Bitcoin and ether are posting gains after a steep market-wide selloff, even as derivatives traders continue to trim risk exposure.

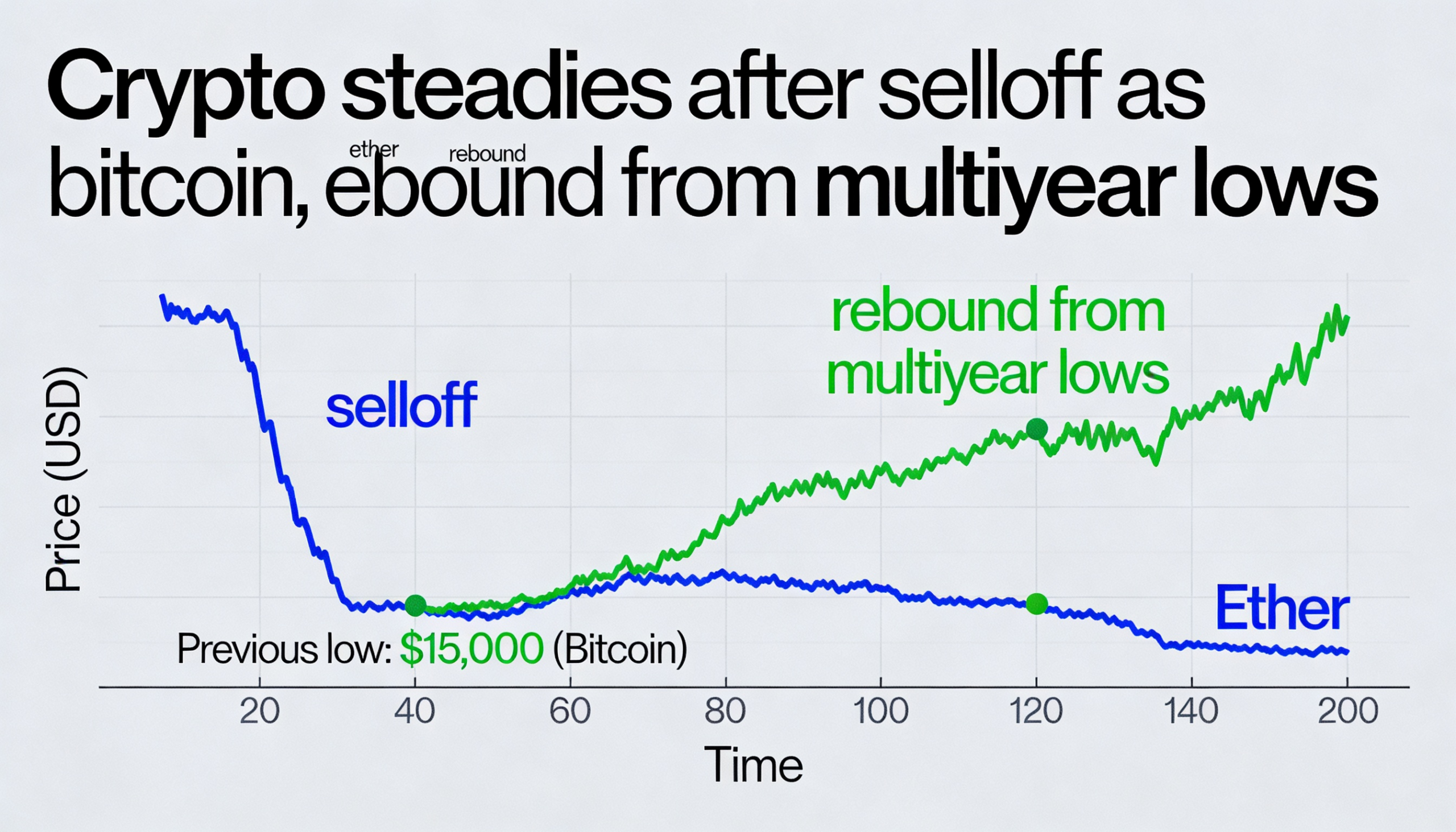

The crypto market steadied following Tuesday’s downturn, which pushed bitcoin and ether to fresh multiyear lows. Bitcoin rebounded to around $76,100 after hitting $72,870, its lowest since November 2024, while ether climbed to $2,255 after briefly falling to a level unseen since May 2025. Both assets were slightly higher since midnight UTC.

Altcoins displayed mixed performance. Privacy coins staged a rebound, while Solana-based tokens such as PUMP and JUP declined 2% and 2.5%, respectively, over the same period.

The bounce coincided with a broader improvement in global risk sentiment. The U.S. House of Representatives passed a government funding package to end a partial shutdown, lifting U.S. equity futures and international markets. Precious metals also recovered, with gold climbing above $5,000 and silver rising nearly 6% to $90.

Derivatives and market positioning

Traders continued to reduce risk, sending cumulative notional open interest across all crypto futures down to $105.9 billion—the lowest level since April 2025. Roughly $679 million in crypto futures positions were liquidated over 24 hours, with bullish bets accounting for most of the losses.

Bitcoin’s 30-day implied volatility rose to 53% annualized, the highest since Dec. 1, signaling elevated market caution. Open interest in bitcoin and ether futures declined 0.7% and 2%, respectively, while DOGE and HYPE saw larger capital outflows. Conversely, LINK futures saw a 2% increase in open interest and a positive cumulative volume delta, pointing to renewed bullish pressure. TRX, XLM, and ZEC also recorded positive 24-hour cumulative volume delta readings.

Options markets reflect persistent demand for downside protection. Deribit-listed bitcoin and ether puts continue to trade at a 10–12 volatility premium to calls, while block trades have favored put spreads, a bearish strategy.

Token performance

Derivatives exchange tokens HYPE, LIT, and ASTER fell over the past 24 hours as traders rotated into privacy coins. HYPE declined 8.5% but remains up roughly 30% since the start of the year.

Monero (XMR) rebounded about 4% to $324.87, halting losses after dropping more than 50% since mid-January, while Zcash (ZEC) rose 3.4% to $232.94 following a more than 62% decline from its November record high.

Overall, altcoins underperformed bitcoin during the recent selloff. Bitcoin dominance has climbed above 59%, up from 58.5% at the start of the year, a typical pattern in bear markets where smaller tokens experience amplified volatility. Major cryptos including SOL, ADA, and XRP are now trading at their lowest levels since 2024, having fully retraced recent bullish rallies.