Crypto markets took a sharp hit Friday morning, shedding more than $300 million in leveraged positions after President Donald Trump’s aggressive tariff announcements rattled investor confidence. Bitcoin (BTC) tumbled 3% from its near-record highs, as traders rushed to close vulnerable long positions.

Data from CoinGlass highlights that the vast majority of liquidations hit traders holding long bets. Bitcoin longs alone accounted for $107 million in forced liquidations, while Ethereum’s Ether (ETH) liquidations approached $87 million. Altcoins like Solana (SOL), Dogecoin (DOGE), and SUI also faced sizable liquidations between $10 million and $18 million.

Crypto trader Skew commented on X, “A broad purge of leveraged longs and spot de-risking—all driven by the latest headline shock.”

The sell-off followed Trump’s declaration of a 50% tariff on imports from the European Union set to begin June 1, alongside a 25% tariff on iPhones manufactured overseas, reviving fears of an intensifying trade war. These geopolitical tensions unsettled markets and triggered a swift rotation out of risk assets.

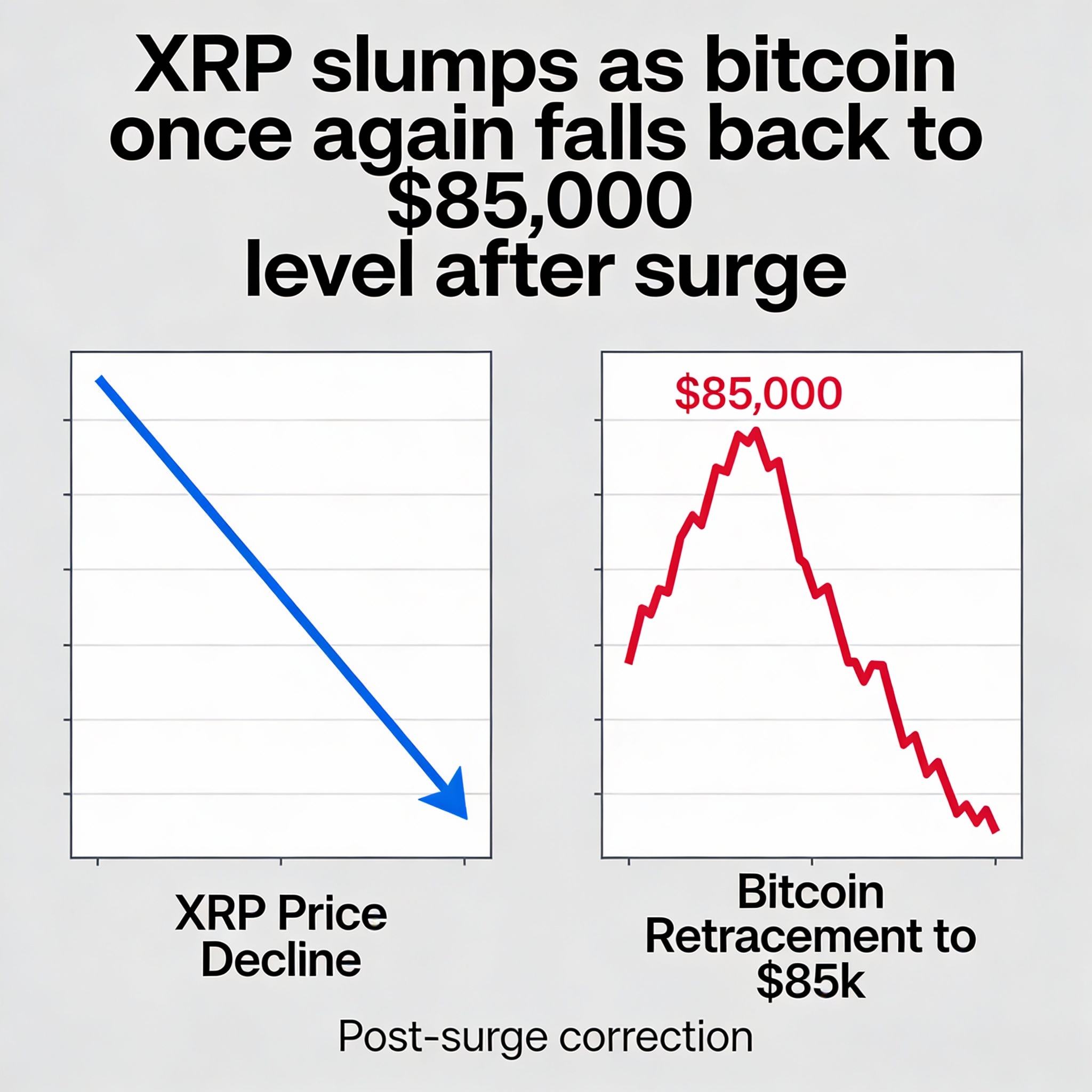

Following the news, bitcoin and leading altcoins such as Ether, XRP, and Cardano dropped between 3% and 4%. Meanwhile, smaller-cap cryptocurrencies like Uniswap (UNI) and SUI were hit harder, falling between 5% and 7%.

Notably, James Wynn—the trader behind a recent headline-grabbing $1.1 billion BTC long position with 40x leverage on Hyperliquid—now faces steep losses. Wynn’s position is down by $7.5 million and at risk of liquidation should BTC dip to $102,000, according to a screenshot shared on social media.

Interestingly, this wave of long liquidations came amid a rising tide of BTC short positions despite the cryptocurrency’s near-record price, suggesting a more cautious mood prevailing among traders.