DeFi’s sUSDe Loop Trades Face $1B Risk After Funding Rates Turn Negative, Sentora Says

The recent market downturn has left nearly $1 billion worth of leveraged DeFi positions tied to Ethena’s staked USDe (sUSDe) exposed to potential liquidations, according to a report from Sentora Research.

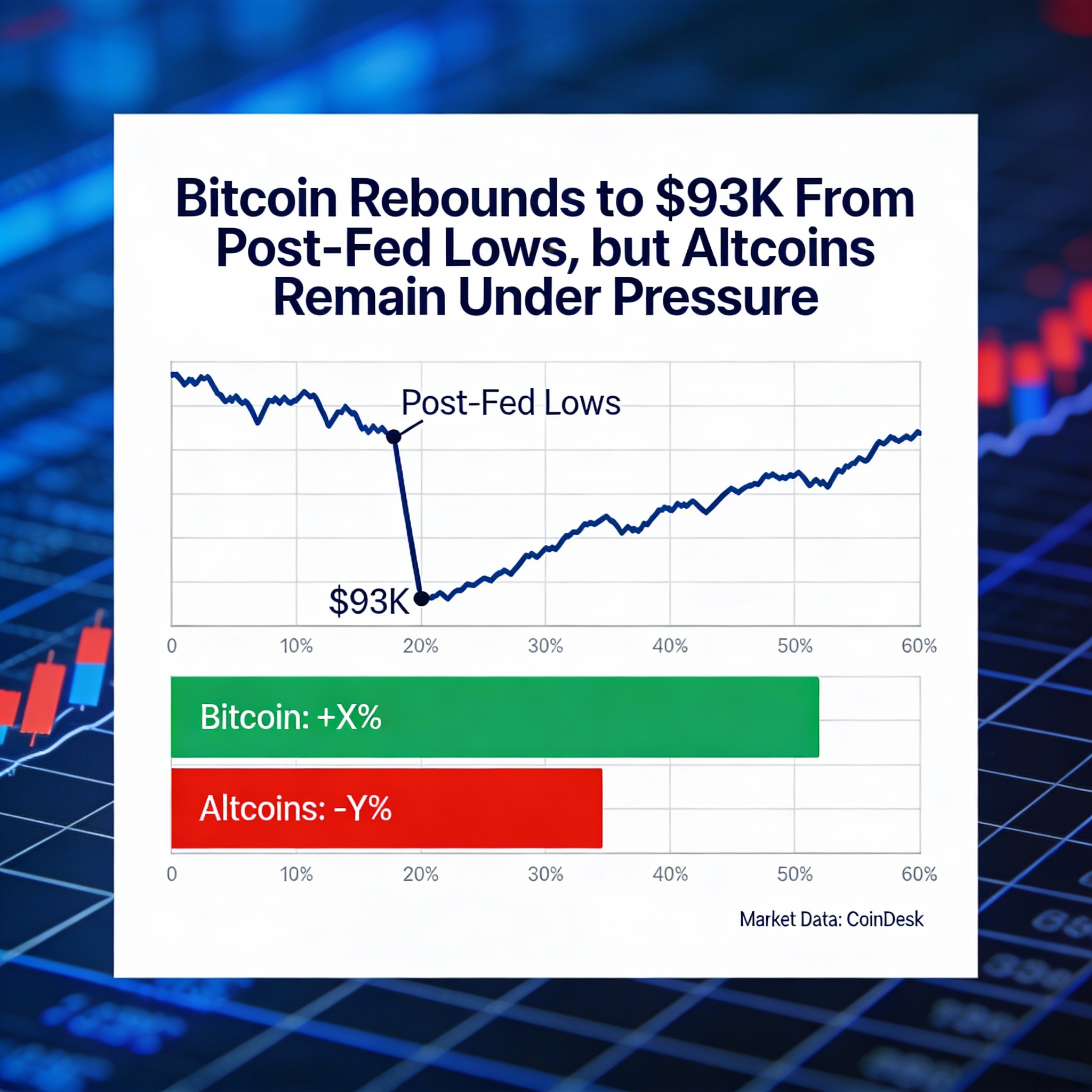

Following the Oct. 10 crypto crash, which triggered steep losses across bitcoin (BTC) and other major tokens, DeFi funding rates have fallen sharply — upending once-profitable looped yield strategies that rely on borrowing stablecoins to buy more sUSDe.

Loop Strategy Turns Sour

The popular trade involves depositing sUSDe as collateral on protocols like Aave and Pendle, borrowing Tether (USDT) or USD Coin (USDC), then using the borrowed funds to buy more sUSDe — repeating the process to amplify yield.

But Sentora said that this “loop” has now become unprofitable. Borrowing costs have overtaken staking rewards, flipping the yield spread negative.

“After the October 10 flash crash, DeFi funding rates dropped significantly,” Sentora told CoinDesk. “On Aave v3 Core, USDT and USDC borrow rates are roughly 2% and 1.5% higher than sUSDe yields, creating a negative carry for leveraged positions.”

$1B in Positions at Risk

With the spread below zero, many traders are now sitting on loss-making positions. Sentora estimates around $1 billion in looped exposure could face deleveraging pressure if conditions persist. Prolonged negative carry may force collateral sales, triggering liquidity stress across key lending pools and potentially causing a cascading unwind of leveraged trades.

Rising Borrow Costs Add Pressure

Utilization rates in USDT and USDC pools are rising, which can further lift borrowing costs and push stressed positions closer to liquidation thresholds.

“We’re seeing an increasing number of looped accounts within 5% of forced liquidation,” Sentora said. “If borrowing costs rise again, we could see an accelerated wave of deleveraging.”

The firm urged traders to track the spread between Aave’s stablecoin borrow APYs and sUSDe yields, calling it the critical metric for monitoring systemic stress in DeFi credit markets.