Crypto and Equities Push Higher Amid Risk-On Rally, but Bitcoin Remains Range-Bound

Risk assets rallied across the board on Friday, with gains in cryptocurrencies, equities, and gold, even as oil slumped toward its steepest weekly loss since June. The broad risk-on mood followed signs of easing trade tensions between the U.S. and Japan.

Japan’s Nikkei 225 led Asian equities with a 2.3% jump after chief negotiator Hiroshi Suzuki confirmed a deal to roll back universal tariffs and reduce levies on automobile exports. The MSCI Asia Pacific Index also extended its winning streak to five consecutive days, adding 0.5%.

Altcoins Lead Crypto Gains as BTC Lags

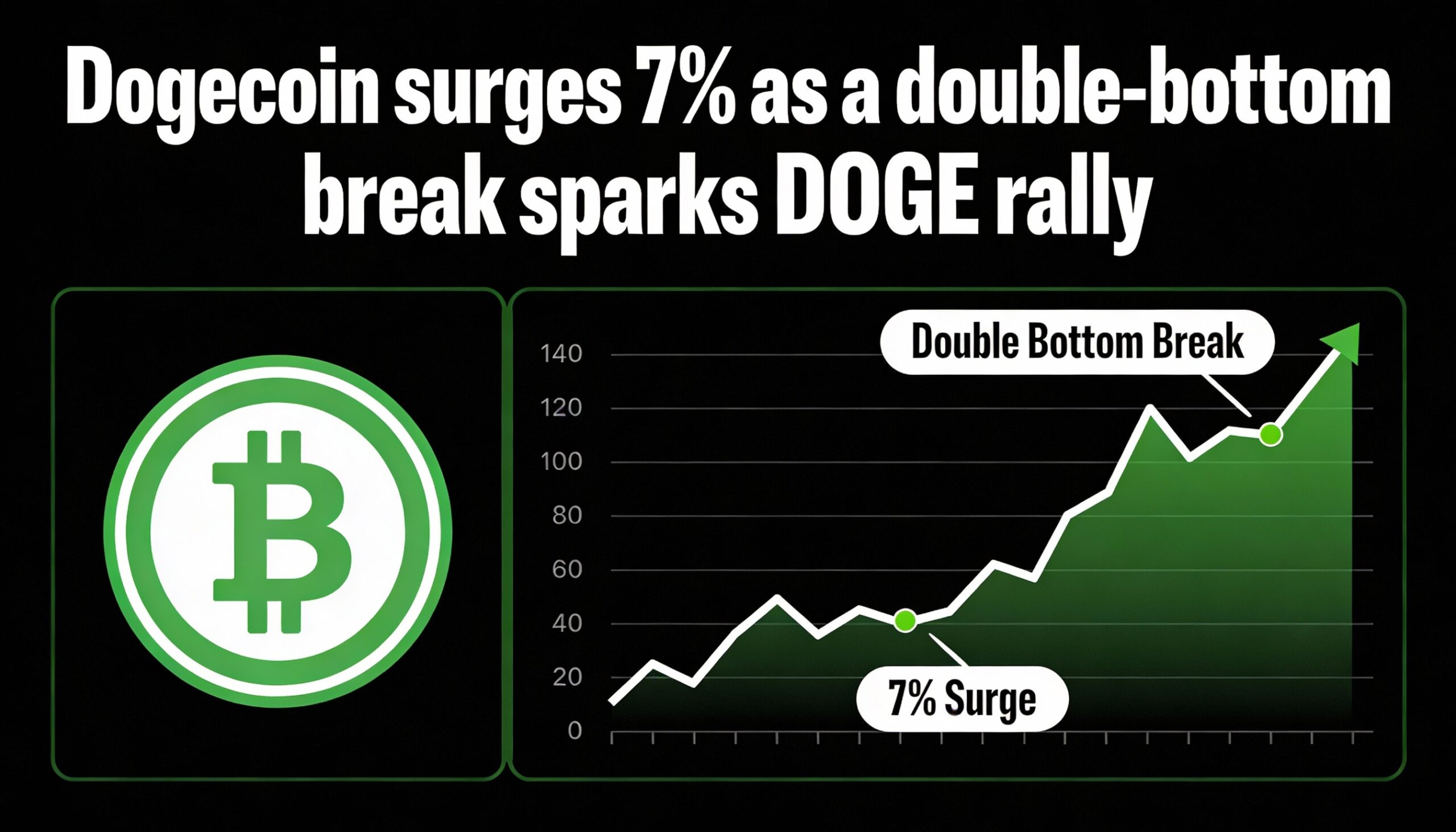

In digital assets, the total crypto market cap climbed 3% to $3.76 trillion over the past 24 hours, led by strong performances from altcoins. Ethereum (ETH) surged 7.3% to $3,935, XRP soared 12% to $3.36, Solana (SOL) gained 4.7% to $175.19, and Dogecoin (DOGE) jumped 8.8% to $0.22.

Bitcoin (BTC), however, underperformed the broader market, inching up just 1.9% to $116,781 on daily volume of $38.8 billion.

Bitcoin Trapped in Consolidation Range

FxPro chief market analyst Alex Kuptsikevich noted that the crypto rally mirrors growing investor appetite in the equity markets but emphasized that BTC remains “trapped in a narrow range.” Key support sits at $112,000—near its 50-day moving average—while resistance is forming around $120,000, a psychologically important level tied to July’s highs.

On-Chain and Options Data Suggest Waning Momentum

According to Glassnode, market sentiment in bitcoin is shifting from “euphoria” to “cooling.” Spot Bitcoin ETF inflows have declined by nearly 25%, network usage is slowing, and transaction fees are falling—signaling a drop in activity.

Options market data points to increased hedging, particularly for downside protection below $100,000 into late August. This suggests that traders are bracing for potential weakness during what’s typically a quieter part of the trading calendar.

Oil Slides as Crude Inventories Rise

Oil prices bucked the risk-on trend. Brent and WTI futures headed for weekly declines of more than 4%, weighed down by higher U.S. stockpiles and weaker import figures out of China, Bloomberg reported.