China’s shadow bitcoin mining sector is expanding once again, fueled by low-cost electricity, growing miner demand and subtle indications that policy attitudes may be softening across several provinces.

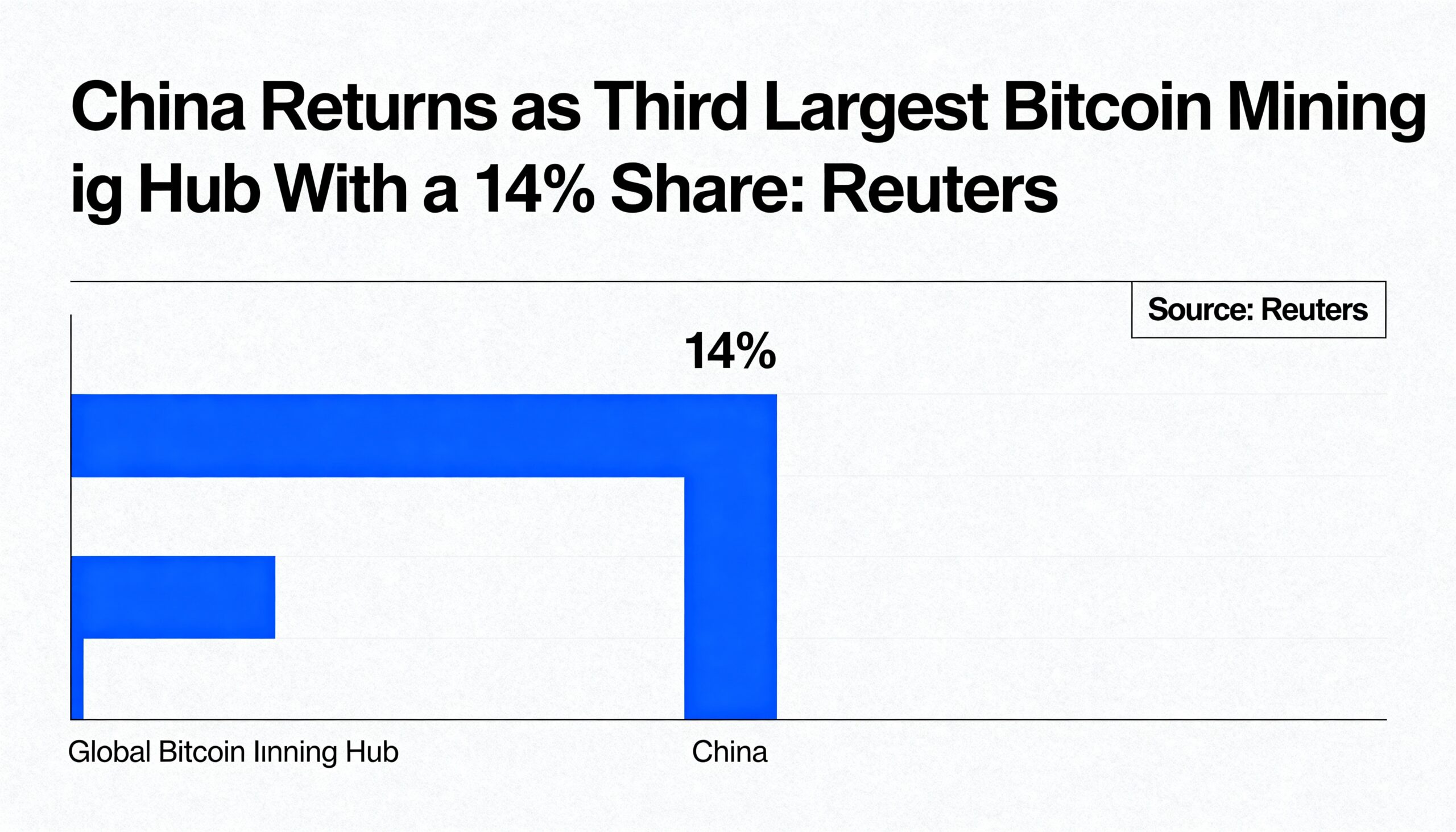

After nearly disappearing from global rankings following the 2021 crackdown, China has re-emerged as the third-largest bitcoin mining hub, now representing roughly 14% of global hashrate as of October, according to data from Hashrate Index. The resurgence is being powered by operators running discreet facilities in regions with abundant surplus energy—especially Xinjiang, where excess electricity and rapid data-center buildout have opened the door to renewed activity.

Miners interviewed by Reuters said the availability of cheap, unused power in Xinjiang and Sichuan is encouraging fresh underground setups, while some former miners have returned to the industry. CryptoQuant estimates that 15% to 20% of global mining capacity is currently located in China.

The uptick is mirrored in hardware demand. Mining equipment supplier Canaan has recorded a strong jump in domestic sales, buoyed by higher bitcoin prices and uncertainty surrounding U.S. tariff policies that have tempered international demand.

Although Beijing hasn’t formally eased its crypto restrictions, its posture appears less rigid. Hong Kong’s push toward stablecoin legislation and early discussions around yuan-backed stablecoins suggest the broader policy outlook on digital assets may be shifting.

Hashprice Falls to Historic Lows

Even as mining activity creeps higher, profitability continues to erode. Bitcoin hashprice—a measure of expected revenue per unit of hashrate—dropped to an all-time low of $34.2 per PH/s on Friday, according to Luxor.

Hashprice is shaped by four factors: bitcoin’s price, network difficulty, block rewards and transaction fees. It tends to rise when BTC prices or fee levels increase and fall when mining difficulty climbs.

With bitcoin down more than 30% from its October high, transaction fees muted, and network hashrate hovering just above one zettahash (roughly 10% below recent peaks), miner revenues have hit new lows. The next difficulty adjustment, expected Wednesday, is forecast to decline slightly more than 2%.