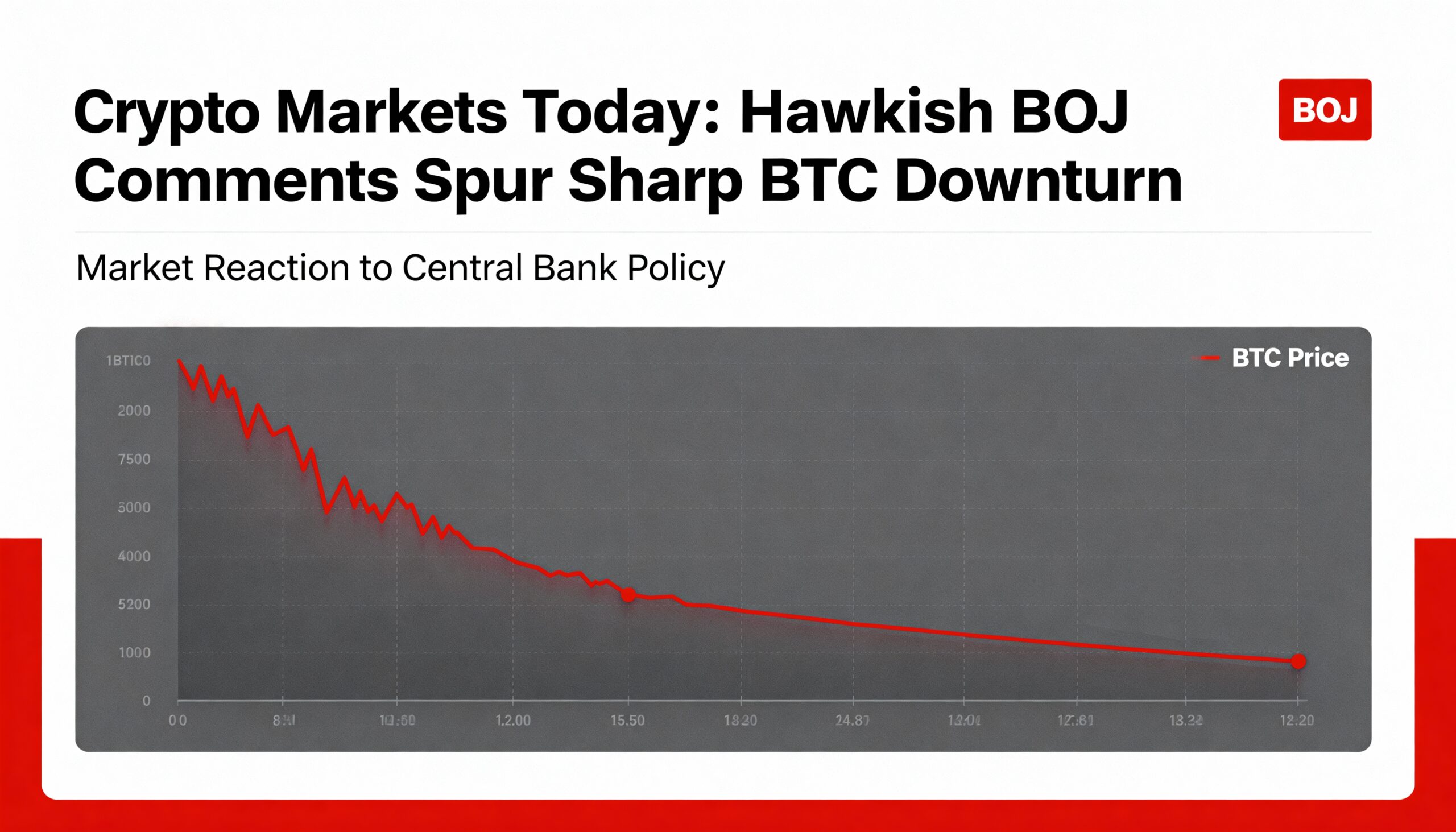

Bitcoin and the wider crypto market slumped on Monday after a sharp wave of selling hit just minutes into the reopening of CME’s bitcoin futures market. The move triggered a broad downturn that pushed the CoinDesk 20 Index lower by nearly 6% over the past 24 hours.

The rapid decline unfolded in a market still grappling with thin liquidity conditions following October’s massive $19 billion liquidation event. The fragility was compounded by macro pressures out of Japan, where Bank of Japan Governor Kazuo Ueda signaled that an interest-rate increase could be imminent. His remarks drove yields on Japan’s 30-, 10- and 2-year government bonds to their highest levels since 2008, and raised concerns that a stronger yen could force hedge funds—many of which borrow in yen to buy risk assets like bitcoin—to rebalance.

Derivatives markets show clear stress

- Futures markets saw significant outflows, with open interest (OI) in assets such as ZEC, SUI, UNI and ENA plunging over 10% in a day.

- Bitcoin’s OI dipped by 2%, while ether’s climbed to 12.51 million ETH, its highest reading since Nov. 21—suggesting traders may be increasing short exposure.

- Funding rates swung sharply negative across a range of tokens including SOL, BBB, XRP, AVAX and DOT, with annualized rates between -7% and -11%, indicating strong demand for short positions.

- Volmex’s BVIV, the 30-day bitcoin implied volatility gauge, surged above 55% during Asian trading before easing slightly, reflecting renewed fear in the market.

- Options activity on Deribit showed firmer put skews for short- and near-term BTC and ETH contracts.

- Block trades were dominated by volatility-focused strategies such as BTC strangles and ETH straddles.

Altcoins hit harder than majors

Monday’s sell-off was even more pronounced in altcoins. ZEC plunged 20% in 24 hours, while ENA and TIA fell 16% and 14% respectively. Altcoins accounted for more than $430 million of the $637 million in total liquidations during that period, as many tokens extended downtrends that have persisted since early October.

The market is approaching a key technical inflection point. A break below November’s lows would confirm a broader bearish reversal from the highs reached in October. Still, the average relative strength index (RSI) across major assets is now in oversold territory, suggesting that a short-term bounce could emerge as short sellers begin to lock in profits.

A handful of tokens remain in positive territory over the past week despite the widespread decline. Layer-1 project KAS is up 29%, and DeFi token SKY—formerly MKR—has gained 17% following multiple buyback announcements.

Even so, broader sentiment remains risk-averse. The altcoin season index stands at just 24/100, a steep drop from September’s peak of 78/100, underscoring the market’s continued tilt toward bitcoin’s relative stability and liquidity.