Cardano outperforms as crypto trading resumes, but analysts say broad altcoin season remains distant

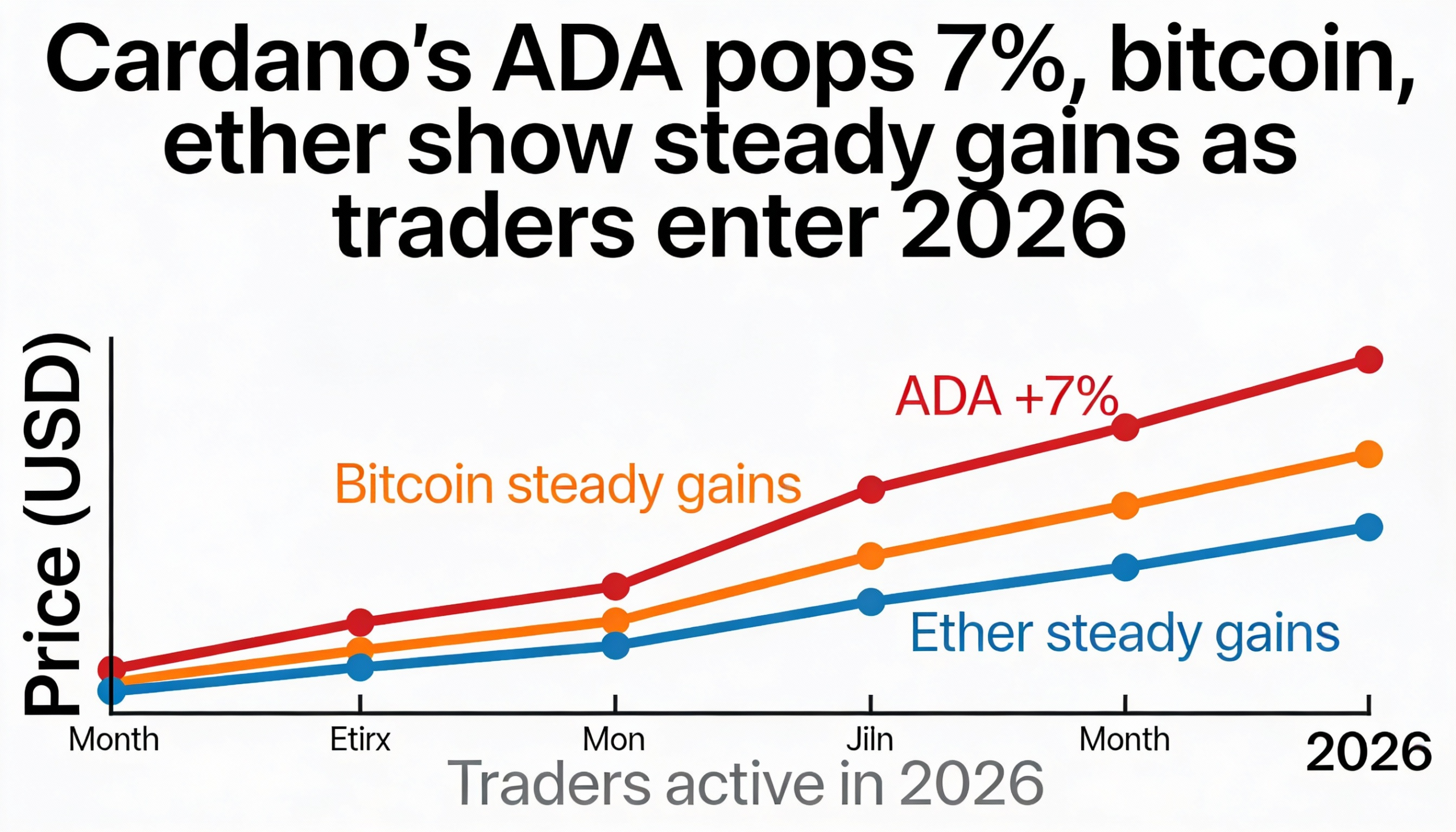

Bitcoin and major cryptocurrencies opened 2026 on firmer footing Friday morning in Asia, with Cardano’s ADA leading gains among large caps as traders returned from the holiday break and risk appetite improved across markets.

Bitcoin added roughly 1%, trading near $88,700, while Ether rose about 1% to hover around $3,010, continuing a measured recovery from late-December lows. ADA surged 7%, outpacing the broader market, while Solana, XRP, and BNB also traded higher. Analysts note that these moves reflect selective positioning rather than the onset of a broad altcoin rally.

“Investors aren’t rotating wholesale out of Bitcoin and Ethereum into altcoins,” said analysts at crypto payments firm B2BINPAY. They pointed to the Altseason Index near 16, signaling continued Bitcoin dominance and limited market-wide participation. According to the firm, inflows into a handful of large-cap altcoins appear more like targeted exposure than an early altseason play.

The crypto rebound coincided with a broader risk-on mood in global markets. Asian equities rose 0.8%, led by technology shares, with a regional tech gauge reaching a record. Nasdaq 100 futures climbed 0.6%, outpacing the S&P 500, as traders leaned into the AI and semiconductor sectors.

Precious metals also extended gains from 2025, with spot gold approaching $4,350 an ounce and silver rising more than 1%, as investors positioned for potential U.S. rate cuts and a weaker dollar in 2026.

Some analysts, however, warned of near-term pressure from portfolio rebalancing after last year’s rally. “We expect roughly 13% of aggregate open interest in Comex silver markets to be sold over the next two weeks, which could trigger a dramatic repricing lower,” wrote TD Securities strategist Daniel Ghali.

In crypto, the cross-asset backdrop remains supportive but fragile. A weaker dollar and improving equity sentiment help, yet traders are cautious following a late-2025 period marked by thin liquidity and quick profit-taking.

For now, Bitcoin holding in the high-$80,000s and Ether stabilizing above $3,000 are early signs of returning dip-buying, even as broader conviction across altcoins remains limited.