While equities and commodities continue to rally, cryptocurrencies are once again under pressure, suggesting investors may be rotating capital away from digital assets.

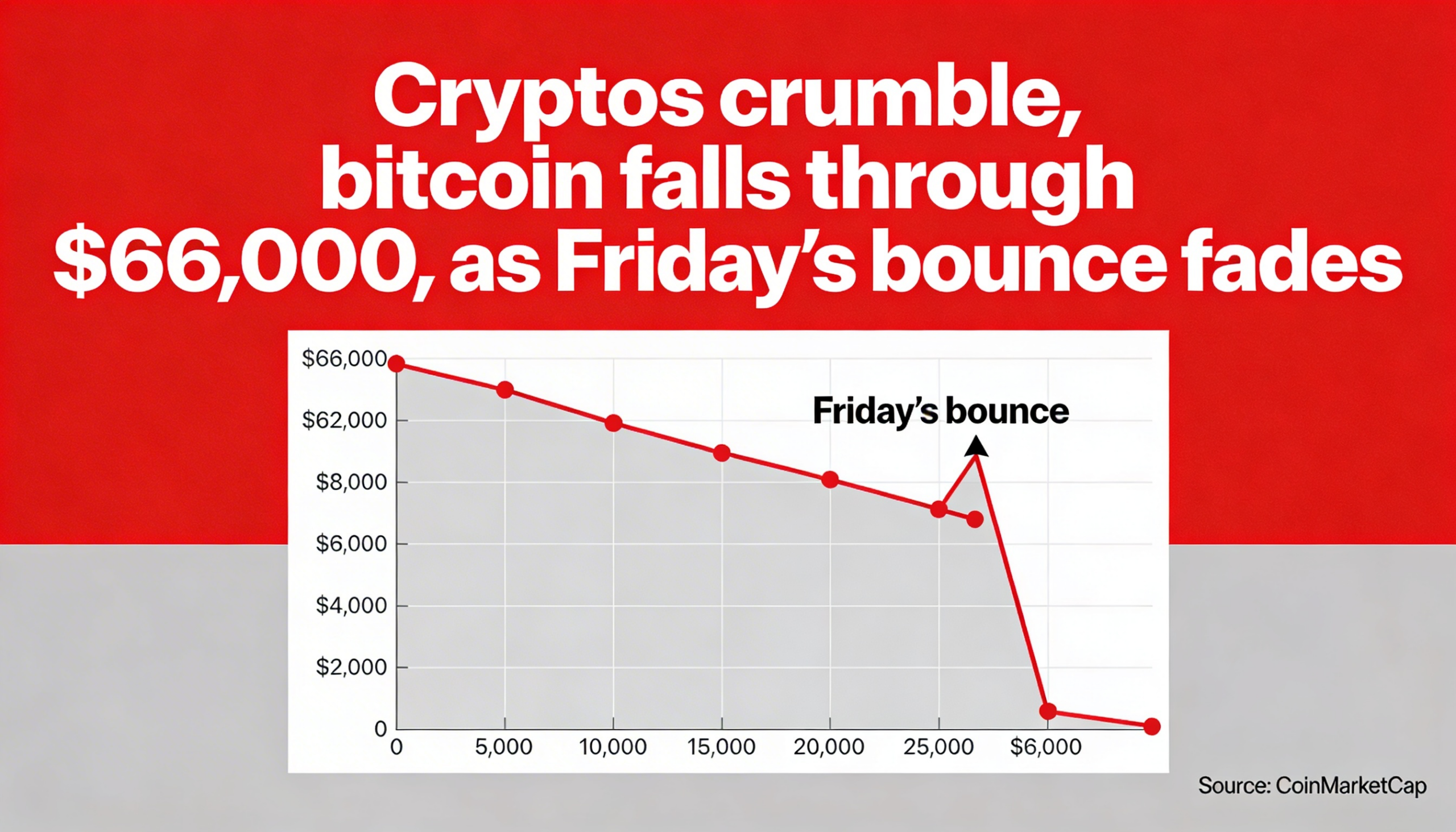

After tumbling for much of the week, Bitcoin (BTC) found support late Thursday around $60,000. A powerful rebound on Friday sent the token nearly 20% higher to just below $72,000. That surge, however, now appears increasingly like a classic “dead cat bounce.”

By mid-morning U.S. trading, Bitcoin had resumed its slide, falling more than 4% over the past 24 hours to trade just under $66,000. Other major tokens were also sharply lower. Ether (ETH) declined roughly 5.5%, Solana (SOL) dropped a similar amount, and XRP (XRP) fell about 3.5%.

Traditional markets were more stable. U.S. equities, which traded higher earlier in the session, turned roughly flat. Meanwhile, gold rose 0.8% and silver gained 3.2%.

Earlier Wednesday, the U.S. government reported that January job growth totaled 130,000 — nearly double economist expectations — while the unemployment rate unexpectedly dipped to 4.3%. The stronger-than-forecast labor data quickly reshaped interest rate expectations.

According to CME FedWatch data, traders are now pricing in just a 6% probability of a March rate cut from the Federal Reserve and a 23% chance of an April reduction. Before the report, markets had assigned a 21% likelihood to a March move and a 52% chance to April easing.

Whether rate cuts would have reversed crypto’s broader downtrend remains debatable. The current leg lower began in 2025, even as the Fed delivered rate reductions at three consecutive meetings.

Fading Investor Appetite

With global equity markets in bull mode and crypto struggling to regain momentum, signs of waning investor enthusiasm are emerging.

Data from Coinglass show that Bitcoin perpetual futures open interest has dropped to 51% below its October 2025 peak, signaling a significant pullback in trader conviction and leverage.

The shift appears particularly pronounced in South Korea. As the KOSPI climbs to record highs, retail participation in crypto markets has cooled sharply. One analyst described the trend as an “exit-crypto” movement, with investors reallocating toward equities.

Monthly trading volume on the Kospi surged 221% year over year last month, while crypto exchange volumes fell roughly 65% over the same period.

“This is a washout,” the analyst said. “Retail is exhausted and fleeing to the Kospi.”

Crypto-Linked Stocks Slide

The weakness extended across crypto-related equities, with no major names trading in positive territory.

Shares of Robinhood dropped 12.5% after the company reported a sharp decline in fourth-quarter crypto trading revenue. The move weighed on peer Coinbase, which fell 7% ahead of its earnings report scheduled for Thursday evening.

Bitcoin treasury heavyweight Strategy declined 4.5%, while ether-focused treasury firm Bitmine Immersion slipped 3.8%.

Elsewhere, Circle fell 4.7%, Galaxy Digital lost 3.2%, and Bullish dropped 5.3%, underscoring broad-based pressure across the sector.