Crypto crime took a violent turn in 2025, with physical attacks aimed at stealing digital assets surging worldwide, according to a new report from blockchain security firm CertiK.

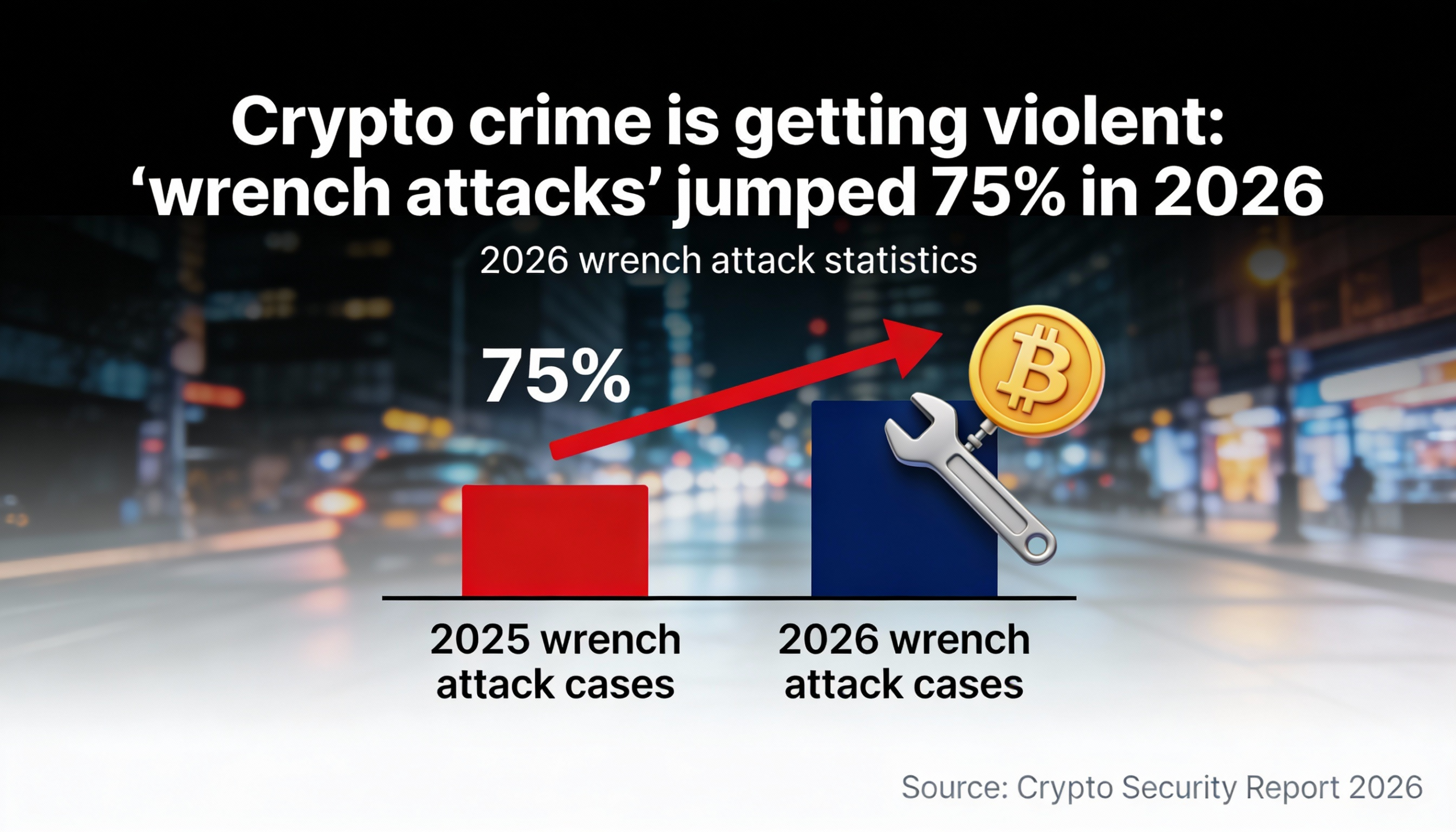

So-called “wrench attacks”—cases in which victims are coerced, often through violence, into handing over private keys—rose 75% from the previous year, with 72 confirmed incidents globally. CertiK described last year as a turning point, warning that physical violence has become a core threat to crypto holders rather than a fringe risk.

The report recorded a 250% increase in physical assaults linked to crypto theft, including home invasions, kidnappings, and at least one murder. Europe emerged as the epicenter of the violence, accounting for more than 40% of global incidents, up sharply from 22% in 2024.

France led the region with 19 reported attacks—more than double the total in the United States—followed by spikes across Spain and Sweden. CertiK attributed the rise to organized crime groups increasingly targeting individuals known or suspected to hold significant crypto assets.

Attack methods varied. In some cases, criminals forced entry into victims’ homes. In others, they targeted spouses, children, or elderly parents to compel cooperation. The data also highlighted the use of “honeypot” schemes, where attackers cultivated fake romantic relationships before staging physical assaults.

CertiK linked the rise in violence to improvements in digital security that have made hacking more expensive and less effective. The firm referred to this dynamic as the “Technical Paradox”: stronger cryptography, but an unchanged—and vulnerable—human layer. “Threatening someone with a weapon still works,” the report noted.

Confirmed losses from wrench attacks exceeded $40 million in 2025, with CertiK warning that the true figure is likely far higher due to underreporting. As a result, the firm said personal safety has become an integral part of the crypto risk equation.

In response, parts of the crypto industry are exploring new protections, including insurance coverage. Several firms, including insurance heavyweight Lloyd’s of London, have begun offering policies that explicitly cover losses stemming from wrench attacks.