Institutional Bitcoin Demand Slows as DAT Inflows Hit Multi-Month Lows

Institutional interest in bitcoin treasuries is cooling, contributing to a stall in BTC’s recent bull run. While more firms continue to adopt bitcoin for their treasuries, their net purchases have fallen sharply.

Data from BitcoinTreasuries.net shows the seven-day moving average of net daily inflows into digital asset treasuries (DATs) recently fell to 140 BTC, the lowest level since mid-June and a steep decline from 8,249 BTC at July’s peak. On a day-to-day basis this month, 12 of 15 days saw inflows under 500 BTC, including several days with no inflows at all.

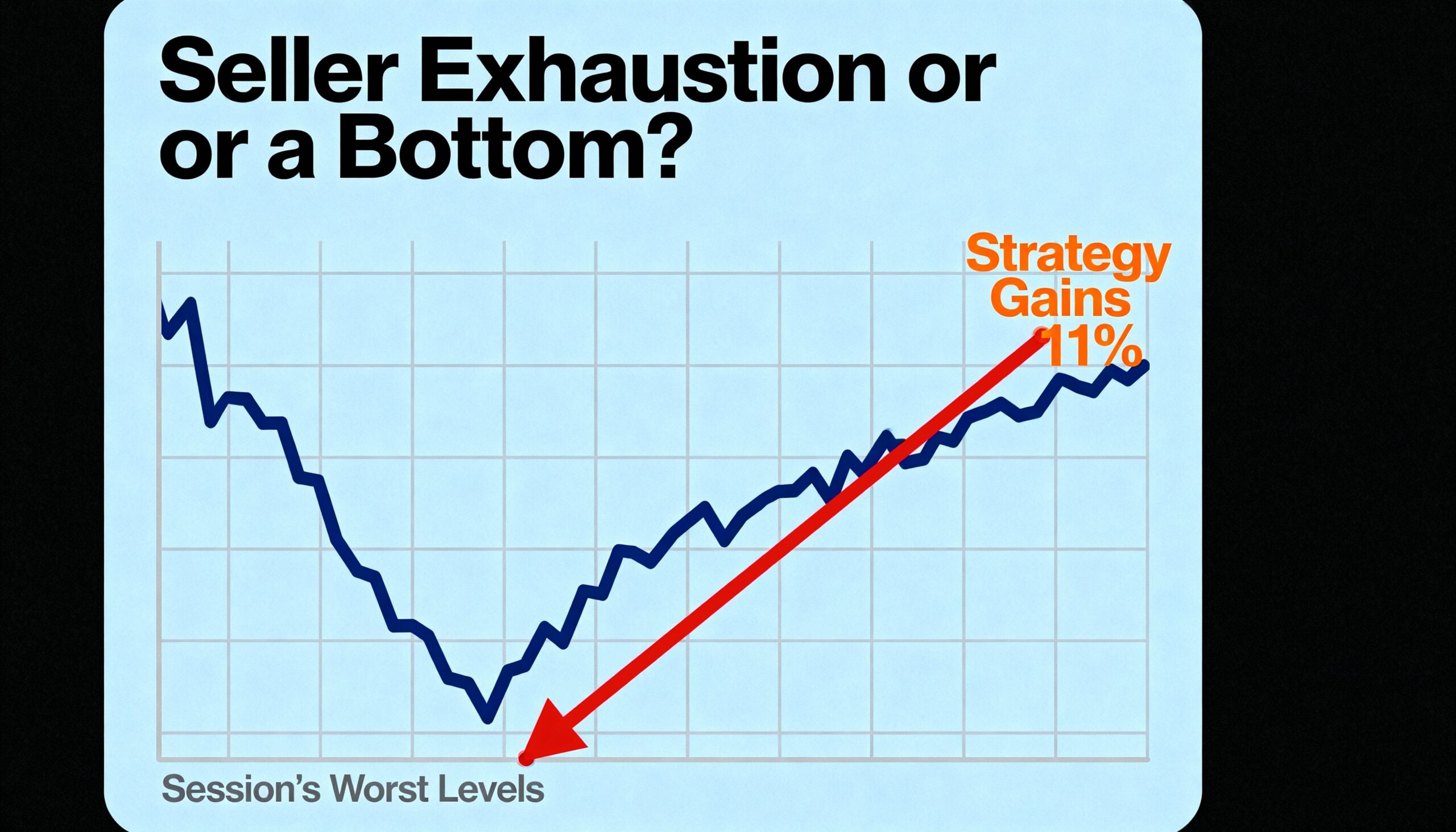

The slowdown indicates that institutional demand for bitcoin through traditional treasury vehicles has weakened after a period of aggressive buying earlier this year, which had supported BTC prices. Bitcoin itself has cooled sharply, falling to nearly $110,000 after hitting a record high of $126,000 on October 6. Since June, BTC has largely traded above $110,000, reflecting a tug-of-war between bullish sentiment and profit-taking.

DATs: Strategy and Risks

The DAT model, popularized by firms like Strategy, mirrors a centuries-old approach: borrowing fiat to acquire scarce, hard assets. Bitcoin, with a fixed supply of 21 million coins and a decade of strong performance, has attracted treasuries seeking to hedge inflation and diversify reserves. Collectively, the top 100 public DATs by market value have acquired over 1 million BTC.

However, like gold, BTC generates no yield, meaning coins purchased with borrowed funds sit idle on balance sheets. DATs rely on price appreciation for returns, making them dependent on favorable market conditions. Most DATs finance purchases by issuing stock at a premium to net asset value (NAV) and raising debt. NYDIG calls this a “memetic premium,” linked to the reputation of the company or its figurehead.

This model carries risk: if the premium fails to grow or investors sell shares, the premium-to-NAV ratio can collapse. Roughly one in four publicly traded DATs now trade below NAV, meaning the market values them less than the cryptocurrencies they hold. NYDIG notes that these premiums are positively correlated with bitcoin prices, so a downtrend in BTC could further erode valuations.