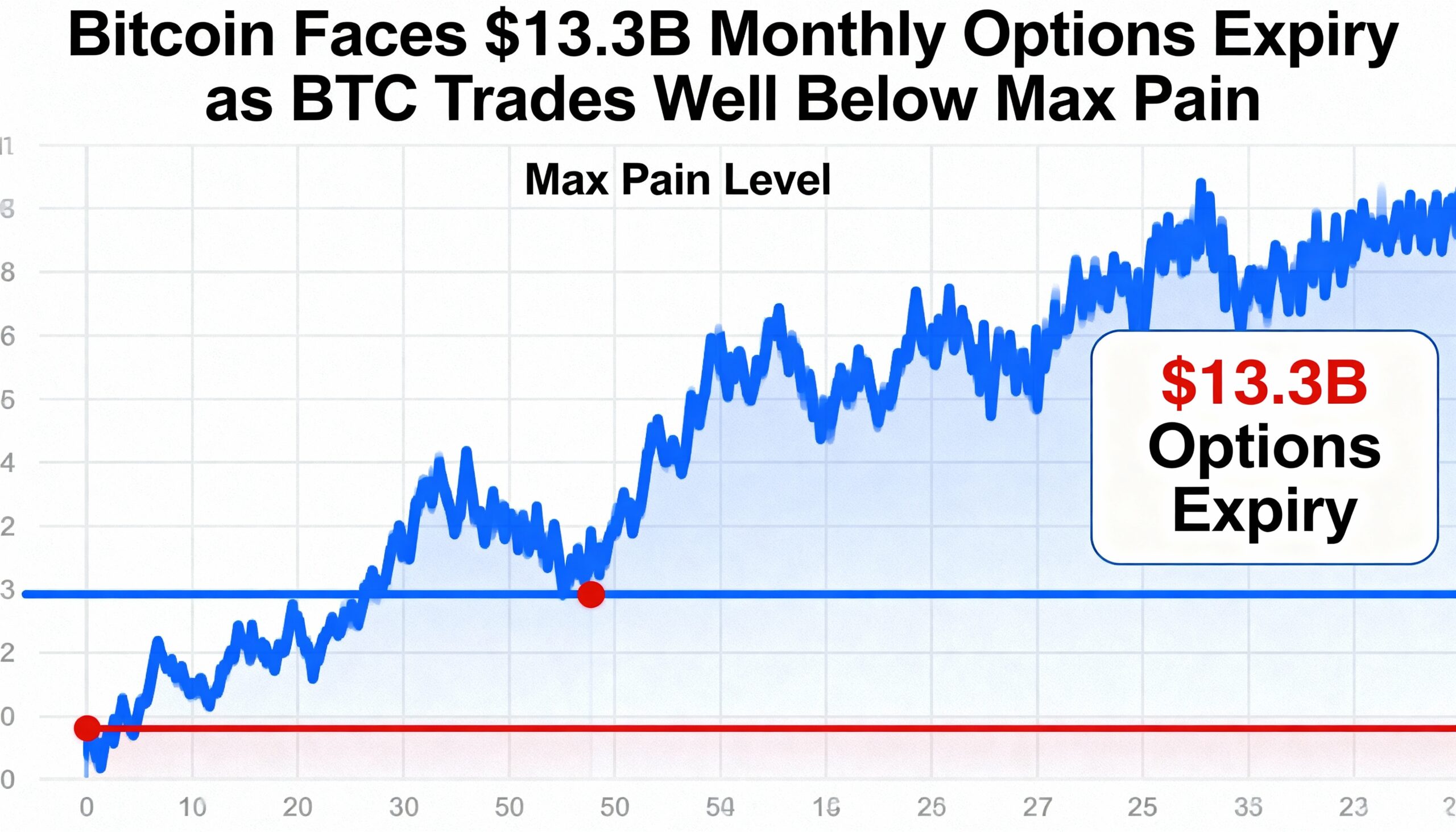

Bitcoin is heading into Friday’s monthly options expiry under renewed pressure, after a steep market pullback dragged prices down to $81,000 before a modest rebound toward $87,000. The sharp correction has shifted attention back to the derivatives market, where traders have increased their focus on downside risk.

Data from Deribit shows 153,778 BTC in options set to expire, made up of 92,692 BTC in call open interest and 61,086 BTC in put exposure. Altogether, the contracts carry a notional value of roughly $13.3 billion, with a put-call ratio of 0.66—indicating calls still dominate, even as hedging demand grows.

Calls represent bullish wagers that give buyers the right to purchase BTC at a predetermined price, while puts provide downside protection by allowing holders to sell at a set strike.

The max pain point, where option sellers would experience the least aggregate loss, is pinned at $102,000—about 17% above current prices. Deribit’s positioning breakdown shows that only $3.4 billion of contracts (around 26%) are currently in the money, while $10 billion (roughly 74%) sits out of the money, reflecting expectations for larger price swings that never materialized.

On the downside, the $80,000 strike remains the most crowded area for put positioning, forming the dominant bearish cluster. Meanwhile, call interest is heavily stacked at higher levels, especially above $120,000, though these strikes remain far from being challenged with spot well below those thresholds.

With sentiment still fragile and much of the open interest sitting at extreme levels, Bitcoin could experience another round of volatility heading into Friday’s expiry as market makers rebalance hedges around key strikes.