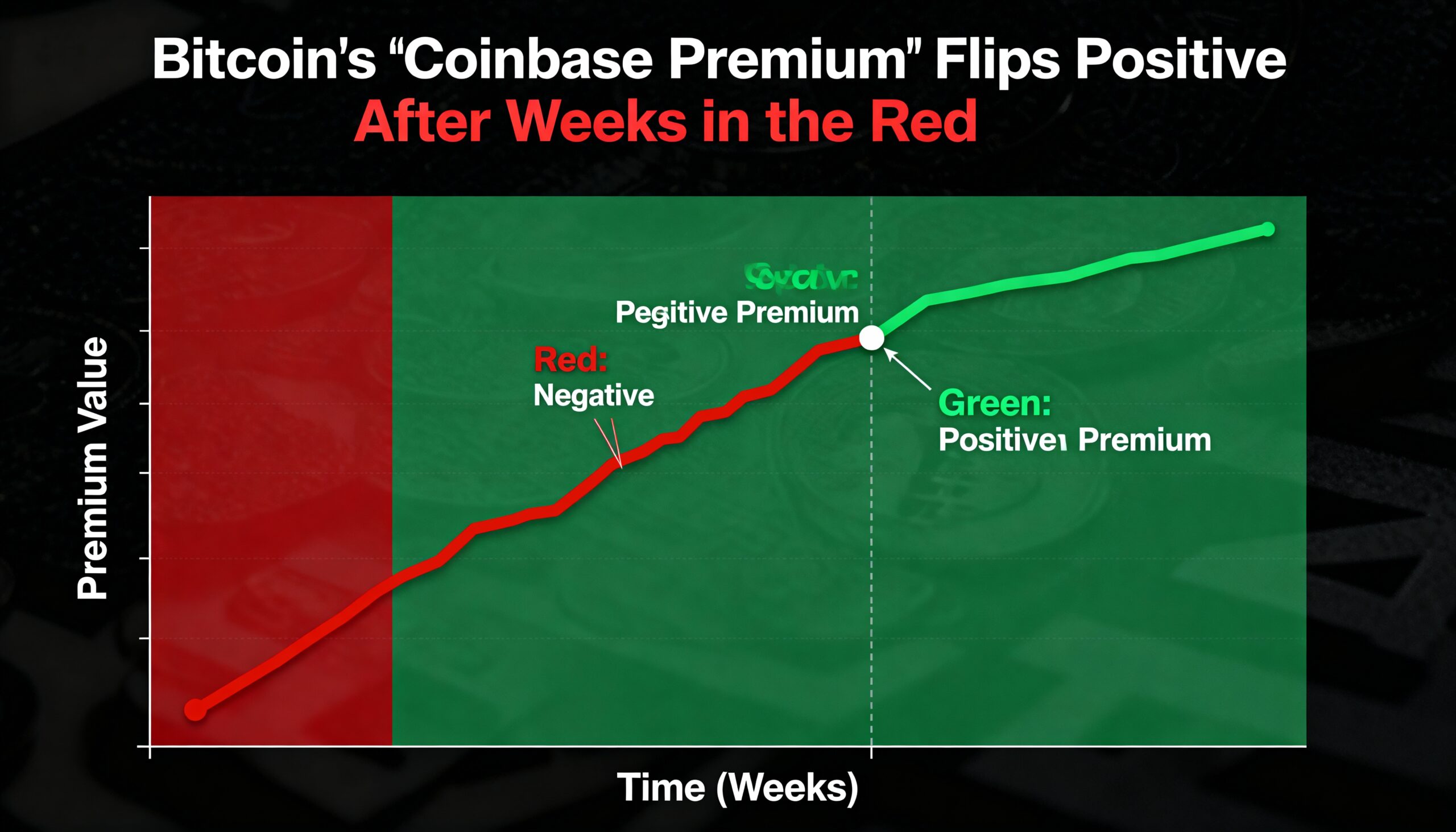

Bitcoin is showing early signs of renewed U.S. demand, with the Coinbase Premium Index turning positive after nearly a month spent below zero — a shift that marks the strongest hint of stateside buying in weeks.

The reversal appeared Saturday during Asian trading hours as BTC hovered around $91,000. The Coinbase Premium, which measures the price gap between Coinbase and the broader global market, is widely viewed as a barometer of U.S. capital flows. Historically, negative readings have signaled domestic outflows or heightened caution among U.S. institutions, while a persistent positive premium has often accompanied ETF inflows and strengthening dollar liquidity.

Thursday was the first session since late October in which Coinbase spot prices traded consistently above global averages, indicating a notable pickup in U.S. bidding activity.

Other flow metrics reinforce the turn. Binance’s stablecoin holdings hit an all-time high of $51.1 billion in November, reflecting a sizeable pool of sidelined liquidity. Options desks also report that positioning has reset meaningfully: GSR highlighted that speculative longs have been flushed out and noted that easing skew and reduced demand for downside protection suggest “a market ready for growth.”

Analysts at Kronos and Presto, in separate briefings earlier this week, described the recent rise as a typical oversold rebound following two weeks of leverage unwinds.

Still, bitcoin remains confined to a key trading range. FxPro analyst Alex Kuptsikevich warned that $90,000 — once a strong reaction level — may now act as resistance, and that bulls will need a firm push above $95,000 to regain broader trend control. On the downside, failure to hold $87,000 could reopen the slide toward $80,000, extending November’s capitulation phase.

Sentiment metrics have only partially improved. The fear index has edged up to 25, lifting it out of extreme fear but still far from signaling a robust shift in market psychology. And despite bitcoin’s bounce, only one of seven major tokens recorded gains over the past 24 hours, underscoring how narrow the recovery remains even as total crypto market capitalization holds near $3.1 trillion.