Bitcoin is struggling through what Citigroup describes as a classic second-year post-halving slowdown, with sustained ETF outflows and nervous long-term investors pushing the market closer to the bank’s bearish expectations.

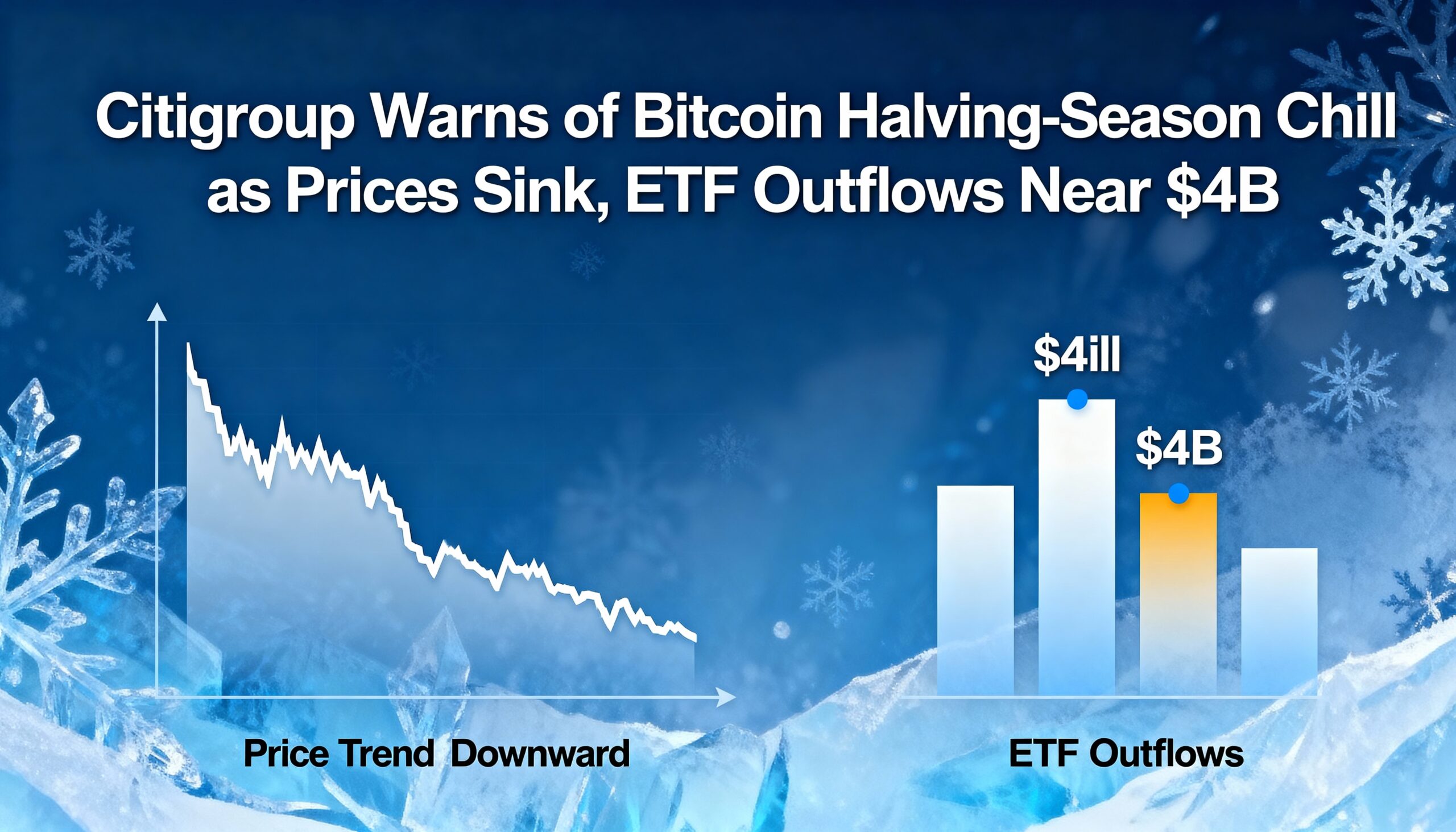

In a Friday report, Citi said the sharp futures-market liquidation in October deeply damaged sentiment, triggering close to $4 billion in redemptions from bitcoin ETFs and wiping out the cryptocurrency’s gains for the year. With fresh inflows drying up, bitcoin has drifted back toward the average cost basis of ETF holders—aligning more with Citi’s bear-case scenario than its base outlook.

The bank highlighted growing concern among long-term holders as the market moves deeper into a historically weak phase of the halving cycle. On-chain indicators show older coins becoming active and major holders reducing exposure, signaling rising caution.

Risk-taking across major digital assets has diminished since the early-October flash crash, which Citi links to broader macro pressures. Analyst Alex Saunders wrote that bitcoin is now underperforming its typical correlations and appears short on near-term catalysts unless equity markets rebound or U.S. lawmakers make progress on digital-asset regulations.

Interest in bitcoin hasn’t vanished, Saunders noted, but veteran holders have shifted to a defensive posture, while new buyers are reluctant to enter with prices sitting below key technical thresholds.

Saunders had originally projected $7.5 billion in ETF inflows by year-end, but the steady pace of outflows has now pushed bitcoin toward the firm’s $82,000 bear-case target. Citi identifies $80,000 as a major support zone for ETF participants and says regulatory clarity in 2025 could help reignite demand. The bank is keeping its 12-month outlook unchanged at $25 billion in ETF inflows and a bitcoin price forecast of $181,000.

At publication time, bitcoin was trading around $86,500.