Bitcoin Reclaims $87K as Altcoins Rally Amid Improving Market Sentiment

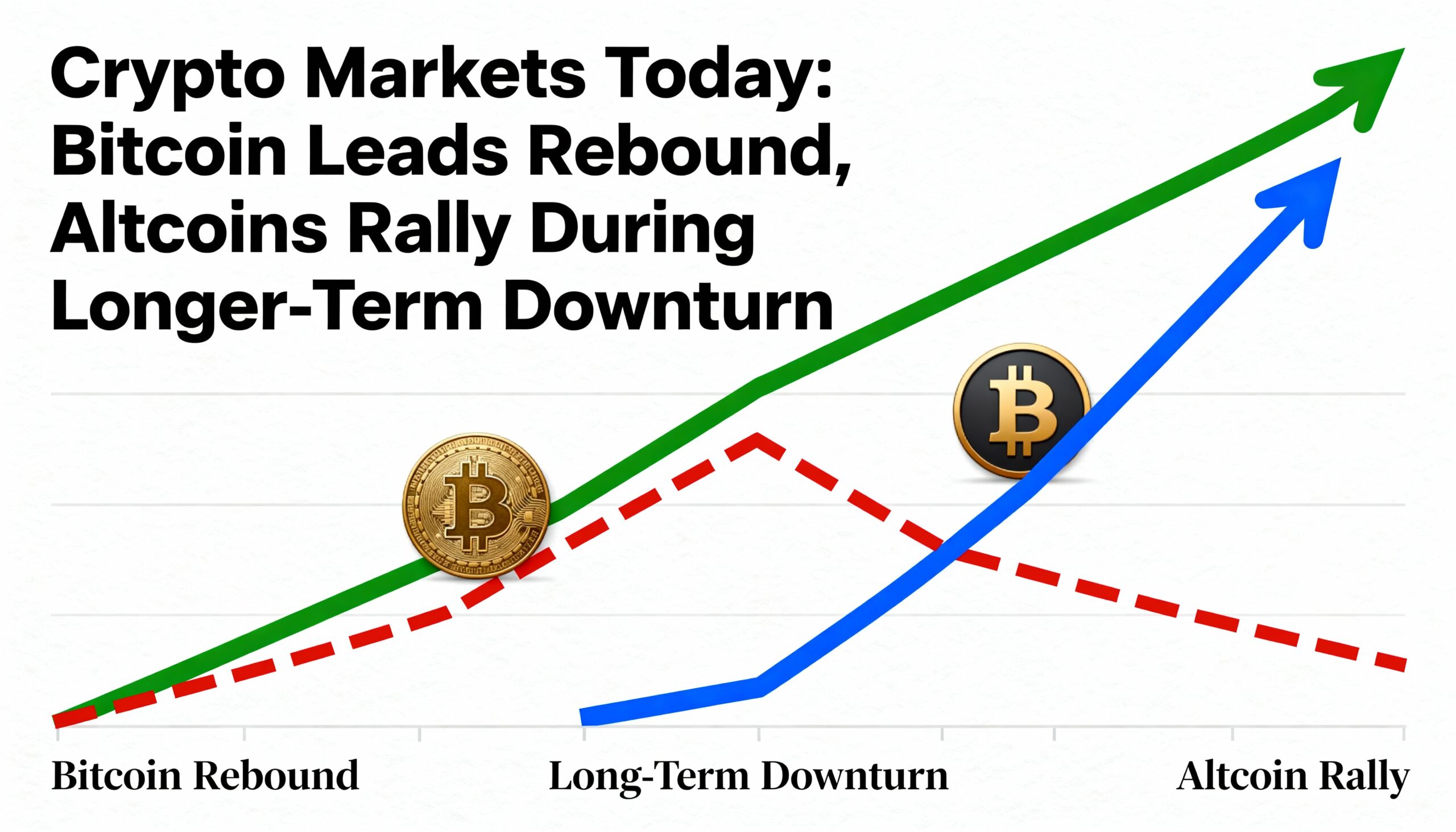

Bitcoin BTC climbed 1.8% to $87,250 on Tuesday, extending its recovery from recent weakness and helping lift major altcoins. SUI, ENA, BONK, and CC each gained more than 8%, as investors returned to higher-risk assets amid signs of stabilizing market conditions.

Despite the short-term bounce, longer-term charts remain bearish. Bitcoin and Ether ETH continue to show lower highs and lower lows, maintaining the downtrend that began in early October.

The recovery was supported by broader market strength. The Nasdaq Composite recorded its largest daily gain since May on Monday, signaling renewed risk appetite. Bitcoin’s 30-day implied volatility (BVIV) eased to 55% from Friday’s 65%, reflecting lower expected near-term turbulence, though volatility remains elevated historically.

Options activity points to a mix of optimism and caution. BTC put skews remain high, highlighting persistent downside concerns, while interest in $100K calls increased, pushing notional open interest to $2 billion, comparable to $85K and $80K puts. BTC call condors dominated 24-hour block trades, targeting a range above $100K, while ETH options favored strangles. Calls tied to BlackRock’s IBIT ETF also saw renewed demand, though overall skew still favors protective puts.

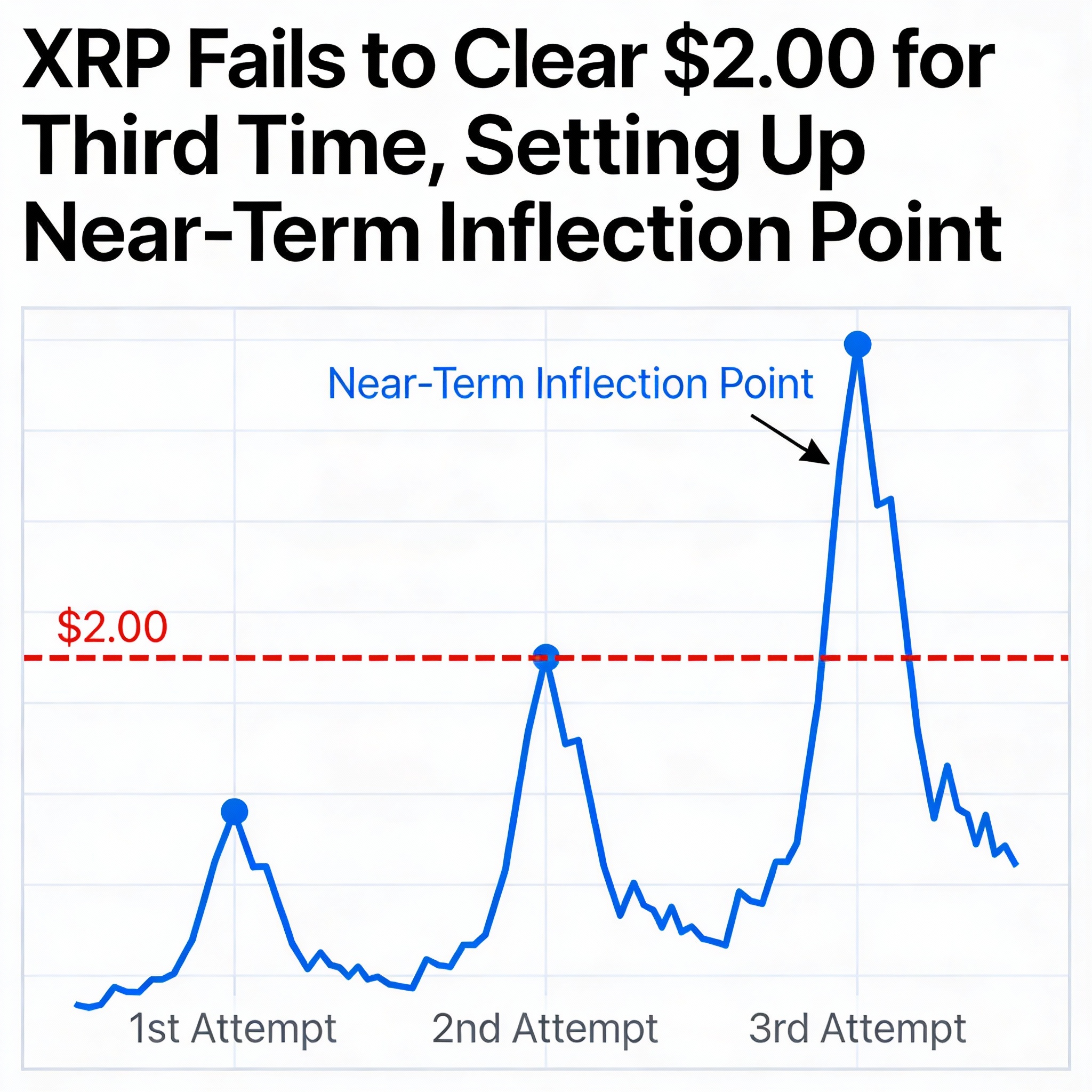

In futures markets, XRP led top coins with a 12% increase in open interest to 1.84 billion XRP, the highest since October 11. BTC perpetual futures saw declining open interest, and funding rates turned negative—the first time in over five weeks—signaling a short bias.

Among altcoins, SUI and ENA gained over 11%, and Ether rose 3.3% to $2,880, with daily volume up 13% to $27.3 billion. ETH could begin forming a bottom if it sustains levels near $3,500.

Lagging sectors included Zcash (ZEC), down 6.6%, and DASH, even as the broader market strengthened. The average crypto RSI sits at 50.34, indicating indecision as sentiment remains mixed amid volatile price action.