Bitcoin Hovers Near Record Highs, but Miner and Whale Selling Signals Possible Pullback

Bitcoin is starting the week trading around $117,300 in Asia, just below last week’s all-time high of $123,000. However, behind the price strength, signs of potential market pressure are emerging as miners and large holders move coins to exchanges at the fastest pace in months.

Ethereum continues to outperform. ETH is holding above $3,800 — up 4% in the last 24 hours and 26% over the past week — as capital rotates from Bitcoin and altcoins into higher-beta assets. The CoinDesk 20 Index remains elevated at 4,071.75, reflecting continued investor appetite across majors.

But CryptoQuant data shows a significant shift in underlying market behavior. On July 15, Bitcoin exchange inflows surged to 81,000 BTC, the highest daily figure since February. Large transactions — 100 BTC or more — jumped from 13,000 BTC to 58,000 BTC, and miners alone moved 16,000 BTC to exchanges. These metrics suggest a wave of profit-taking, potentially signaling a local top.

Ethereum also saw notable outflows. On July 16, 2 million ETH were transferred to exchanges — the highest single-day total since February — following ETH’s 131% rally since April. Miner balances have also declined, dropping from 68,000 BTC to 65,000 BTC since June 26, underscoring increased sell pressure.

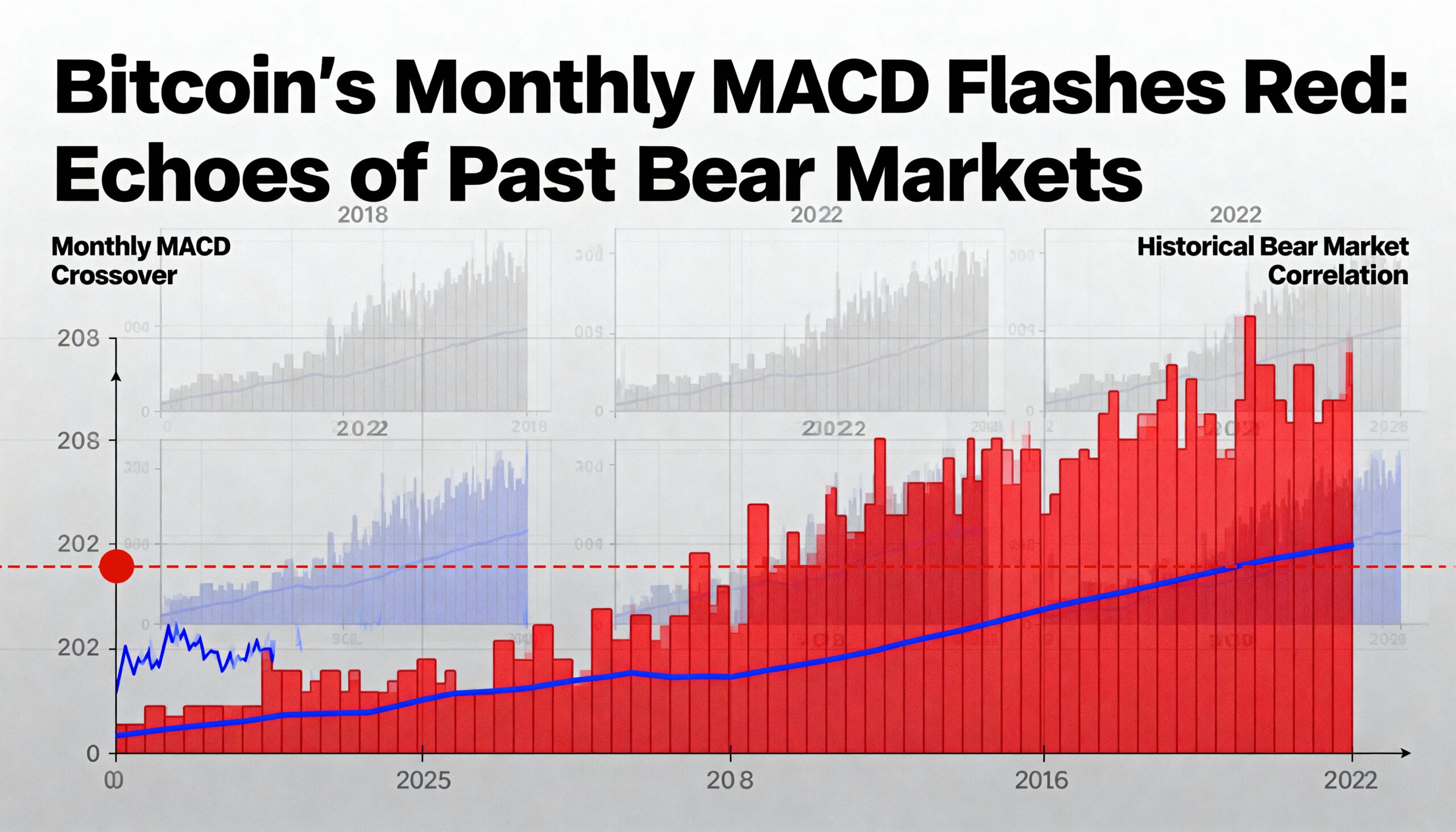

Historically, such inflow spikes have often preceded periods of heightened volatility or price corrections. While bullish momentum remains intact, traders are watching for signs of exhaustion.

Market maker Enflux noted that despite healthy liquidity conditions, they are closely monitoring perpetual open interest and altcoin depth:

“If ETH dominance continues, we expect strength in mid-cap assets to carry into the week.”

Altcoin flows remain muted. Daily exchange inflows for altcoins sit at just 31,000, well below the 120,000 seen during prior cycle peaks. This could reflect stronger holder conviction or simply a pause in capital rotation until clearer signals emerge.

For now, Bitcoin and Ethereum continue to lead, but rising exchange inflows from whales and miners suggest that market participants are beginning to lock in gains, potentially capping further upside in the near term.

Market Snapshot:

- BTC: Trading near $117,100 after breaking below $118,000 support late in the session; signs of institutional profit-taking noted.

- ETH: Up 3.78% as capital continues rotating into majors; a short squeeze could be triggered by $331M in bearish positioning.

- Gold: Despite recent softness, CIBC expects an average of $3,600 in H2 2025, citing macro uncertainty and central bank demand.